Global RegTech Funding Soars 66% in Q1 2025, Fueled by $100M+ Deals

In Q1 2025, the global RegTech investment landscape experienced a significant resurgence, with funding levels increasing dramatically. This rebound reflects a growing need for compliance solutions and digital risk management tools across various industries.

Overview of Global RegTech Funding in Q1 2025

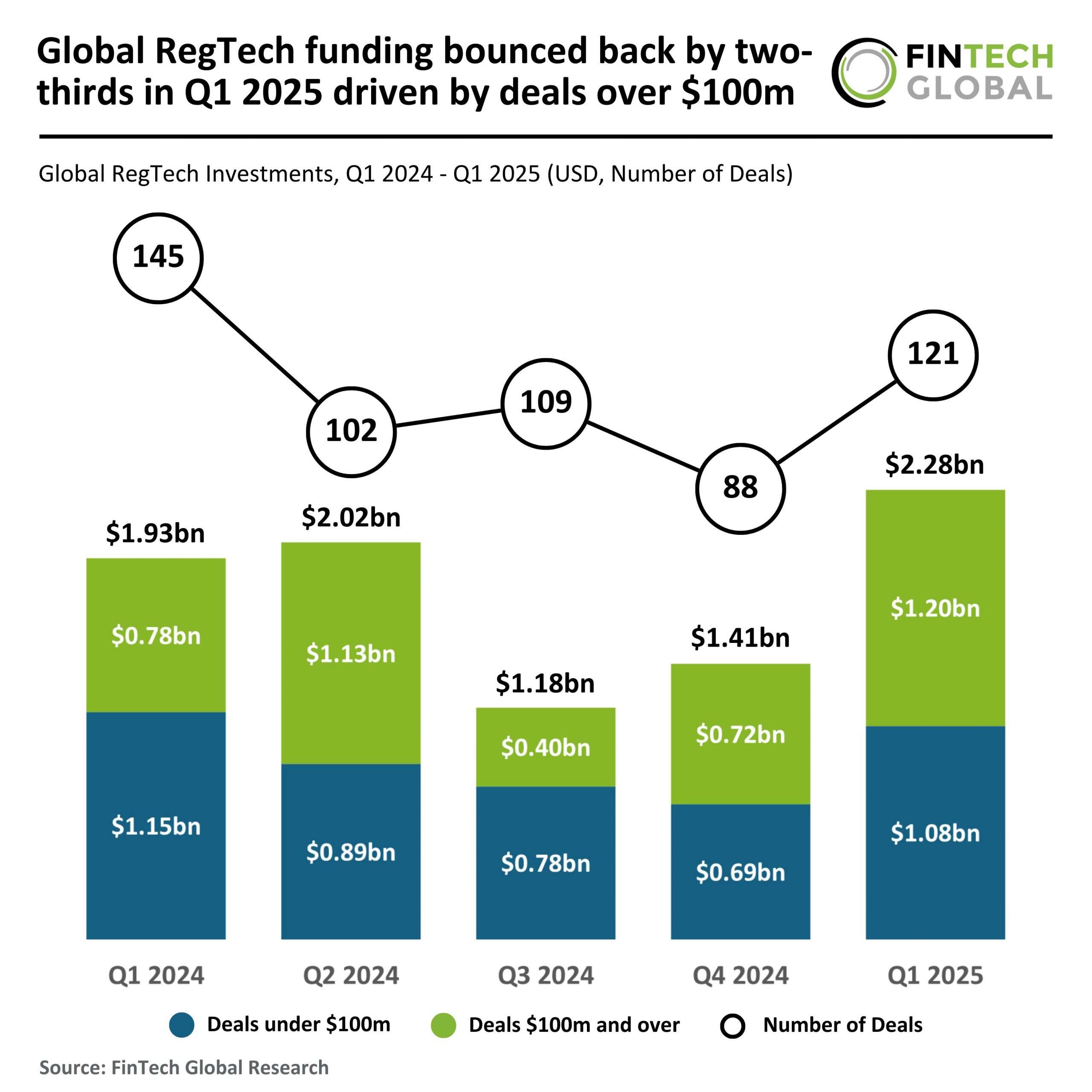

The RegTech sector has shown remarkable growth in the first quarter of 2025, closing with 121 deals. This marks a 36% increase from the 88 deals recorded in Q4 2024, although it is still 17% lower than the 145 deals seen in Q1 2024.

Funding Statistics

Total funding for Q1 2025 reached an impressive $2.3 billion, reflecting a 63% rise from the $1.4 billion raised in Q4 2024 and an 18% increase over the $1.9 billion secured in Q1 2024. The average deal size also saw a jump, rising to $19 million compared to $16 million in the previous quarter, although slightly down from $21 million a year ago.

Key Drivers of Growth

This uptick in funding is predominantly attributed to larger deals worth over $100 million, which surged by 68% quarter-over-quarter. Here are some key insights:

- Funding from deals under $100 million totaled $1.1 billion, down 6% from Q1 2024 but up 58% from Q4 2024.

- High-value deals accounted for $1.2 billion, a 68% increase from the $715 million in Q4 2024 and a 53% rise compared to the $782 million raised in Q1 2024.

- This trend indicates a renewed investor confidence, as stakeholders show a willingness to invest in major RegTech players amidst evolving regulatory landscapes.

Spotlight on Norm Ai

One of the standout performers in the RegTech industry is Norm Ai, which recently closed a significant funding round of $48 million. This deal brings Norm Ai’s total capital raised over the past 18 months to $87 million.

Supported by a strong syndicate of investors, including Coatue, Craft Ventures, Blackstone Innovations Investments, Citi Ventures, and Bain Capital, Norm Ai is pioneering a “compliant by design” platform that integrates regulatory compliance into business workflows.

Innovative Solutions Offered by Norm Ai

Norm Ai’s proprietary Legal Engineering Automation Platform (Leap) allows legal experts to transform complex regulatory obligations into AI-driven solutions. This innovation enables organizations to:

- Automate compliance across AI-generated content

- Streamline internal documentation and marketing materials

- Enhance contractual communications

As global demand for AI-driven compliance infrastructure continues to grow, Norm Ai is positioned at the forefront of establishing regulatory standards in the automation era.

Conclusion

The resurgence of the RegTech investment landscape in Q1 2025 highlights a robust demand for compliance solutions, driven by technological advancements and evolving regulatory requirements. For more insights on the regulatory technology sector, visit our RegTech Insights page.