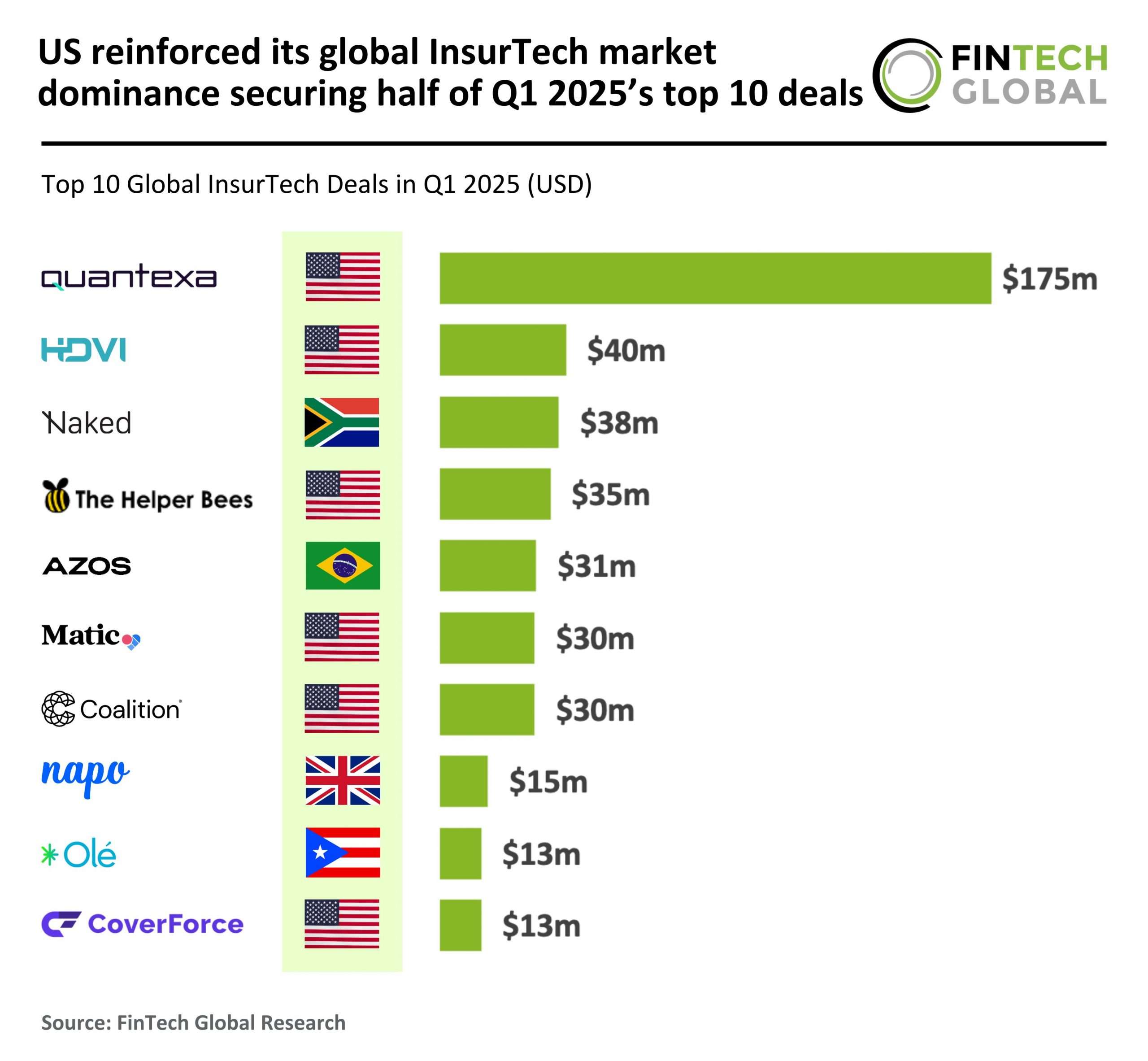

US Strengthens Global InsurTech Leadership with 50% of Q1 2025’s Top 10 Deals

In the world of InsurTech, Q1 2025 has shown a remarkable surge in global funding, indicating a growing investor confidence in the sector. This article delves into the key statistics and trends shaping the InsurTech landscape, highlighting the significant growth in funding and the rise of innovative platforms.

Global InsurTech Funding Reaches New Heights

During the first quarter of 2025, the global InsurTech sector secured an impressive $1.1 billion in funding across 58 deals. This marks a substantial 59% year-on-year increase compared to the $718 million raised in Q1 2024 through 65 deals. Notably, while the number of deals decreased, the amount of capital deployed increased, suggesting a shift towards larger deal sizes and a preference for more established InsurTech companies.

Trends in Investment Activity

- Increased Capital Deployment: The rise in funding reflects a renewed confidence in the InsurTech sector.

- Focus on Digital Transformation: Investors are increasingly favoring companies that emphasize digital innovation and embedded insurance models.

U.S. Dominates the InsurTech Market

The United States has solidified its position as a leader in the global InsurTech market, securing half of the top 10 funding deals in both Q1 2024 and Q1 2025. The United Kingdom also made strides, increasing its share from one top deal in Q1 2024 to two in Q1 2025, thereby reinforcing its status as Europe’s leading InsurTech hub.

Diversification of Global InsurTech Markets

Several countries that featured prominently in Q1 2024, such as Germany and Indonesia, did not appear in the top 10 deals for Q1 2025. Instead, nations like South Africa, Brazil, and Puerto Rico emerged, showcasing a diversification of investment into developing InsurTech markets. This shift indicates a broader global appetite for insurance innovation beyond traditional markets.

Highlighting Naked’s Success in the InsurTech Landscape

Among the notable players in the InsurTech sector is Naked, an AI-driven digital insurance platform based in South Africa. Naked secured one of the largest deals of the quarter with a $38 million Series B2 funding round, making it the only African company to feature in the global top 10 deals.

Naked’s Unique Business Model

Founded in 2018, Naked has transformed the insurance experience through its fully digital platform. Key features include:

- Automation-led policies for car, home, and single-item insurance.

- Proprietary AI technology that enhances user convenience and optimizes risk selection.

- A transparent model that allocates a portion of premiums to operations and donates excess funds to user-nominated causes.

With the recent funding boost, Naked plans to enhance its AI capabilities, expand its product offerings, and scale customer acquisition efforts, further modernizing the insurance experience in the region.

For further insights into the InsurTech industry, consider exploring resources such as InsurTech News and Forbes InsurTech.