FCA Supercharges UK FinTech: Exciting New Sandbox Enhancements and AI Innovations!

The Financial Conduct Authority (FCA) has unveiled a comprehensive set of initiatives designed to boost innovation and streamline the regulatory framework for emerging firms in the UK. As part of its 2025-2026 work programme, the FCA is committed to implementing smarter regulatory strategies that encourage growth while prioritizing consumer protection and crime prevention.

Enhancements to the Regulatory Sandbox

A key aspect of the FCA’s strategy is the expansion of its Regulatory Sandbox, which has played a crucial role since its launch in 2016. The sandbox has enabled 195 firms to safely test and launch innovative products tailored specifically for UK consumers. Under the new framework, each participating firm will benefit from dedicated support from an authorization case officer from the very beginning, significantly improving the speed at which new products can be introduced to the market.

Pre-Application Support Service Expansion

In a bid to attract more companies to the UK market, the FCA has broadened its pre-application support service to include wholesale, payments, and cryptoasset firms. This initiative aims to stimulate growth, enhance exports, and create jobs while upholding high regulatory standards. Over the past year, the FCA has assisted 80 wholesale firms through pre-application meetings, demonstrating its proactive approach.

Commitment to Supporting Growth

Nikhil Rathi, the chief executive of the FCA, has expressed the regulator’s dedication to becoming a more efficient entity. He stated, “We’re committed to being a smarter regulator – one that supports growth, helps consumers, and fights crime. Our annual work programme outlines our objectives for achieving these goals, and we’re enhancing our support for firms looking to enter our markets through improved application processes and testing of innovative products.”

Introduction of New Market Initiatives

To further drive financial innovation, the FCA is launching the Private Intermittent Securities and Capital Exchange System (PISCES). This new market will empower private companies to scale operations and improve growth prospects, ultimately offering investors greater access to lucrative opportunities in private markets.

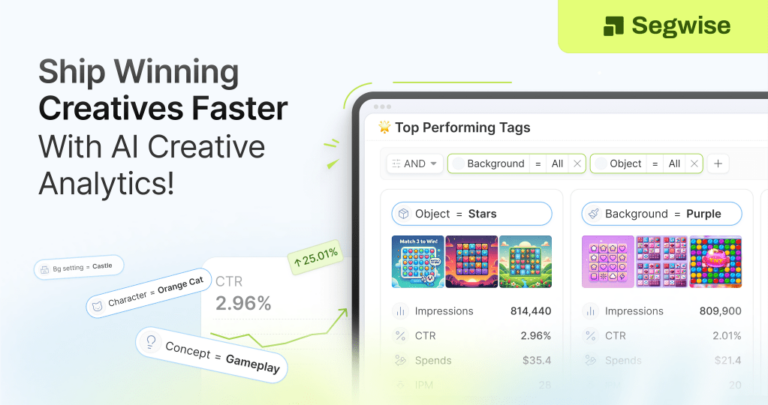

Collaboration with AI Firms

Additionally, the FCA’s AI Lab will work closely with firms to enhance the understanding and integration of artificial intelligence solutions, which are expected to significantly boost growth and competitiveness in the financial sector.

Enhancing Consumer Accessibility

On the consumer side, the FCA intends to establish a new regulatory framework aimed at making financial advice and guidance more accessible and affordable. The inclusion of Buy Now Pay Later (BNPL) products under the FCA’s regulation seeks to strike a balance between consumer protection and the promotion of innovative financial solutions.

Combating Financial Crime

The FCA is also taking proactive measures to combat financial crime, planning to implement a new data-led detection capability to enhance the identification and mitigation of financial criminal activities.

Fee Adjustments to Support Regulatory Activities

As part of its comprehensive strategy, the FCA is consulting on a proposal to increase its fees and levies by 2.5%, reflecting the rise in ongoing regulatory activities.

For more details on FCA initiatives, visit the FCA’s official website. To stay updated on financial regulations and innovations, check our related articles on financial regulations and innovation in finance.