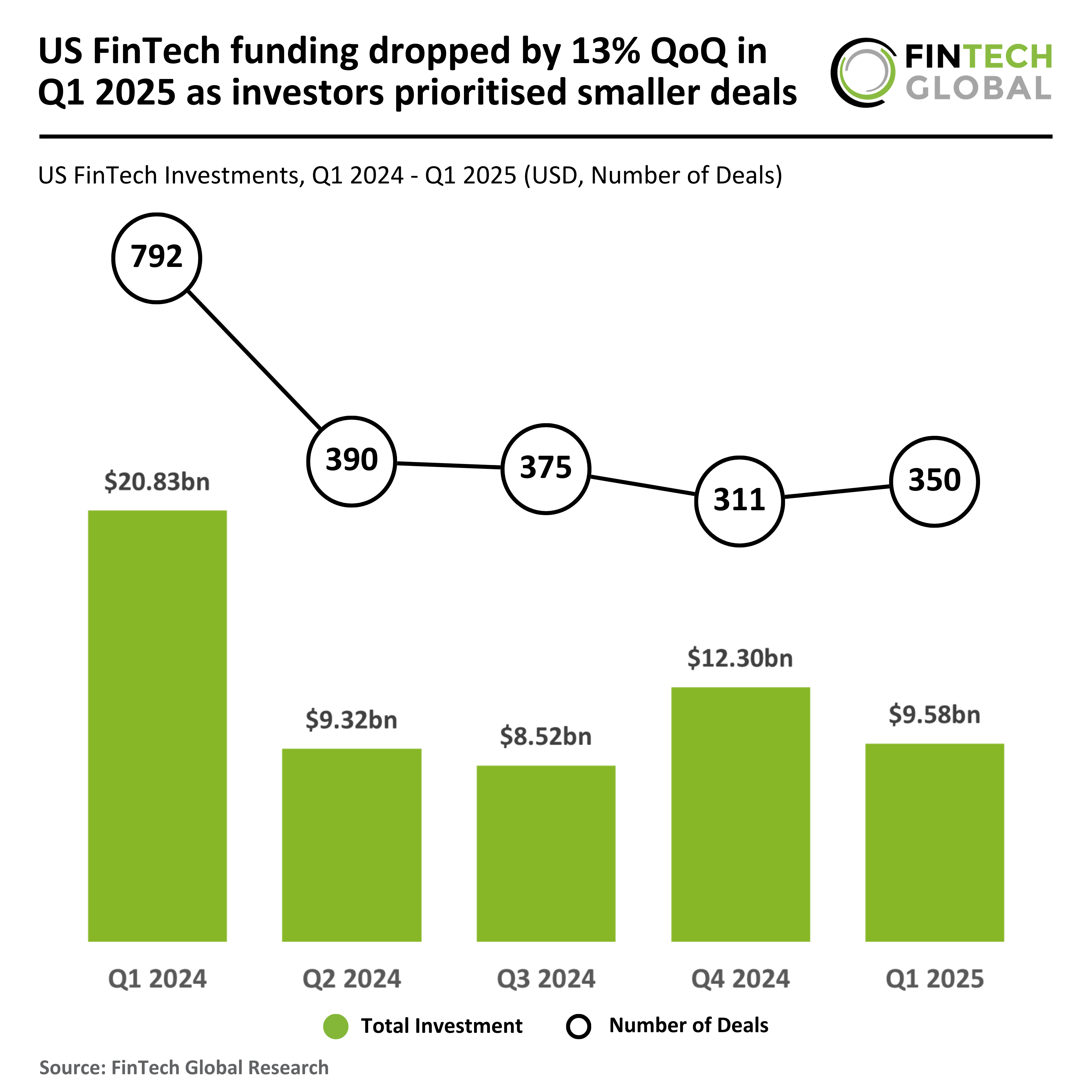

US FinTech Funding Falls 13% QoQ in Q1 2025: Investors Shift Focus to Smaller Deals

In Q1 2025, the US FinTech landscape witnessed a significant decline in investment activity, with a notable 13% quarter-over-quarter drop. This downturn reflects a cautious approach from investors amid evolving economic conditions and market dynamics.

Overview of US FinTech Investment Trends

The first quarter of 2025 marked a challenging period for the US FinTech sector, characterized by a decrease in both deal volume and funding:

- Total Deals: 350 deals were executed, a stark 56% decrease from the 792 deals in Q1 2024.

- Funding Amount: FinTech companies raised $9.6 billion, down 54% from $20.8 billion in the same quarter last year.

Comparative Analysis: Q4 2024 vs. Q1 2025

When contrasting Q4 2024 with Q1 2025, the number of deals increased modestly by 13% from 311 to 350. However, total funding fell by 22%, dropping from $12.3 billion to $9.6 billion. This indicates a trend where investors are favoring smaller deals, opting for more strategic and cautious capital allocation.

Average Deal Value Declines

The average deal value in Q1 2025 decreased to $27.3 million, a significant decline from $39.1 million in Q1 2024 and slightly below the $39.5 million average in Q4 2024. This trend suggests that investors are prioritizing lower-risk opportunities as they navigate a more conservative funding environment.

Highlighting Major Deals: Rokt’s Success

Among the notable transactions, Rokt, a New York-based FinTech leader, secured a substantial $335 million share offering, making it one of the largest deals in the US FinTech space for the quarter. This transaction elevated Rokt’s valuation to $3.5 billion and was supported by major investors such as Tiger Global Management, Square Peg, Barrenjoey, and SecondQuarter.

Rokt utilizes advanced data science and machine learning to enhance e-commerce experiences, and its solutions are crucial in boosting online engagement and revenue. Additionally, Rokt has announced a planned merger with the customer data platform mParticle for $300 million, which aims to deepen customer insights and strengthen its position in the data-driven marketing landscape.

Conclusion

The trends observed in Q1 2025 underscore a cautious yet strategic approach in the US FinTech sector, highlighting a shift towards smaller, more focused investments. As the market evolves, companies like Rokt are paving the way for innovation and growth, adapting to the changing economic landscape.