Unlocking Compliance: The Power of Traceability from Audit Trails to Accountability

In the evolving landscape of regulatory compliance, organizations are facing increased pressure to adopt a proactive approach. Gone are the days when compliance was merely a tick-box exercise; now, businesses must integrate compliance deeply into their operational frameworks to maintain regulatory trust and effectively manage risks.

The Importance of Traceability in Compliance

According to Corlytics, traceability is crucial for this transformation. It enables firms to understand not just what actions were taken, but also the context—how, when, and why those actions occurred. This foundational aspect of compliance fosters trust by demonstrating how internal controls align with regulatory obligations.

Benefits of Integrated Compliance Frameworks

- Dynamic Compliance Architectures: By utilizing intelligent mapping and real-time updates, organizations can adapt their compliance strategies in response to regulatory changes.

- Enhanced Audit Clarity: Traceability simplifies the audit process, allowing firms to swiftly identify existing controls, their effectiveness, and their alignment with regulations.

- Improved Risk Management: A comprehensive understanding of controls and their functions reduces the risk of non-compliance and enhances decision-making visibility.

Challenges in Maintaining Effective Compliance

Despite efforts to improve compliance frameworks, many organizations still struggle with audit trail weaknesses. Common challenges include:

- Reliance on manual processes.

- Undocumented knowledge among long-tenured employees.

- Inadequate adaptation to staff turnover or system changes.

Regulatory bodies such as the SEC and DOJ now expect organizations to implement robust and adaptable compliance programs. Controls must not only act as safeguards but also serve as frameworks for integrity, transparency, and accountability across various domains, including financial crime and ESG.

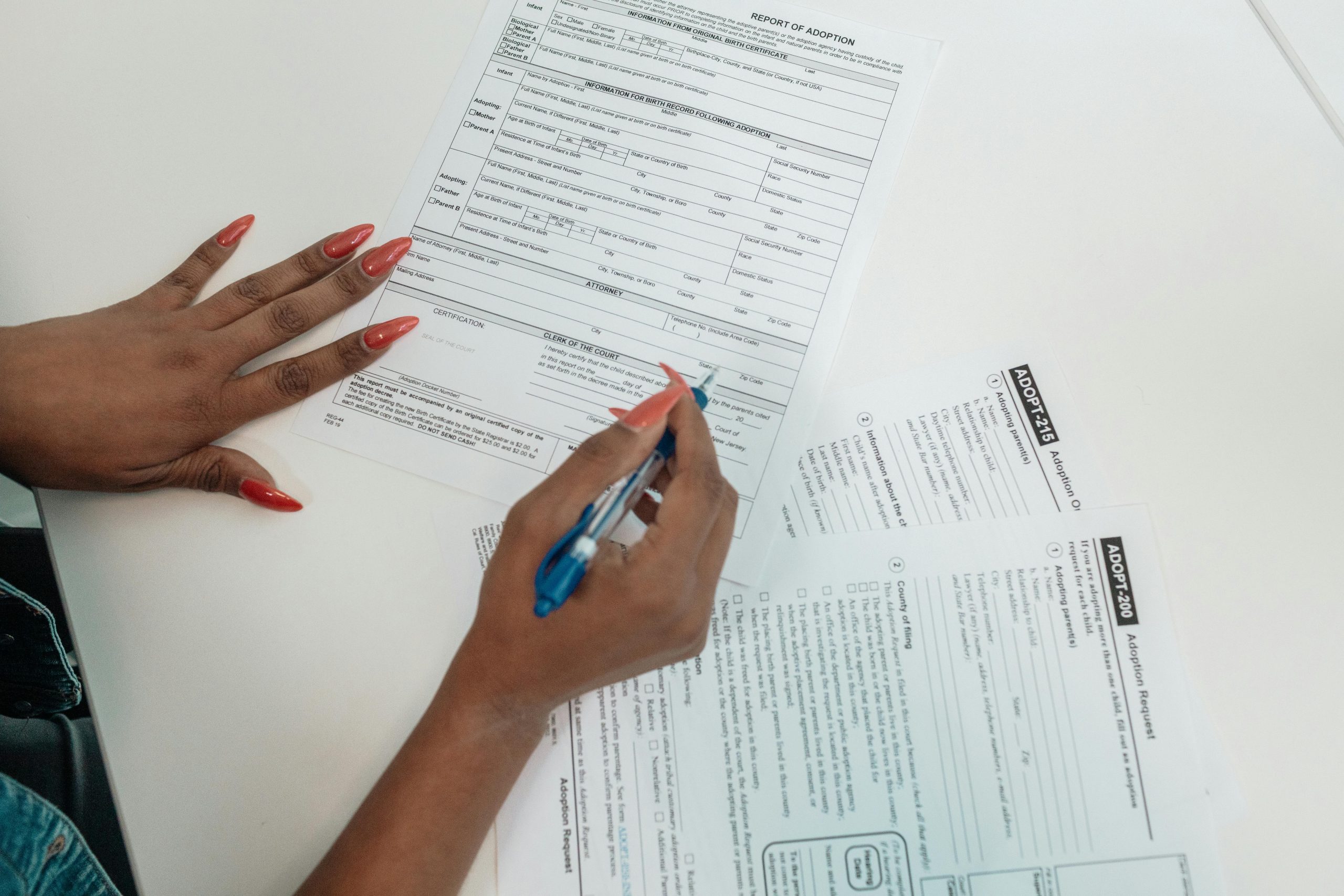

Implementing Effective Compliance Controls

To be effective, compliance controls should:

- Directly map to relevant regulations.

- Utilize standardized workflows for implementation.

- Be supported by real-time monitoring tools.

For instance, a policy on data encryption might involve both data-at-rest and data-in-transit controls. Fragmented control frameworks can hinder effectiveness, necessitating consolidation to eliminate redundancies and promote multi-purpose compliance.

Building a Culture of Accountability

Well-structured controls are vital for fostering traceable compliance. They allow firms to:

- Reconstruct decision-making processes.

- Respond effectively to regulatory reviews.

- Establish a culture of accountability.

Firms that leverage connected control environments, equipped with automation and centralized data, can promptly flag breaches and significantly reduce audit costs.

The Need for Agility in Compliance Frameworks

It is essential that traceable compliance frameworks remain agile. Controls should not be treated as static; they must be regularly tested, monitored, and updated to align with evolving regulations. Failure to do so can have severe repercussions. For example:

- Meta Platforms Ireland faced a €251 million fine for GDPR violations.

- Block, Inc. incurred a $175 million penalty for inadequate fraud protection.

- Metro Bank was fined £16.68 million for insufficient AML controls.

Bridging the Gap Between Technology and Governance

Many compliance failures stem from misalignments between technology and governance. At the Pay360 Conference, European and UK regulators cautioned against control designs that do not align with operational risks. Simply automating processes is often insufficient for effective financial crime prevention.

As Carolin Gardner of the EBA emphasized, “Technology alone is not a control system.” Instead, tools must function within a governed, structured framework to produce measurable outcomes. Integrating automated safeguards with human oversight creates a reliable, auditable system where every action is traceable.

Conclusion: Embracing Traceable Compliance

Ultimately, successful compliance is not solely about technology; it requires a harmonious integration of people, processes, and technology. By viewing compliance controls as essential infrastructure rather than mere back-office tasks, organizations can build the trust and transparency that regulators demand. In an era of increasing enforcement, firms that adopt traceable compliance strategies will set themselves apart as leaders in their industries.