US Firms Dominate InsurTech Landscape: 50% of Q1 2025 Deals as Funding Surges 59% Year-Over-Year!

In the first quarter of 2025, the global InsurTech investment landscape witnessed a remarkable surge, highlighting the evolving dynamics of the insurance technology sector. This article explores key statistics and trends that illuminated the InsurTech funding scene.

Significant Growth in Global InsurTech Funding

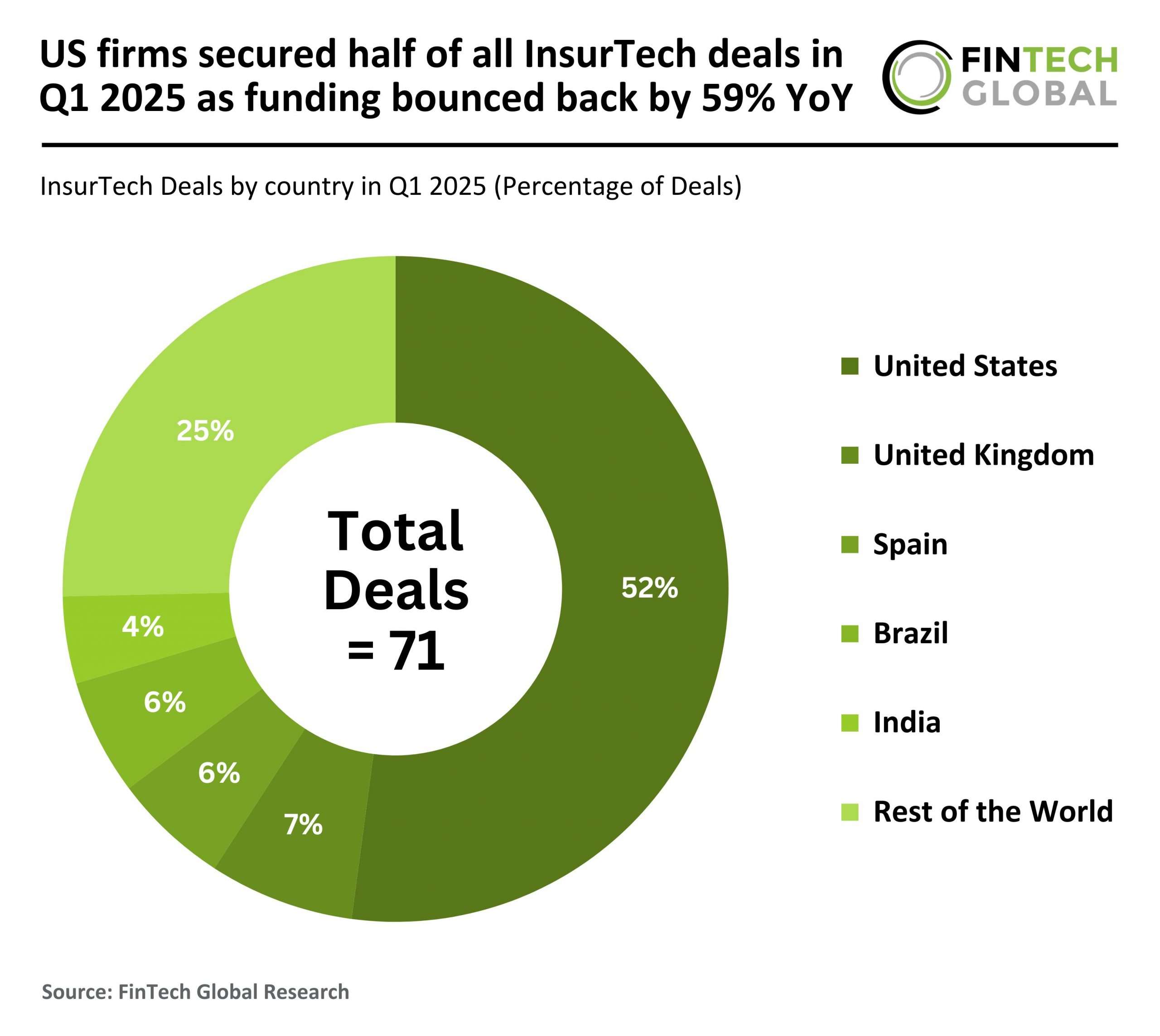

During Q1 2025, the global InsurTech funding landscape demonstrated impressive growth, achieving a 59% year-over-year increase. The total funding amounted to $1.1 billion, a notable rise from the $718 million recorded in Q1 2024. However, the number of deals saw a decline, dropping by 22% from 91 to 71.

Investor Focus Shifts to High-Value Opportunities

This funding increase, despite the drop in deal volume, indicates a strategic shift among investors, who are now prioritizing fewer but more substantial opportunities. This trend reflects a gradual recovery in investor confidence following a prolonged downturn in the sector.

US Dominates the InsurTech Market

The United States continued to solidify its position as the leading InsurTech hub, accounting for 52% of all deals in Q1 2025 with 37 transactions. This marks a slight decrease from 45 deals (49% share) in Q1 2024. Other notable regions included:

- United Kingdom: 5 deals (7% share)

- Spain: 4 deals (6% share)

- Brazil: 4 deals (6% share)

Germany and Canada, previously significant players in the InsurTech space, did not feature in the top tier for Q1 2025, indicating the rise of newer markets like Spain and Brazil.

High Definition Vehicle Insurance (HDVI) Secures Major Funding

One of the standout deals in Q1 2025 was secured by High Definition Vehicle Insurance (HDVI), a tech-driven commercial auto InsurTech, which raised $40 million in growth capital. This funding round, co-led by prominent investors such as 8VC, Autotech Ventures, Munich Re Ventures, and Weatherford Capital, aims to enhance HDVI’s telematics-based product suite and expand its nationwide coverage.

Innovative Solutions Driving HDVI’s Growth

HDVI leverages over 7.5 billion miles of telematics data to revolutionize underwriting and claims processing. This innovative approach enables:

- Dynamic pricing

- Real-time risk assessment

- Improved safety measures for fleet operators

Since launching HDVI Shift™ in 2021, the company has achieved an impressive 107% compound annual growth rate while maintaining a loss ratio significantly below industry averages. With increased reinsurance capacity and a dedicated leadership transition, HDVI is poised to redefine commercial auto insurance by aligning safety performance with pricing incentives.

For further insights into the InsurTech industry, visit InsurTech News or explore related trends on our InsurTech Trends page.