New York Leads US WealthTech Sector with 29% of Q1 2025 Deal Flow

In the first quarter of 2025, the US WealthTech sector witnessed a significant downturn in investment activity, with deal-making sharply declining. These changes highlight the evolving landscape of financial technology and investor sentiment within the WealthTech domain.

US WealthTech Investment Overview in Q1 2025

During the first quarter of 2025, the US WealthTech industry saw a dramatic reduction in both deal volume and funding amounts:

- Deal Activity: A total of 68 deals were executed, marking a 71% decrease from the 235 deals recorded in Q1 2024.

- Funding Levels: Total investment plummeted by 76%, amounting to $1 billion compared to $4.1 billion in the same quarter last year.

This downturn reflects a cautious approach from investors amid a broader slowdown in the FinTech investment landscape, particularly affecting the WealthTech sector.

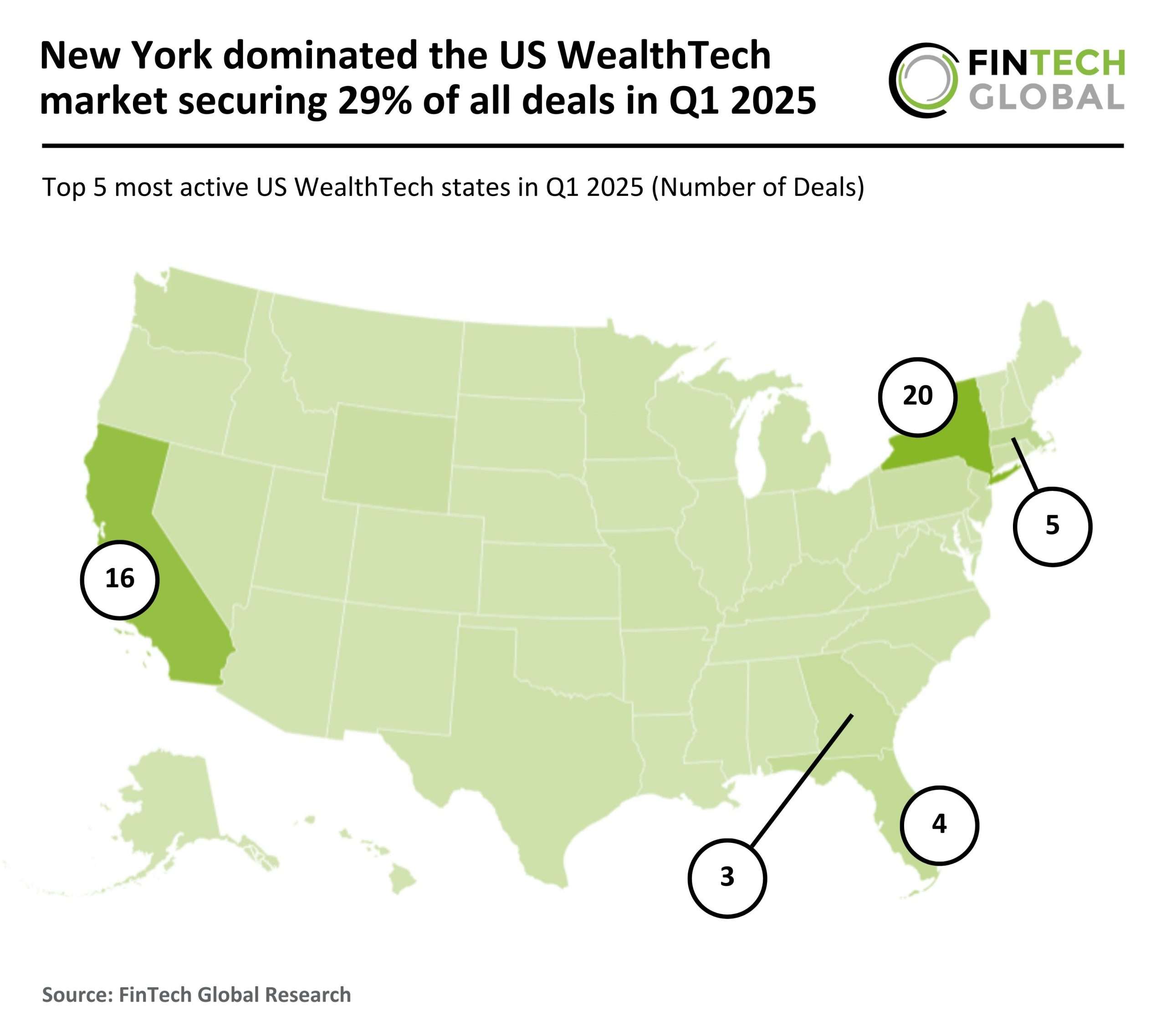

Regional Highlights: New York and California Lead the Market

New York emerged as the leading hub for WealthTech investments in Q1 2025, accounting for 29% of all deals, despite a 57% drop from the previous year. Meanwhile, California secured 24% of the market share with 16 deals, down from 96 deals in Q1 2024.

Other notable states include:

- Massachusetts: Completed five deals, capturing a 7% market share.

- Texas: Dropped from the top three, recording 26 deals last year.

Despite the overall decline, New York and California continue to play critical roles in the US WealthTech ecosystem, emphasizing their importance even in challenging market conditions.

Taktile: A Major Player in WealthTech Funding

One of the standout developments in Q1 2025 was the $54 million Series B funding round raised by Taktile, a leading WealthTech platform focused on automated risk decisioning. This funding round is among the largest WealthTech deals of the quarter.

Supported by Balderton Capital and a consortium of prominent investors including Index Ventures and Tiger Global, Taktile’s total funding now stands at $79 million.

Taktile’s Impact on Financial Institutions

Taktile empowers financial institutions such as banks, insurers, and FinTechs to develop and enhance AI-driven risk strategies across:

- Credit underwriting

- Fraud detection

- Compliance workflows

The platform is currently making hundreds of millions of high-stakes decisions each month, enabling organizations to quickly adapt to shifting risk environments while ensuring precision and transparency.

In 2024, Taktile achieved an impressive 3.5x growth in annual recurring revenue and expanded its customer base across 24 markets, receiving multiple accolades for its leadership in decision intelligence. Major institutions like Allianz and Rakuten Bank are leveraging Taktile’s tools to modernize financial decision-making in an increasingly complex regulatory environment.

For further insights into the WealthTech landscape, consider exploring additional resources on WealthTech trends and investment strategies.