DPI Unveils DPI Venture Capital and Acquires Nclude to Boost African Investments

Development Partners International LLP (DPI), an Africa-focused private investment firm, is pioneering investment opportunities in early-stage companies that cater to the burgeoning middle class across the continent. With the launch of its new venture, DPI Venture Capital, the firm aims to bolster its commitment to supporting innovative firms that drive economic growth in Africa.

DPI Venture Capital: A New Era for Investment in Africa

With an impressive eighteen-year history of fostering innovation-led businesses, DPI is well-equipped to enhance its portfolio by focusing on companies that leverage digitization to provide essential goods and services to a rapidly growing population. The establishment of DPI Venture Capital represents a significant step in this direction, supported by the firm’s extensive presence in over 43 African countries and investments across various sectors, particularly technology-driven enterprises.

Strategic Partnership with Nclude Innovation Fund

The launch of DPI Venture Capital coincides with the successful completion of a fund restructuring transaction involving the Nclude Innovation Fund LP (Nclude), a fintech-focused fund based in Egypt. This strategic partnership allows DPI to assume the investment advisory responsibilities for Nclude, enhancing its capacity to support innovative financial solutions in the region.

Insights from DPI Leadership

Runa Alam, co-founder and CEO of DPI, shared her enthusiasm about the new venture: “The establishment of DPI Venture Capital fulfills our long-standing ambition to offer a diverse range of investment strategies in Africa. This platform enables our limited partners to invest in some of Africa’s most exciting startups right from their inception.”

She further emphasized the significance of the Nclude transaction, stating, “This is an opportunity to build on our successful investments in technology-led firms, empowering our investors to gain exposure to dynamic growth-oriented businesses.”

Nclude’s Impact and Achievements

Since its inception in March 2022, Nclude has successfully invested over $28 million in nine transactions, supporting notable companies such as:

- Paymob

- Khazna

- Flapkap

- Connect Money

Nclude enjoys backing from various limited partners, including national banks like Banque Misr, National Bank of Egypt, and Banque du Caire, as well as financial services institutions such as e-Finance Investment Group, EBC, and Mastercard. The fund was launched with the support of the Central Bank of Egypt, which has facilitated its capacity to invest up to 30% of its commitments in opportunities across the Middle East and Africa.

Focus on Egypt’s Fintech Landscape

Egypt is a key market for DPI, with nearly $850 million invested in the country over the past decade. DPI has recognized the transformative power of digitization through its portfolio companies, including MNT-Halan and Kazyon. With DPI now serving as the investment adviser for Nclude, the firm will manage the entirety of the Fund’s $105 million in assets, aiming to strengthen the fintech ecosystem and enhance financial inclusion in Egypt.

Securing a Leadership Role in African Investment

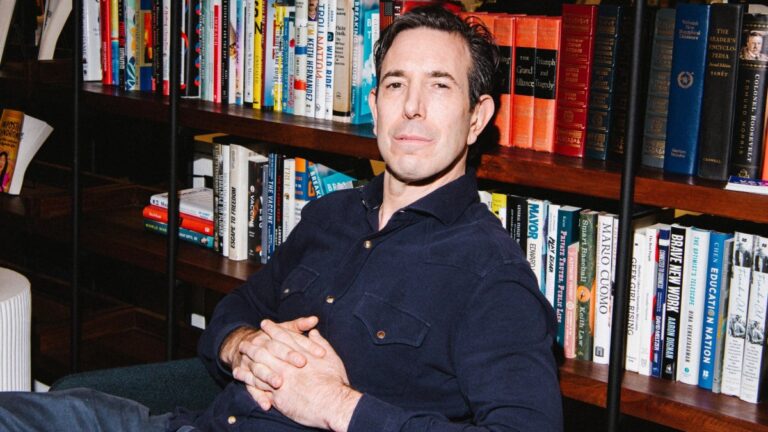

The launch of DPI Venture Capital, alongside the Nclude transaction, solidifies DPI’s status as a premier private investment adviser in Africa. Led by managing partner Ashley Lewis, the new venture comprises a team of seasoned venture capital professionals, including general partner Mohamed Aladdin.

Ashley Lewis remarked, “The African venture capital ecosystem remains underpenetrated, presenting a significant opportunity for Africa-focused fund sponsors to make a notable impact. We look forward to integrating the Nclude team, portfolio companies, and LPs into DPI and expanding our reach within Egypt’s vibrant investor and tech community.”

For more information about DPI and its investment strategies, visit DPI’s official website.