Unveiling the Secrets: How Bold Investors Are Achieving Success with Unique Strategies

In today’s rapidly evolving financial landscape, having a robust investment strategy is crucial for success. Gone are the days when simply picking stocks was enough. Investors now face a dynamic environment shaped by technological advancements and market volatility. Understanding how to navigate these changes is essential for anyone looking to build a future-proof portfolio.

Long-Term Growth with a Technological Edge

The traditional approach to long-term investing—purchasing blue-chip stocks and holding them indefinitely—is becoming obsolete. While long-term investing remains vital, modern portfolios are increasingly centered around innovative sectors such as:

- Emerging technology

- Sustainable infrastructure

- Digital finance platforms

These sectors are not mere buzzwords; they represent the foundation of the global economy’s future. Investors are now focusing on scalable companies with strong competitive advantages that can withstand market fluctuations. Key sectors that show resilience include:

- Clean energy

- Semi-conductors

- Digital payments

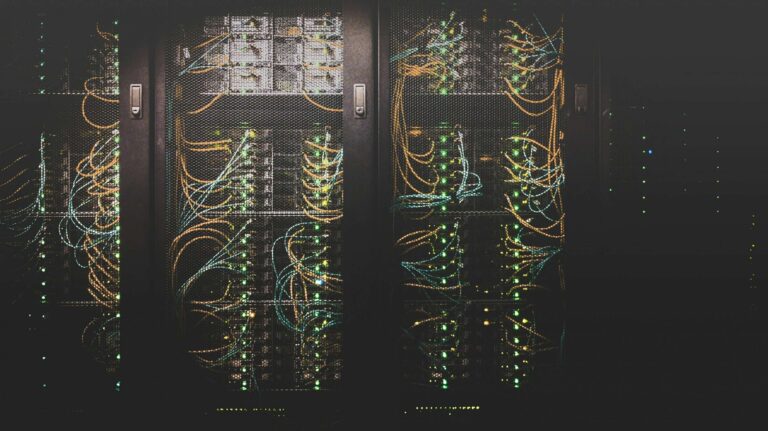

- Cloud-based infrastructure

Data-Driven Investment Decisions

Successful investors aren’t just following market trends; they’re leveraging data analytics. The integration of artificial intelligence (AI) into investment strategy is transforming how portfolios are managed. Robo-advisors were just the beginning. Today, institutional investors utilize:

- Real-time data analysis

- Pattern recognition for market anomalies

- Automated position adjustments

These advancements allow for a logical approach to investing, minimizing emotional reactions that often lead to poor decision-making. AI remains unaffected by market fears or excitement, providing a significant advantage over traditional human investors.

The Rise of Pre-IPO Investing

One of the hottest topics in the fintech sector is pre-IPO investing. This strategy grants investors access to companies before they go public, allowing them to capitalize on growth before valuations skyrocket. Historically limited to venture capitalists, this opportunity is now available to qualified individual investors, allowing them to:

- Engage with startups showing real traction

- Identify companies with strong revenue and leadership

- Capitalize on the final stages before a public offering

While pre-IPO investing carries risks, it can yield substantial returns for those who conduct thorough due diligence.

Evolving Diversification Strategies

Diversification has evolved beyond simply mixing stocks, bonds, and real estate. In 2025, effective diversification includes various asset classes such as:

- Cryptocurrencies

- Private equity

- Commodities

- Fractional ownership of art and collectibles

This strategy aims to create a portfolio capable of thriving in diverse market conditions, focusing on inflation-resistant assets and long-term value storage. With the aid of fintech tools, individual investors can now achieve diversification without needing massive capital.

Generating Passive Income in Today’s Market

While passive income isn’t a new concept, opportunities for generating it are expanding. Options now include:

- Dividend-paying ETFs

- Yield farming in decentralized finance

- Token staking

- Peer-to-peer lending platforms

Investors should prioritize sustainable opportunities. While high yields are attractive, it’s crucial to evaluate the underlying mechanisms of these investments. Resources offering clear analytics can aid in making informed decisions.

Conclusion: Embracing a Fluid Investment Mindset

The ideal investment strategy is not a rigid formula; it requires adaptability and a willingness to blend traditional methods with modern technology. By embracing risk in pursuit of reward and seeking transparency, investors can build portfolios that withstand market volatility. Whether you’re leveraging AI analysis, exploring pre-IPO opportunities, or crafting a diversified investment mix, the future of investing is more accessible and engaging than ever before.

For further reading on investment strategies, check out our articles on investment basics and pre-IPO investing.