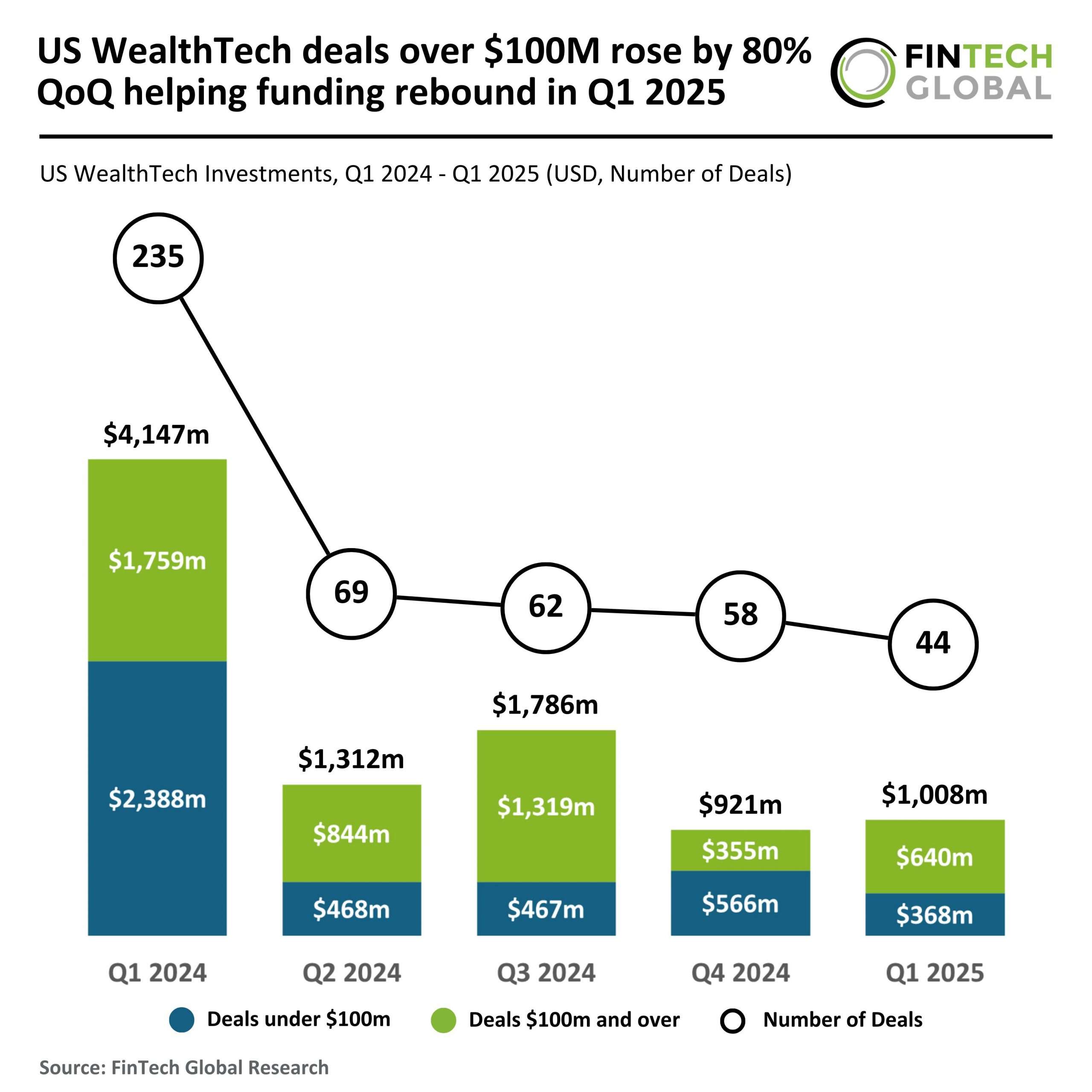

US WealthTech Surges: $100M+ Deals Soar 80% QoQ, Driving Funding Rebound in Q1 2025

In the dynamic landscape of WealthTech, recent statistics reveal intriguing trends in US investments during the first quarter of 2025. Despite the overall decline in deal numbers, the funding landscape shows a notable shift towards larger investments, indicating a focused strategy among investors.

US WealthTech Investment Overview for Q1 2025

During the first quarter of 2025, US WealthTech funding experienced a 9% increase quarter-over-quarter (QoQ). Here are some key metrics:

- Total funding: Reached $1 billion, up from $921 million in Q4 2024.

- Deal count: 44 deals, down 24% from 58 in Q4 2024.

- Year-on-year (YoY) decline: Funding was down 76% compared to $4.1 billion in Q1 2024.

Average Deal Size and Trends

The average deal size in Q1 2025 was $23 million, a significant increase from $16 million in Q4 2024 and $18 million in Q1 2024. This trend indicates a shift towards fewer, but more substantial investments as investors concentrate on established and late-stage WealthTech firms.

High-Value Deals Surge

Investments in deals exceeding $100 million rose by 80% QoQ, signaling a renewed focus on high-value opportunities. In contrast, funding from deals under $100 million totaled $368 million, marking a 35% decrease from Q4 2024 and an 85% drop from Q1 2024.

- Large deals ($100m+): Generated $640 million, an 80% decrease YoY from $1.8 billion in Q1 2024, but up 80% from $355 million in Q4 2024.

This recovery in high-value deals could suggest renewed investor confidence in select WealthTech companies, despite a general caution in the market.

Spotlight on CredCore’s Funding Achievement

Among the standout performers, CredCore, a New York-based vertical-AI company, secured a prominent funding round of $16 million, making it one of the top US WealthTech deals of the quarter. The funding was led by Avataar Ventures and included participation from Inspired Capital, Fitch Group, BellTower Partners, and other senior figures in asset management.

Founded in 2022, CredCore leverages advanced AI models to enhance the debt capital market processes for lenders and borrowers. Their innovative platform expedites the debt deal lifecycle—from pre-deal evaluations to post-deal management—allowing credit funds to scale their assets under management more effectively.

Future Plans and Market Position

The recent funding will bolster CredCore’s AI capabilities, support team expansion, and enhance platform features to cater to a broader range of credit market participants. This positions CredCore as a frontrunner in WealthTech innovation within the evolving credit investment landscape.

For more insights into WealthTech trends, explore our articles on WealthTech Trends and Investment Strategies.

Stay tuned for more updates on the WealthTech sector as it continues to evolve amid shifting market dynamics.