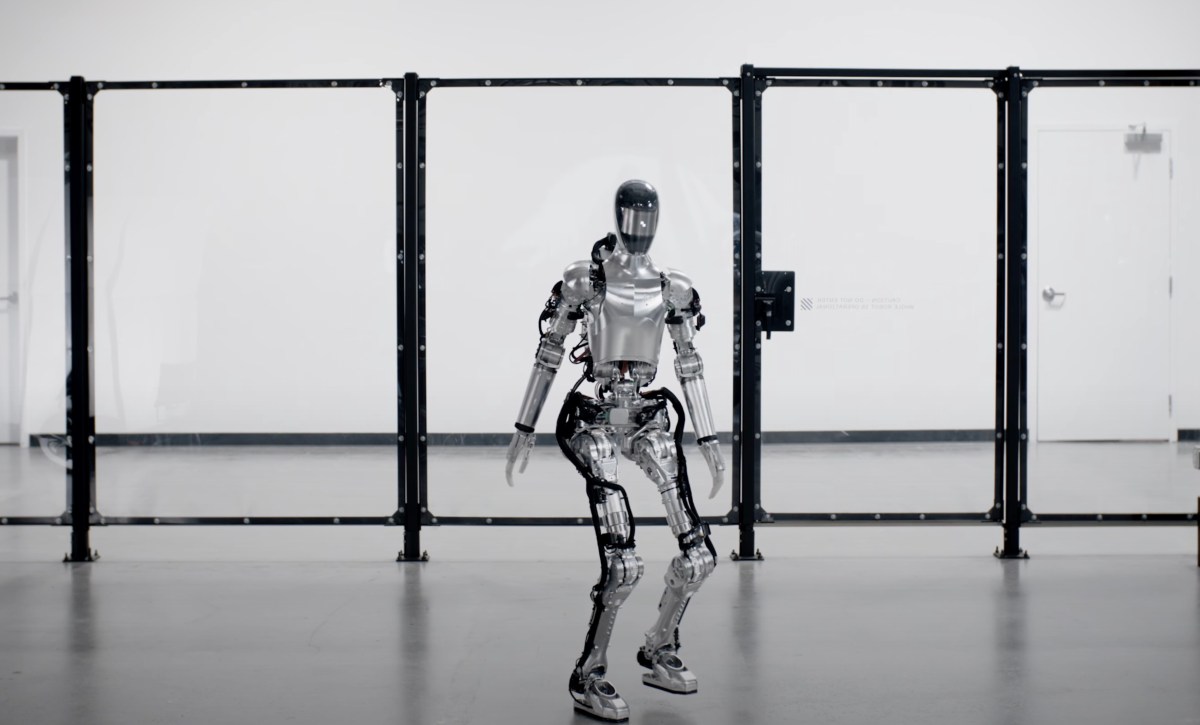

Figure AI Takes Action: Cease-and-Desist Letters Issued to Secondary Market Brokers

In the competitive world of private equity, Figure AI, a robotics startup founded by Brett Adcock, has recently made headlines. Last month, Adcock announced on X that his company has become the “most sought-after private stock in the secondary market.” However, this claim has sparked controversy as the company has issued cease-and-desist letters to brokers involved in secondary stock sales.

Figure AI’s Cease-and-Desist Actions

According to reports from TechCrunch, Figure AI has sent cease-and-desist letters to at least two brokers operating secondary marketplaces. These letters were aimed at stopping the unauthorized marketing of the company’s stock.

Background on Cease-and-Desist Letters

Both brokers reported receiving these letters shortly after Bloomberg revealed that Figure was pursuing a significant funding round of $1.5 billion at a staggering $39.5 billion valuation. This valuation marks a dramatic increase from the $2.6 billion valuation achieved in February 2024.

A spokesperson for Figure AI clarified that the company typically sends such letters when brokers lack the necessary authorization to sell its stock. “This year, when we discovered an unauthorized third-party broker was marketing Figure shares without approval from the Figure Board of Directors, we acted swiftly to protect our interests,” the spokesperson stated.

The Dynamics of Private Stock Sales

As a private entity, Figure AI’s stock is not as easily traded as public stocks, which is why secondary markets have emerged. These platforms provide investors with alternative avenues to liquidate their shares before an initial public offering (IPO), often through loans secured by their equity.

The Impact of Secondary Market Activity

Some brokers believe that the reluctance of CEOs to allow secondary sales stems from various concerns, including:

- Existing shareholders attempting to sell their stock at prices lower than the anticipated $39.5 billion valuation.

- The fear that lower-priced shares may undermine new fundraising efforts.

Sim Desai, founder and CEO of the secondary shares marketplace Hiive, commented on the situation, stating that some companies view direct secondary sales as a “zero-sum game.” He argues, however, that active trading in secondary markets can actually enhance interest in primary shares during new funding rounds.

Valuation Challenges and Future Prospects

The ongoing discussion about Figure AI’s valuation raises important questions. If secondary market activity does not generate excitement for upcoming funding rounds, it may indicate underlying issues with the company’s valuation strategy. Desai noted, “If someone is having a hard time selling something, it’s merely a function of price and valuation rather than availability of capital.”

Figure AI has also been in the news for its partnership with BMW, which has led to various articles highlighting the company’s progress. Figure has challenged some of these reports, threatening legal action over inaccuracies.

Conclusion: What Lies Ahead for Figure AI?

The future of Figure AI’s funding and valuation remains uncertain. Whether existing investors will have the opportunity to cash out through secondary transactions is yet to be determined. As the company navigates these challenges, it will be interesting to see how its strategies evolve in the private equity landscape.