Similar Posts

Nubank Secures Banking License Approval in Mexico: A Game-Changer for Fintech

The National Banking and Securities Commission (CNBV) has granted Nu Mexico a banking license, transforming it from a Popular Financial Society into a fully operational bank. Since entering Mexico in 2020, Nubank has successfully introduced a no-fee credit card, debit accounts, savings accounts, and personal loans, attracting over 10 million customers and $4.5 billion in deposits. Following this approval, Nu Mexico will undergo a regulatory audit to ensure compliance before starting operations. The license allows for expanded product offerings, including a payroll account, aimed at enhancing customer convenience and further impacting the banking landscape in Mexico.

UK Post Office and Banks Forge Innovative Cash Access Partnership

The UK Post Office’s recent agreement with various banks significantly enhances cash access for customers nationwide. Under this partnership, customers can withdraw cash at over 11,500 Post Office branches, addressing the rising demand for accessible banking solutions. Key benefits include increased accessibility, convenient locations, and support for local economies, particularly in communities facing cash availability challenges. Cash remains essential for many, especially the elderly and those in rural areas, ensuring financial inclusion. This collaboration reflects a commitment to adapting banking services to meet evolving consumer needs in the digital age.

PalmPay and Jumia Join Forces to Revolutionize Nigeria’s Digital Payment Ecosystem

Jumia has integrated PalmPay, enabling users to pay seamlessly with their PalmPay wallet, enhancing transaction reliability and promoting digital payments across Africa. To celebrate this collaboration, they are launching a Christmas campaign from December 11 to 30, where customers using PalmPay can win cash rewards. This partnership offers seamless transactions, increased convenience, and encourages cashless transactions. Sofia Zab, Chief Marketing Officer of PalmPay, highlighted their commitment to improving the online shopping experience, while Jumia’s CEO, Sunil Natraj, emphasized their focus on providing reliable and secure shopping, enhancing access to affordable goods through digital payments.

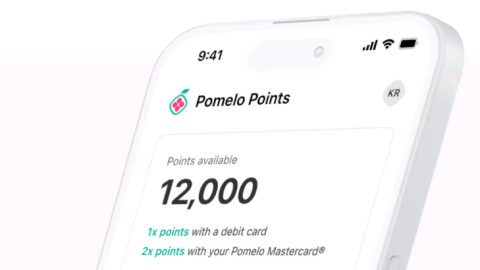

Pomelo Revolutionizes Finance: Merging US Consumer Credit with Seamless International Transfers to the Philippines

Pomelo is transforming the financial landscape by merging US consumer credit with international money transfers, specifically for the Philippines. This innovative fintech platform allows users to leverage their credit for seamless and speedy transactions, featuring a user-friendly interface. Advantages include cost-effective solutions with competitive rates, secure transactions, and mobile accessibility. To get started, users can create an account, link their credit card, and easily transfer funds. Pomelo is set to become a preferred choice for those sending money to the Philippines, emphasizing convenience and efficiency in financial management. For further insights, visit Money Transfer Comparison.

Asia Set to Lead the Global Fintech Revolution: Insights from Latest Report

A report by Singapore’s UnaFinancial reveals that fintech transactions in Asia surged to $16.8 trillion in 2024, up $2.1 trillion from the previous year. The Asian fintech market is projected to reach $18.9 trillion by 2025, growing at 12.6% annually. Asia will account for 47.1% of the global fintech market, expected to hit $40.1 trillion this year. Key growth drivers include the rise of digital banking, smartphone adoption, super-apps, and supportive government initiatives. The digital payments sector is anticipated to contribute 45% to this growth, surpassing the global average of 32%.

JPMorgan Chase Boosts Financial Innovation with Strategic Investment in FairPlay

JPMorgan Chase has invested in FairPlay, a leader in digital finance solutions, aiming to enhance its fintech portfolio and help FairPlay scale operations. This partnership is expected to drive technological advancements and improve customer service. FairPlay’s innovative technology, strong market presence, and growth potential made it an attractive investment for JPMorgan Chase. The collaboration is anticipated to increase competition among fintech companies, enhance customer offerings, and contribute to overall market growth. As both companies join forces, the investment highlights the growing convergence between traditional banking and technology, signaling a transformative shift in the financial sector.