Similar Posts

Unlocking Success: How Wealth Advisors Can Leverage Personalized Data and Client-Centric Tools to Stay Relevant

In the evolving wealth management landscape, advisors must adapt to industry changes and anticipate client needs. A recent LSEG report emphasizes a client-centric approach, highlighting that 68% of clients value a comprehensive view of their assets. Advisors need to leverage data-driven insights and technology to deliver timely, personalized advice. The Advisor Dashboard by LSEG aids this by providing essential data and insights to enhance client interactions. With 61% of wealth managers prioritizing personalized analytics, firms must utilize cost-effective technology solutions to improve productivity and foster long-term, value-driven client relationships in a competitive environment.

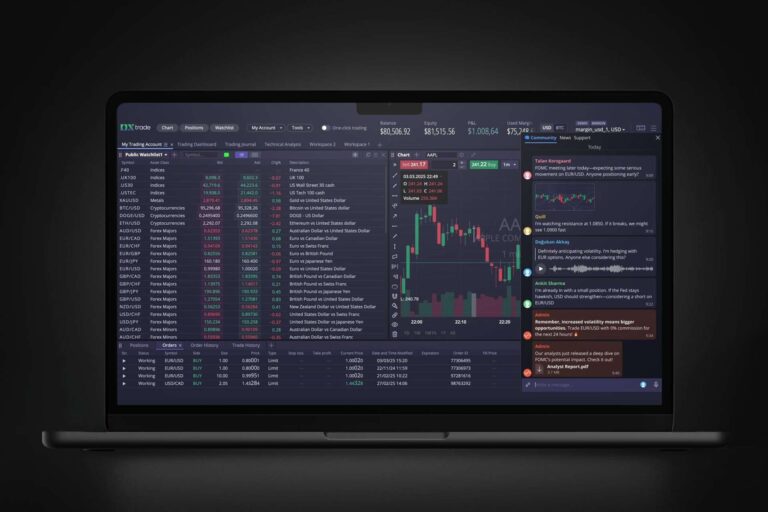

Devexa Unveils Groundbreaking Secure Trading Community Feature for Enhanced Broker Platform Experiences

Devexa, the AI-powered trading assistant by Devexperts, has launched a new community feature that enhances trader engagement within brokers’ platforms. This secure environment allows traders to share insights, discuss market trends, and collaborate on strategies, reducing risks associated with third-party platforms like Discord. Key benefits include secure interactions, rich content support, broker control, and improved trader retention. The feature promotes compliance and security by allowing brokers to oversee discussions. It also facilitates dynamic interactions through event threads, collaborative analysis, live Q&A sessions, and community competitions. Jon Light from Devexperts emphasizes its advantages for community-building and trader safety.

CodeAnt AI Secures $2M Funding to Accelerate Software Development with Innovative AI Code Review Platform

CodeAnt AI, a U.S.-based software development startup, has raised $2 million in seed funding to improve its AI-driven code review processes, enhancing code quality and efficiency. Led by investors including Y Combinator and VitalStage Ventures, this funding round values the company at $20 million. Founded by Amartya Jha and Chinmay Bharti, CodeAnt AI automates code reviews, integrates with GitHub and GitLab, and offers AI insights and one-click fixes for over 30 programming languages. The investment will support team expansion and scaling of its platform, addressing the growing need for quality control in AI-generated code.

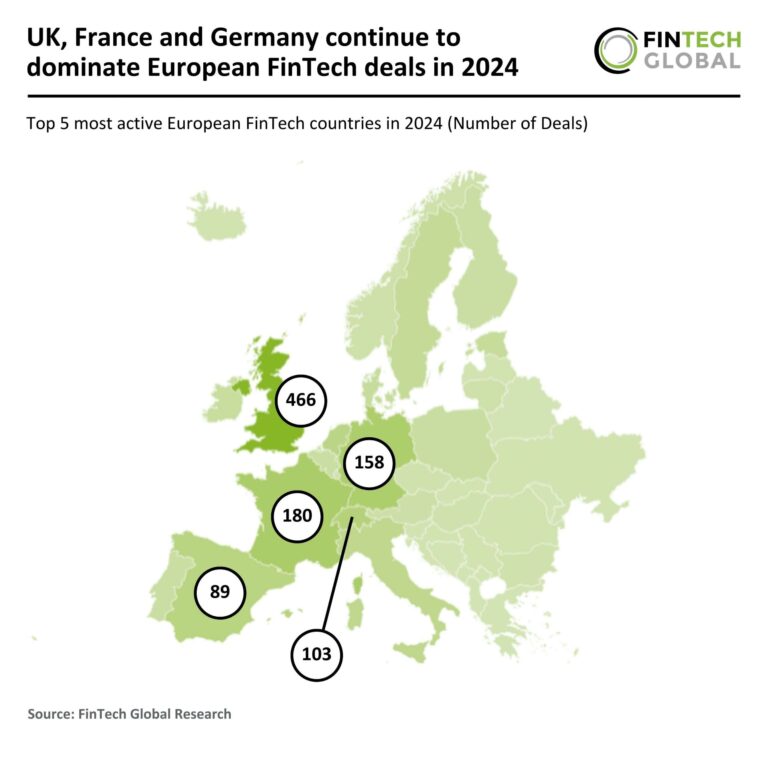

2024 European FinTech Landscape: UK, France, and Germany Lead the Charge in Investment Deals

In 2024, European FinTech investment faced a severe downturn, with a 63% drop in deal activity year-over-year. Total funding fell to $18.37 billion, a 47% decrease from 2023, and transactions decreased to 1,506 from 4,030. The UK, France, and Germany remained the leading countries in FinTech deals, although they experienced significant declines. Notably, London-based Zepz raised $267 million, one of the largest deals in the sector, to expand its operations and enhance financial inclusion in African markets. This challenging environment emphasizes the need for innovation and adaptability among FinTech companies to attract capital.

SEC Dismisses Kraken Lawsuit as Crypto Regulatory Landscape Evolves

Kraken announced that the U.S. Securities and Exchange Commission (SEC) has agreed to dismiss its lawsuit against the company, a significant milestone for the cryptocurrency industry. The dismissal, which is with prejudice, means the lawsuit cannot be refiled, and Kraken made no admission of wrongdoing, paid no penalties, or changed its business practices. The SEC initially accused Kraken of running an unregistered securities exchange. Kraken attributed the dismissal to recent leadership changes and criticized the previous “regulation-by-enforcement” approach. The company remains committed to collaborating with regulators to foster a clear framework for digital assets, indicating a potential shift towards a favorable regulatory environment.

Unlocking Innovation: DXC Technology Launches Insurance SaaS Suite on AWS Marketplace

DXC Technology has launched its DXC Assure SaaS insurance solutions on the AWS Marketplace, aiming to streamline software procurement and management for insurers in their digital transformation efforts. The offerings include the DXC Assure Platform, DXC Assure BPM (powered by ServiceNow), DXC Assure Life+, DXC Assure Claims, DXC Assure Legal, and DXC Assure Legal Insights, all leveraging AI to enhance insurance workflows and claims management. This initiative strengthens DXC’s partnership with AWS, which has supported over 200 migrations and 30 million policies globally. DXC’s President emphasized the company’s commitment to delivering value and improving operational efficiencies for insurers.