Similar Posts

Jessie Kwok Appointed Chief Investment Officer at Wealthify: A New Era in Investment Leadership

Wealthify has appointed Jessie Kwok as its new Chief Investment Officer (CIO), succeeding Colleen McHugh, who will remain on the Investment Committee. This leadership transition underscores Wealthify’s commitment to enhancing investment management and providing accessible financial services. Kwok, a seasoned expert with a background at Investec, Fidelity International, and other notable firms, is poised to strengthen Wealthify’s investment strategies amid market uncertainties. She expressed enthusiasm about joining the company and aims to protect customers’ financial futures. McHugh praised Kwok’s capabilities, expressing confidence in her ability to navigate future challenges and ensure ongoing success.

Kraken’s Game-Changing $1.5 Billion Acquisition of NinjaTrader: What It Means for the Future of Trading

Kraken plans to acquire NinjaTrader, a US-based retail futures trading platform, for $1.5 billion, aiming to strengthen its presence in the US futures market. Founded in 2003, NinjaTrader serves nearly two million futures traders and holds a Futures Commission Merchant license. Kraken’s co-CEO, Arjun Sethi, emphasized the need to bridge traditional finance with crypto, aiming for a comprehensive trading platform. The acquisition will enable Kraken to offer crypto futures, enhance product offerings, and provide advanced trading tools. Expected to close in early 2025, the deal requires regulatory approval and is backed by Long Ridge Equity Partners.

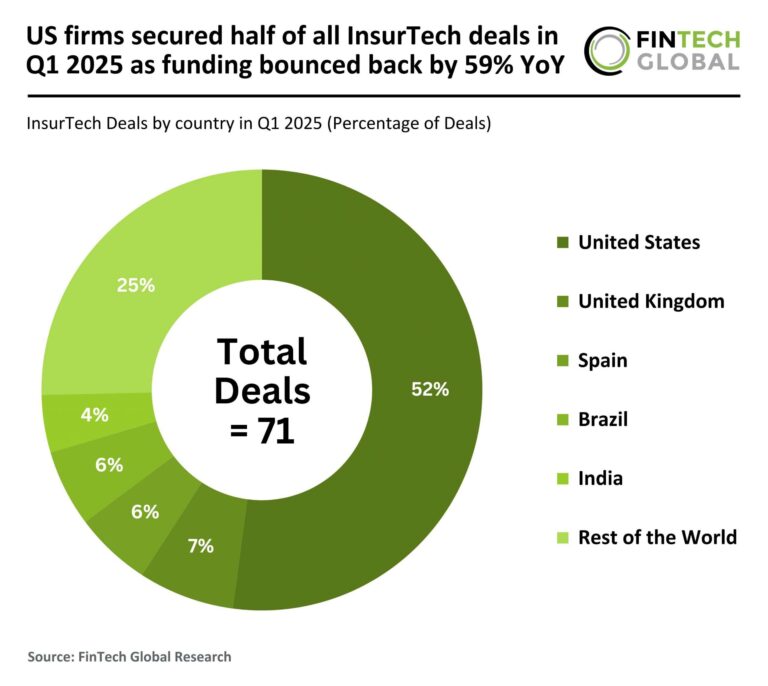

US Firms Dominate InsurTech Landscape: 50% of Q1 2025 Deals as Funding Surges 59% Year-Over-Year!

In Q1 2025, global InsurTech funding surged by 59% year-over-year, reaching $1.1 billion, despite a 22% drop in deal volume to 71 transactions. This shift indicates investors are now favoring fewer, high-value opportunities, signaling renewed confidence in the sector. The US dominated the market, accounting for 52% of deals, while the UK, Spain, and Brazil followed. Notably, High Definition Vehicle Insurance (HDVI) secured $40 million in funding to enhance its telematics-based offerings, achieving a 107% annual growth rate since its 2021 launch and maintaining a low loss ratio, positioning itself to innovate commercial auto insurance.

Crypto.com Unveils Cutting-Edge Exchange Tailored for US Institutional Traders

Crypto.com has launched its institutional-grade exchange in the United States, enhancing options for both retail and institutional users. This platform offers over 300 cryptocurrencies and 480 trading pairs, emphasizing advanced trading capabilities and robust security features. Co-Founder and CEO Kris Marszalek highlighted substantial investments made to improve technology and banking systems, aiming to establish Crypto.com as a top USD-supporting exchange. Key features include a customizable interface, support for various trading strategies, and automated trading options. Users can easily fund their accounts via Fedwire transfers, ensuring quick access to funds without additional withdrawal fees.

FDIC Slams Discover with $250M Fine: Major Merchant Restitution Required!

The Federal Deposit Insurance Corporation (FDIC) has taken enforcement actions against Discover Bank due to misclassifying credit cards, resulting in over $1 billion in overcharges to merchants. The FDIC’s measures include a Consent Order requiring corrective actions, an order for Discover to return at least $1.225 billion to merchants, and a $150 million civil penalty. The Federal Reserve also penalized Discover Financial Services, the bank’s parent company, with a $100 million fine and additional corrective actions. These actions underscore a regulatory push for transparency and ethical practices in the banking industry.

FinTech Funding Soars: Over $16 Billion Raised in Record-Breaking Week!

In a remarkable week for the fintech sector, over $16 billion was raised, signaling strong investment interest, particularly in artificial intelligence and sustainable solutions. Databricks led with a $15 billion Series J funding round to enhance its AI offerings and expand globally. Other notable raises included Bees & Bears with €500 million for sustainable energy and Phantom’s $150 million for blockchain innovations. The fintech sector executed 12 deals, while the USA dominated with 15 transactions. Overall, the week showcased a vibrant landscape driven by strategic investments, setting a promising tone for the year ahead.