Similar Posts

FS-ISAC Champions Quantum-Resistant Cryptography: Essential Guidance Series for Cybersecurity

The Financial Services Information Sharing and Analysis Center (FS-ISAC) has released essential papers from its Post Quantum Cryptography Working Group to guide the payment card industry (PCI) toward adopting quantum-resilient standards. As quantum computing advances, it poses significant threats to cryptographic security essential for card transactions. One key paper outlines necessary steps for implementing quantum-resistant cryptography, emphasizing strong access controls, data encryption, and thorough risk assessments to mitigate threats. FS-ISAC highlights the dual nature of quantum technology, which can both solve complex problems and challenge existing security. Early strategic planning for quantum migration is crucial for maintaining cybersecurity in the evolving landscape.

FinTech Powerhouses Qonto and Mollie Unite to Address Europe’s £275 Billion Late Payment Challenge

Qonto and Mollie, two FinTech unicorns, have formed a strategic partnership to enhance financial services for small and medium-sized enterprises (SMEs) and freelancers in Europe, aiming to tackle the £275 billion issue of late payments. Their collaboration will integrate banking and payment functions on a single platform, simplifying financial processes and improving cash flow for nearly 50% of European businesses. Key features include “Payment Links” for secure transactions and “Qonto Embed” for white-label banking. This alliance is poised to strengthen their positions in the competitive European FinTech landscape, with leaders from both companies emphasizing its transformative potential for SMEs.

Revolutionizing Regulatory Oversight: How Central Banks are Leveraging RegTech and SupTech Innovations

Central banks globally are increasingly adopting RegTech and SupTech to tackle regulatory reporting challenges, according to a 2024 survey by Central Banking involving 15 financial authorities. Over half of the respondents are using these technologies, with one central bank in the implementation phase. Key benefits include improved data management and proactive issue resolution. AI and machine learning enhance analytical processes, aiding in timely regulatory interventions. However, challenges with varying data standards persist. Central banks must develop structured strategies to integrate these technologies as financial markets evolve, highlighting the need for ongoing adaptation to technological advancements.

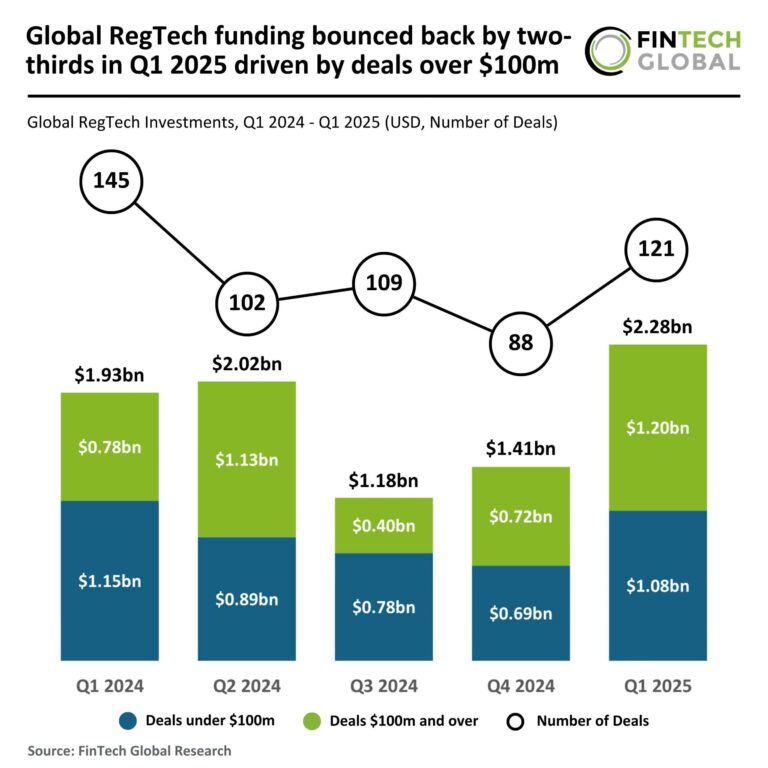

Global RegTech Funding Soars 66% in Q1 2025, Fueled by $100M+ Deals

In Q1 2025, global RegTech investment surged, with funding reaching $2.3 billion across 121 deals, a 63% increase from Q4 2024. This rebound reflects heightened demand for compliance solutions and digital risk management tools. Notably, larger deals over $100 million surged by 68%, indicating renewed investor confidence. Norm Ai emerged as a key player, securing $48 million in funding, bringing its total to $87 million over 18 months. The company offers innovative solutions through its Legal Engineering Automation Platform (Leap), which automates compliance and streamlines regulatory processes, positioning it as a leader in the evolving regulatory landscape.

Devexperts Welcomes Mark Belane as New VP of Strategic Partnerships to Drive Growth and Innovation

Devexperts has appointed Mark Belane as Vice President of Strategic Partnerships and Alliances, aiming to enhance its financial technology offerings. With over 30 years of experience in FinTech and capital markets, Belane will help financial institutions select effective software solutions while ensuring compliance and security. His diverse career includes roles at IBM and Nykredit Investment, consulting for major banks, and founding seven start-ups. Belane is also a mentor and visiting professor in Barcelona, teaching big data analytics and corporate strategy. His expertise is expected to strengthen Devexperts’ global partnerships and drive innovation in the financial technology sector.

Airwallex Enhances Payment Flexibility: Now Accepting Discover and Diners Club Cards!

Airwallex has partnered with Discover Global Network, enabling its merchants to accept payments from Discover and Diners Club International cardholders. This collaboration allows businesses to process transactions from over 345 million cardholders across 200 countries, enhancing payment flexibility. Key benefits include reduced cart abandonment rates, increased customer satisfaction through diverse payment options, and global scalability for growth. Airwallex’s Chief Revenue Officer, Kai Wu, highlighted the partnership’s role in broadening payment acceptance, while Discover’s Chris Winter emphasized its commitment to expanding merchant access to a global audience. This alliance is poised to improve the payment processing landscape significantly.