Similar Posts

Red Flag Alert Secures £4M Series A+ Funding to Strengthen Market Position and Drive Growth

Red Flag Alert, a Manchester-based business intelligence platform, has secured a £4 million Series A+ investment from Foresight Group and Ric Traynor, following a previous £3.5 million investment. The funding will support strategic expansion across five industries: Financial Services, Accounting, Legal, Construction/Manufacturing, and Business Utilities. The company has experienced significant growth, with its Annual Recurring Revenue (ARR) rising from £1.8 million to £5.2 million, aiming for £10 million within two years. CEO Richard West highlighted increased inquiries from enterprise clients, while Vincent Kilcoyne has been appointed Chief Product Officer to drive product development.

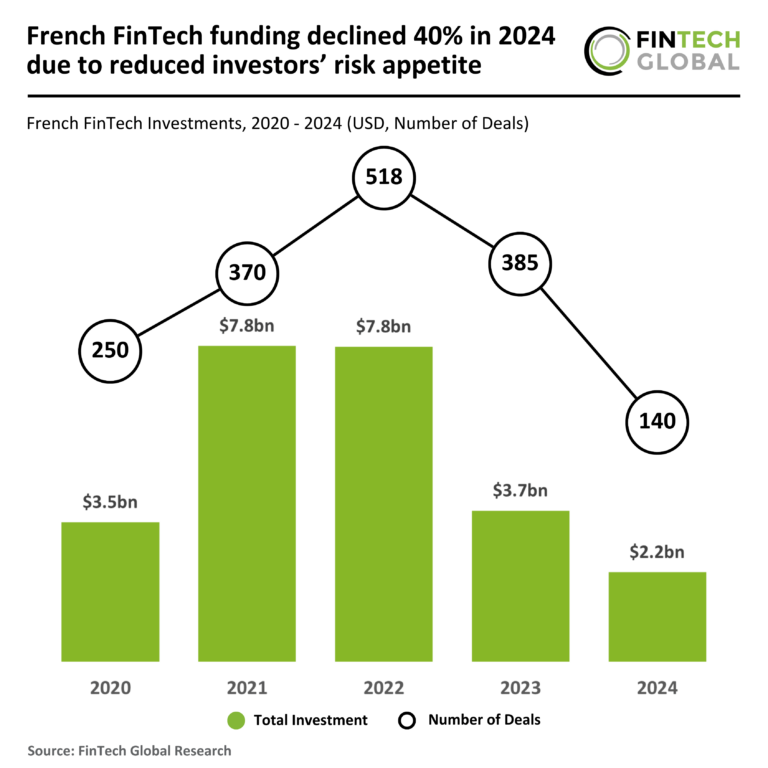

French FinTech Funding Plummets 40% in 2024 Amidst Diminished Investor Risk Appetite

In 2024, the French FinTech sector experienced a significant decline, with funding dropping 40% year-over-year to $2.2 billion and a 64% decrease in deal activity, totaling only 140 deals— the lowest in five years. This downturn reflects investor caution due to macroeconomic challenges and regulatory shifts, emphasizing profitability over growth. Despite fewer deals, the average deal value rose by 67% to $15.8 million, indicating a focus on high-value opportunities. Notably, ChapsVision secured $90 million in funding to expand into European and North American markets, enhancing its AI capabilities through the acquisition of Sinequa.

Stay Ahead: Discover This Week’s 24 Game-Changing FinTech Funding Rounds!

The FinTech sector saw a significant funding increase this week, totaling $425.8 million across 24 deals, up from $336 million raised through 17 deals last week. Key highlights include Komainu, a WealthTech firm, securing $75 million for international expansion, and Sygnum, a digital asset bank, raising $58 million to achieve unicorn status. Other notable investments include Skor Technologies and Float Financial. However, European WealthTech funding has dropped to a five-year low, with a 71% decline in deal activity. Despite challenges, the FinTech landscape remains dynamic, with companies adapting to market changes and securing vital funding for growth.

Exploring the Impact of Geopolitical Shifts on Global Financial Regulations

Geopolitical shifts are significantly affecting financial regulations, prompting governments to adapt their frameworks for stability amid trade conflicts and economic sanctions. Toby Cook from Opoint highlights the need for stronger financial safeguards, including tighter controls and enhanced due diligence, to mitigate risks like money laundering. However, regulatory divergence complicates compliance for multinational firms. Advanced RegTech solutions, like global adverse media screening, are crucial for real-time risk management and informed decision-making. Institutions must embrace AI-powered risk intelligence to navigate evolving regulations and maintain agility in a rapidly changing environment, as emphasized by industry leaders.

WineFi Secures £1.5M Funding to Revolutionize Fine Wine Investment in the FinTech Space

WineFi, a London-based FinTech company, has raised £1.5 million in seed funding to transform fine wine investments for a new generation. Led by Coterie Holdings and supported by SFC Capital, Founders Capital, and angel investors, the platform aims to democratize access to high-value wine investments. Co-founded by Oliver Thorpe and Callum Woodcock, WineFi provides a data-driven approach for high-net-worth individuals and investment funds, enhancing transparency in this asset class. Additionally, a partnership with Lympid utilizes blockchain technology for fractionalized investments, starting at £3,000, making fine wine more accessible and appealing to diverse investors.

Episode Six Secures Strategic Investment from Japan Airlines to Revolutionize Payments Infrastructure

Episode Six, a provider of ledger and card infrastructure solutions, has secured a strategic investment from Japan Airlines (JAL), enhancing their long-standing partnership since 2017. While the investment amount is undisclosed, it aims to improve Episode Six’s offerings and support JAL’s financial services strategy, particularly for JAL Pay, their flagship payment solution. The collaboration has already led to innovations like the JAL Global Wallet. Episode Six’s CEO, John Mitchell, and JAL’s Director of New Business Development, Yoshiaki Yabugami, expressed enthusiasm for the strengthened partnership, anticipating advancements in financial services within the travel industry.