Similar Posts

Mollie Expands to the UK: Unlocking Fast and Flexible Funding Solutions for SMEs

Mollie, a leading payment provider, has launched its funding solution, Mollie Capital, in the UK to support small and medium-sized enterprises (SMEs) with quick and flexible capital access. Traditional lending often presents challenges for SMEs, including lengthy applications and slow approvals. Mollie Capital offers funding up to £250,000, with a simplified application process taking just five minutes and funds transferred within 24 hours. After a successful launch in Europe, Mollie aims to fill the gap in financial services for UK SMEs, as highlighted by Managing Director Mia Hunter, emphasizing the need for simplicity and flexibility in their financial management.

Revolutionizing Fraud Prevention and User Experience: The Impact of Digital Identity Verification (IDV)

Digital ID verification has become essential for businesses to secure online transactions and prevent fraud. This process confirms a person’s identity electronically using government-issued IDs, biometric data, blockchain technology, and social media accounts. It is crucial for regulatory compliance in sectors like finance and e-commerce, helps in fraud prevention through AI technology, and streamlines the onboarding process, enhancing customer satisfaction. Digital ID verification software automates verification, ensuring adherence to regulations and improving risk management. The process is quick, often completed in seconds, making it vital for businesses looking to enhance security and customer interactions.

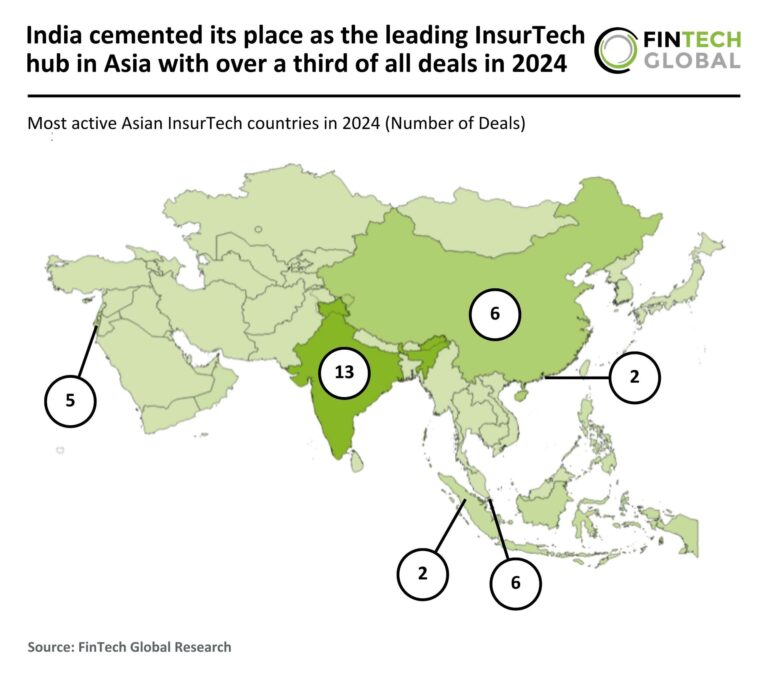

India Emerges as Asia’s Top InsurTech Hub, Capturing Over 33% of All Deals in 2024

In 2024, the Asian InsurTech market faced a significant downturn, with deal activity dropping 64% year-over-year and funding plummeting 71% to $369 million from $1.3 billion in 2023. This decline is attributed to investor caution, regulatory challenges, and changing funding priorities. Despite the overall contraction, India emerged as the leading InsurTech hub, securing 13 deals (35% market share), followed by China and Singapore with six deals each. Notably, Indian startup Zopper raised $25 million in a Series D funding round, aimed at enhancing its digital infrastructure and product offerings, highlighting ongoing innovation in the sector.

RIIG-HOOTL Secures UAE Funding to Scale AI-Powered Cybersecurity and Health Tech Insurance Solutions

RIIG – HOOTL, a cybersecurity and AI-driven health tech company, has secured significant funding from UAE investors, prompting a rebranding to HOOTL, which stands for “Humans Out of the Loop.” This funding will accelerate product development, establish a UAE office, and strengthen partnerships with local entities. HOOTL aims to enhance insurance processes through advanced AI systems, aligning with the UAE’s digital transformation goals. CEO Denver Riggleman expressed gratitude for the support, highlighting the innovative nature of their solutions in insurance verification and claims adjudication. Engagements with UAE leaders have reinforced HOOTL’s commitment to the region’s healthcare modernization efforts.

EarlyBird Partners with Acorns to Revolutionize Financial Tools for Kids and Families

Acorns, a prominent U.S. financial wellness app, has acquired EarlyBird, a digital family wealth platform, enhancing its offerings for families. This strategic move allows Acorns to support families in investing in their children’s futures while preserving digital memories. Acorns previously acquired UK-based GoHenry, solidifying its leadership in family financial services. The integration of EarlyBird, which enables contributions to children’s investment accounts and stores digital memories, will enrich Acorns’ product suite. Acorns CEO Noah Kerner and EarlyBird leaders express excitement about the partnership, aiming to promote financial accessibility and education for families.

Vertex Revolutionizes E-Invoicing: Boosting Global Tax Compliance Efficiency

Vertex, a leading tax technology provider, has upgraded its e-invoicing solution to help businesses comply with complex global tax regulations. This enhancement is crucial as e-invoicing mandates increase worldwide. The updated solution features integration of Continuous and Periodic Transaction Controls to streamline e-invoice management, a scalable cloud-based network for automating financial transactions, and improved indirect tax reporting. CEO David DeStefano highlighted the need for a unified approach to cross-border compliance. Benefits of the solution include increased efficiency, improved compliance with local laws, and scalability for growing businesses. For more details, visit Vertex’s official website.