Similar Posts

Panda Remit Partners with dLocal to Accelerate Cross-Border Remittances in Africa

dLocal has partnered with Panda Remit to enhance financial access in Africa by improving cross-border payments. This collaboration aims to address the inefficiencies in the current remittance infrastructure, which sees Sub-Saharan Africa with the highest global remittance costs, averaging 8.72% for a $200 transfer. By integrating with dLocal’s payment network, Panda Remit will reduce transaction costs, enhance payout speeds, and improve reliability, facilitating transfers through mobile wallets and bank services like M-Pesa and Airtel. Leaders from both companies emphasized the partnership’s potential to empower individuals and communities by providing efficient and affordable remittance solutions across the continent.

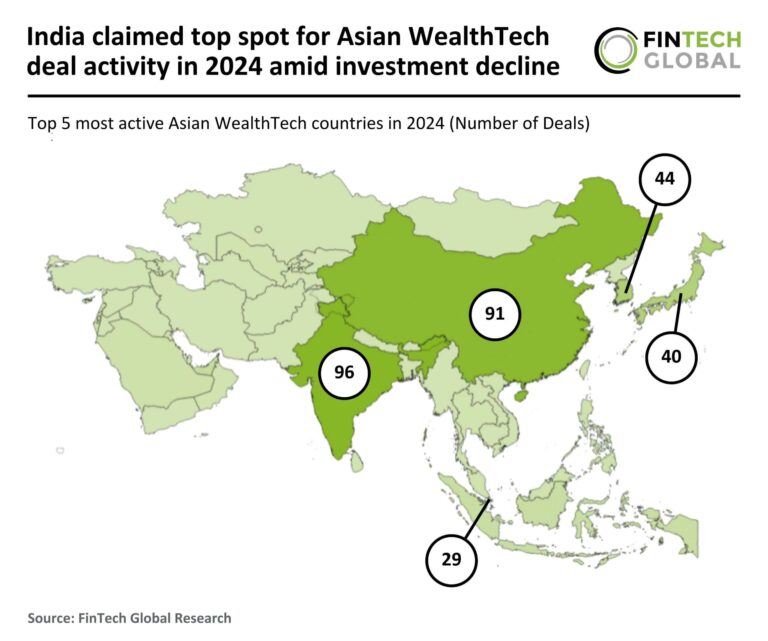

India Rises to the Top in Asian WealthTech Deals for 2024 Despite Investment Decline

In 2024, Asian WealthTech investments plummeted by 79% year-on-year, totaling $4.5 billion compared to $21.4 billion in 2023, with deal activity decreasing by 69% to 373 transactions. This downturn reflects cautious investor behavior amid economic uncertainties. India emerged as the leading country in WealthTech, accounting for 26% of deals despite a drop from 286 to 96 transactions. China followed with 91 deals, down from 416. DMI Finance secured the largest deal in India, raising $333 million, enhancing its digital lending capabilities. These trends indicate a shift in investment dynamics and strategies within the sector.

Lemonway and Entrust Join Forces to Transform Marketplace Onboarding with Cutting-Edge Automated Identity Verification

Lemonway, a prominent pan-European payment institution, has partnered with Entrust to enhance the onboarding experience for marketplaces through their new Online Onboarding solution. This innovative tool simplifies the onboarding process by utilizing Entrust’s advanced identity verification technologies, enabling rapid identity verification for individuals in under two minutes and businesses within 48 hours. Key benefits include end-to-end onboarding management, customizable branding, and advanced fraud prevention, all while ensuring compliance with European regulations. Industry leaders from both companies emphasize that this collaboration allows marketplaces to focus on growth and strategy while maintaining a secure onboarding experience.

Clair Secures $23.2M to Revolutionize Real-Time Wage Access in Embedded FinTech

Clair, a prominent FinTech company specializing in Earned Wage Access (EWA) solutions, has raised $23.2 million in its Series B funding round, led by Upfront Ventures with continued support from Thrive Capital. This funding will enhance Clair’s services that allow employees instant access to earned wages, benefiting both employees and businesses. The platform has reached over 29,000 locations and recently partnered with Gusto, significantly increasing adoption rates. CEO Nico Simko highlighted the potential to integrate EWA into payroll systems, tapping into a market of over 50 million U.S. employees. The funding aims to drive product development and expansion efforts.

Dinari Secures $12.7 Million to Revolutionize Global Investment with Onchain Access to the US Stock Market

Dinari, a FinTech company, has successfully raised $12.7 million in its Series A funding round, bringing its total funding to $22.65 million. Led by Hack VC and Blockchange Ventures, this funding will bolster Dinari’s mission to provide global access to US equities via blockchain technology. The company offers tokenized US equities and ETFs, known as dShares™, accessible through a single API and operational in over 60 countries. Dinari aims to eliminate barriers like complex onboarding and high transaction costs, with plans to expand its tokenized assets and strengthen institutional partnerships. Wyatt Lonergan emphasizes Dinari’s role in the future of global finance.

FinTech Funding Soars in Early 2025: Over $300 Million Raised and Counting!

Last week, the FinTech sector experienced a notable investment surge, with 17 deals totaling $336 million. OnPay led the way, securing $100 million for service expansion, primarily through a $63 million Series B round. Other significant funding included ICEYE’s $65 million for satellite technology, Nomupay’s $37 million for its Unified Payments platform, and Matic Insurance’s $30 million for embedded insurance solutions. Additionally, ThreatMark raised $23 million to enhance cybersecurity, while Parsyl secured $20 million for cargo insurance. Emerging AI innovations also attracted investment, with firms like Jones and Dataships raising funds for advanced technology solutions.