Similar Posts

Tax Compliance SaaS Notice Ninja Raises $500K Seed Investment to Fuel Growth and Innovation

Notice Ninja, a tax compliance SaaS platform, has raised $500,000 in a seed funding round, showcasing investor confidence in its AI-powered tax notice solutions. This investment will accelerate product development, enhance market reach, and strengthen partnerships. Notice Ninja provides automated tax compliance solutions for various sectors, including tax departments and corporations, reducing inefficiencies and penalties from manual processes. CEO Amanda Reineke emphasized the company’s mission to simplify tax compliance and highlighted the funding as a testament to investor trust in their technology and execution. This capital will drive innovation and deliver greater value to customers.

Revolutionizing Wealth Management: The Transformative Impact of AI on Financial Services

Artificial intelligence (AI) is significantly transforming the FinTech sector, particularly in wealth management. In a discussion with Dion Kraanen, managing director at Brightstone, the importance of integrating AI into business strategies was emphasized for achieving success. Key elements include adopting a long-term vision, maintaining agility and innovation, and ensuring compliance with regulatory standards. Kraanen noted that with technology’s advancement, AI has become essential in finance, urging firms to adapt and innovate continuously. As AI evolves, its integration will be crucial for competitiveness in the FinTech industry, aligning business strategies with regulatory frameworks and client needs.

Mastering FATCA and CRS Audits: A Comprehensive Guide for Luxembourg’s Financial Institutions

Financial institutions in Luxembourg must adhere to strict reporting standards under FATCA and CRS to promote tax transparency by identifying and reporting relevant financial accounts. TAINA has released a guide to aid compliance, highlighting the need for due diligence and accurate reporting. FATCA requires institutions to report U.S. account holders, while CRS facilitates the automatic exchange of financial information among jurisdictions. Audits by the Administration des Contributions Directes (ACD) ensure compliance, identifying common issues such as incomplete reporting. TAINA’s automated platform assists institutions in managing compliance efficiently, reducing operational burdens and risks.

FCA Launches Bold Five-Year Enforcement Strategy to Combat Market Abuse

The UK Financial Conduct Authority (FCA) has launched a five-year strategy to combat market abuse, enhance financial crime enforcement, and strengthen economic resilience. Announced by Therese Chambers on April 29, 2025, the plan emphasizes a predictable, proportionate, and purposeful approach to regulation. Key initiatives include simplifying compliance processes, utilizing data analytics, and fostering cooperation to tackle organized crime, which accounts for 25% of suspicious activity reports. The FCA warns that non-compliance will result in significant penalties. Firms must improve internal controls and engage proactively with the FCA to maintain market integrity and prevent insider trading and leaks in mergers and acquisitions.

MAPFRE MSV Life Enhances AML Compliance with Innovative KYC Portal in Major Digital Transformation

MAPFRE MSV Life has enhanced its anti-money laundering (AML) processes by integrating the KYC Portal CLM, improving compliance and customer onboarding. The initiative began in August 2022 with a request for proposals, aimed at automating AML tasks and customer risk assessments. Previously, manual workflows hindered efficiency, but the new system, launched in June 2023, allows for real-time screening and rapid onboarding for retail clients. This consolidation of operations has significantly improved efficiency and reduced manual work. Future plans include extending the platform to corporate clients and enhancing reporting frequency for compliance. The KYC Portal CLM is now central to client engagement.

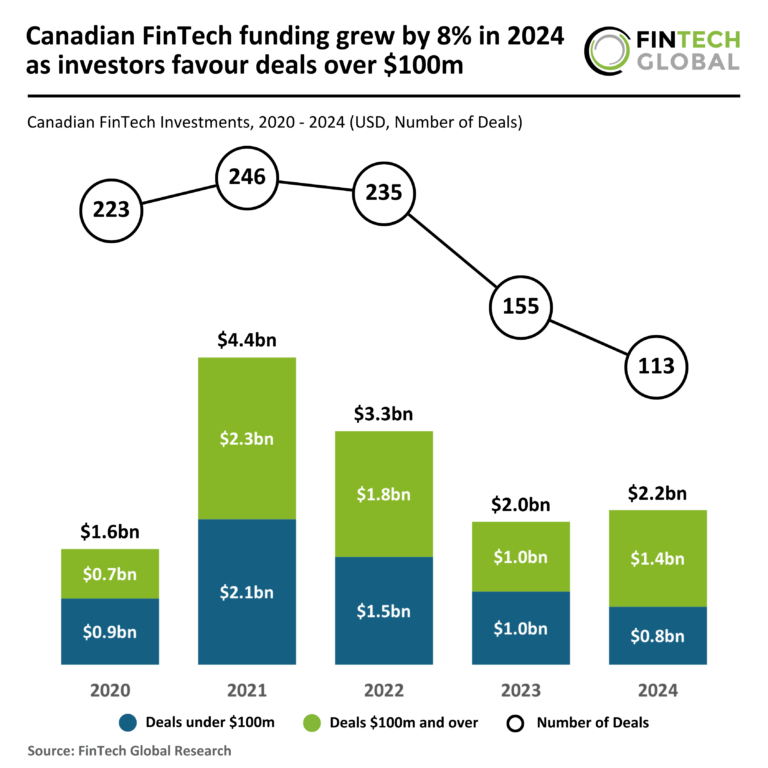

Canadian FinTech Funding Surges 8% in 2024: Investors Prefer $100M+ Deals!

In 2024, the Canadian FinTech sector experienced an 8% increase in funding, reaching $2.2 billion, up from $2 billion in 2023 and showing a 34% rise since 2020. However, the number of deals declined by 27% to 113, while the average deal size surged by 47% to $19.5 million. A notable trend is the shift towards larger deals, with investments over $100 million totaling $1.4 billion, a 38% increase from 2023. Cohere, a Toronto-based AI startup, secured the largest deal at $500 million, enhancing its total funding to $970 million and planning workforce expansion.