Similar Posts

TradeBridge Secures £70M Credit Line from Castlelake to Boost UK SMEs and eCommerce Growth

TradeBridge, a FinTech lender focusing on embedded finance for small and medium-sized enterprises (SMEs), has secured a £70 million financing facility led by Castlelake, furthering its commitment to SME growth. This follows a £100 million facility granted earlier in 2023. The funding will enhance TradeBridge’s ability to support B2B and B2C eCommerce, especially benefiting UK Amazon sellers through a new partnership. TradeBridge has disbursed over £5 billion in capital across various sectors globally. Castlelake, a significant player in private credit, has a history of supporting SMEs, reinforcing TradeBridge’s role in providing essential financing solutions.

Payd Secures $400K Investment to Expand Earned Wage Access Services in Malaysia and Thailand

Payd, a Malaysian FinTech firm specializing in earned wage access (EWA), has completed a $400,000 seed extension funding round to boost growth in Southeast Asia, led by A2D Ventures, Orbit Startups, and AngelSpark. EWA enables employees to access earned wages before payday, reducing financial stress. Payd currently serves over 100,000 employees and is expanding its services in Malaysia and Thailand, partnering with major employers like McDonald’s and Starbucks. Investors believe Payd can enhance financial inclusion and potentially introduce new services for the underbanked population, positioning it well for future growth in the region.

Concirrus Unveils Revolutionary Submission Ingestion and Instant Quoting Technology with Near 100% Accuracy!

Concirrus, a leader in InsurTech, has launched a revolutionary technology that achieves nearly 100% accuracy in submission ingestion and offers instant rating and quoting capabilities. This advanced solution addresses inefficiencies in the insurance industry, significantly enhancing the quote-to-bind ratio by optimizing manual data processing. Key features include AI integration for underwriting tasks, a proprietary engine with 95-98% accuracy, and cost reductions by minimizing errors. The platform enables rapid risk assessment and seamless integration with insurers’ systems, enhancing operational efficiency. Concirrus CEO Andy Yeoman emphasizes that this innovation empowers insurers to maximize their potential and adapt to market dynamics effectively.

Indian FinTech Startup Bachatt Raises $4M Seed Funding to Revolutionize Daily Savings Platform

Bachatt, a daily savings platform for self-employed individuals, has raised $4 million in seed funding to enhance its financial solutions. The funding round was co-led by Lightspeed and Info Edge Ventures, with participation from notable investors like Urban Company co-founder Abhiraj Bhal and executives from OYO. Founded in November 2024 by Anugrah Jain, Ankur Jhavery, and Mayank Agarwal, Bachatt helps users accumulate savings through daily Systematic Investment Plans (SIPs). The app aims to promote effective financial management and empower users, positioning itself as a game-changer in India’s FinTech sector.

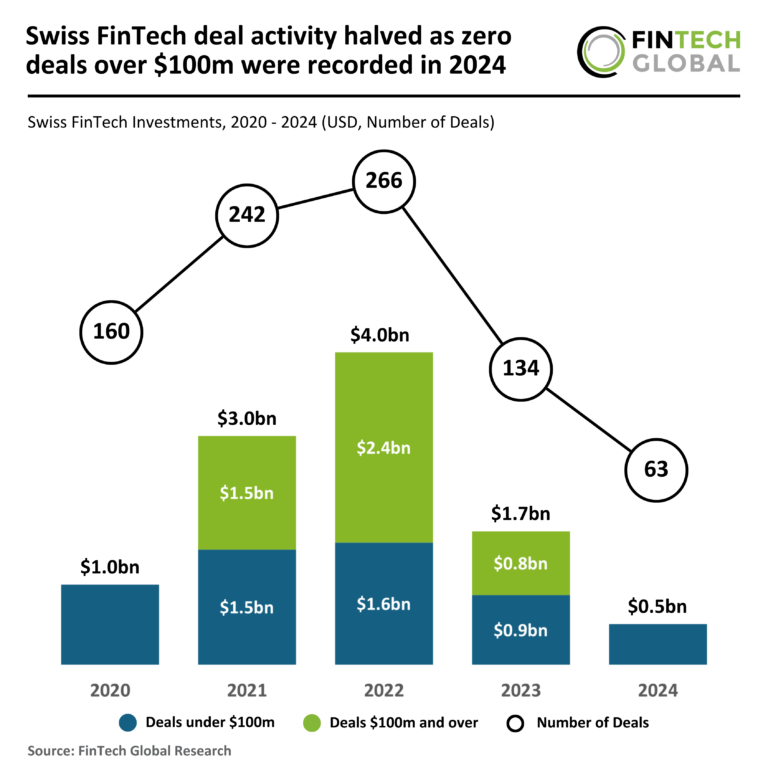

Swiss FinTech Landscape Shifts: 2024 Sees Dramatic 50% Drop in Deal Activity with No Transactions Over $100M

In 2024, the Swiss FinTech sector saw significant declines in deal activity and total funding. The year ended with just 63 deals, a 53% drop from 2023’s 134 deals, and total funding fell to $521 million, down 70% from $1.7 billion the previous year. All investments were under $100 million, reflecting a shift towards smaller, less risky ventures amid economic uncertainties. Despite this downturn, Alpian, a digital banking platform, secured the largest deal at $84 million and doubled its client base within four months, demonstrating resilience and effective financial strategies.

Fana Sparebank Partners with Tietoevry Banking for a Five-Year Digital Transformation Journey

Fana Sparebank has partnered with Tietoevry Banking for a five-year strategic collaboration to modernize its banking operations. The partnership aims to enhance digital capabilities through an integrated technology platform set to launch by April 1, 2025. Key solutions will include core banking systems, payments and card services, and tools for financial crime prevention. This initiative will improve customer experience with expanded mobile and self-service options for better loan management and user-friendly digital interactions. Tietoevry will ensure the new core banking system meets Norway’s regulatory standards, providing high operational reliability and advanced analytics capabilities.