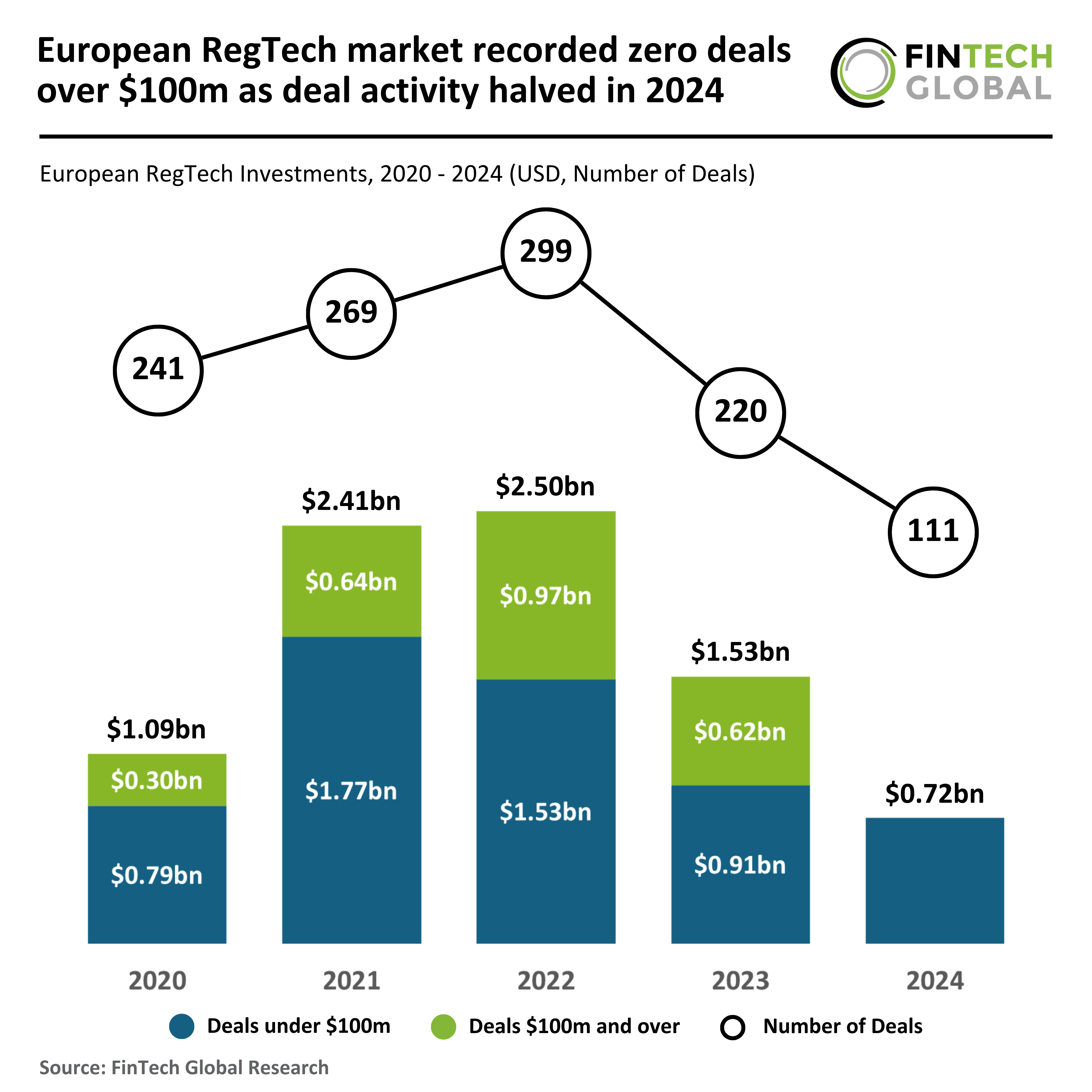

European RegTech Market Sees Halved Deal Activity in 2024, No Transactions Exceeding $100M

In 2024, the European RegTech landscape witnessed a significant downturn, with investments experiencing a dramatic decline. The cautious approach of investors led to a sharp reduction in both deal volume and total funding in the RegTech sector.

European RegTech Investment Declines in 2024

The European RegTech market faced a challenging year in 2024, as total funding fell to $724 million across 111 deals. This represents a staggering 53% decrease from the $1.5 billion raised in 2023, as well as a 34% drop from the $1.1 billion raised in 2020.

Key Statistics for 2024

- Total Funding: $724 million

- Number of Deals: 111

- Year-over-Year Change: 53% decrease from 2023

- Average Deal Size: $6.5 million (up 3% from 2023)

Deal volume also mirrored this downward trend, falling by 50% from the 220 funding rounds closed in 2023 and 54% from the 241 deals recorded in 2020. This downturn illustrates a market marked by cautious investor sentiments and reduced activity.

Absence of High-Value Deals

One of the most striking trends in 2024 was the total absence of deals exceeding $100 million. In contrast, high-value transactions accounted for $615 million in 2023 and $300 million in 2020.

Funding under $100 Million

All funding in 2024 was derived from deals under $100 million, amounting to $724 million. This figure shows a 21% decline from the $913 million raised in 2023 and an 8% decrease from the $794 million garnered in 2020.

Highlight: Kaizen’s Significant Investment

Despite the overall decline, Kaizen, a prominent provider of regulatory compliance solutions for global financial institutions, secured a notable minority investment of $54.1 million from Guidepost Growth Equity. This investment marks Kaizen’s first external funding since its inception in 2013 and is poised to enhance its product development, broaden its reach in North America, and improve its acclaimed ReportShield platform.

Kaizen’s innovative capabilities include detecting 100% of errors across various global regulatory frameworks, such as MiFID, EMIR, and SEC. Additionally, the company has expanded its services to include shareholding disclosures, regulatory rules management, and trade surveillance, solidifying its reputation as a trusted compliance partner for top-tier financial institutions worldwide.

For further insights into the European RegTech market and investment trends, consider visiting RegTech for up-to-date information and resources.