Similar Posts

SPP and Acuminor Join Forces to Enhance Financial Crime Risk Management Solutions

SPP Pension & Försäkring has partnered with Acuminor to enhance its financial crime risk assessment capabilities, focusing on combating money laundering, terrorist financing, and sanction violations. This collaboration aims to strengthen compliance with stringent regulations and protect customers from financial crimes. Acuminor’s expertise in financial crime intelligence will enable SPP to utilize advanced analytics for improved risk identification and mitigation. The partnership reflects both companies’ dedication to innovation and leadership in financial crime prevention, with SPP’s General Counsel and Acuminor’s CEO expressing enthusiasm for the initiative’s potential to set new industry standards.

Revolutionizing RegTech: How Quantum Computing is Set to Transform Risk Modeling and Fraud Detection

Quantum computing is poised to transform the financial and RegTech sectors by significantly enhancing financial crime detection capabilities. It allows institutions to process risk models in seconds and conduct real-time transaction evaluations, improving anomaly detection for anti-money laundering efforts. Major firms like IBM and JPMorgan Chase are implementing this technology, which also poses security challenges, particularly to traditional encryption methods. Experts advocate for post-quantum cryptography to protect sensitive data. While quantum computing promises advanced calculations and better decision-making, it presents risks if misused, prompting discussions among regulatory bodies to establish protective standards for financial infrastructures.

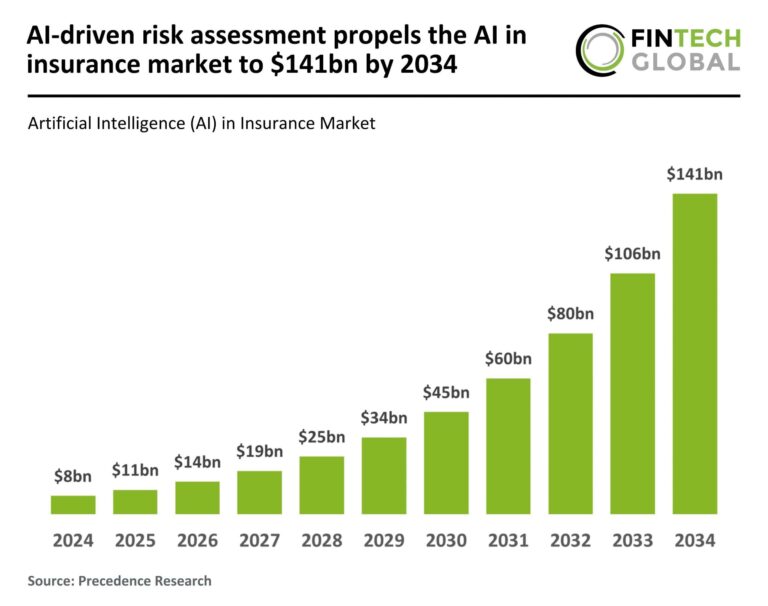

AI-Driven Risk Assessment Set to Propel Insurance Market to $141 Billion by 2034

The AI in the insurance market is set for significant growth, projected to rise from $8.13 billion in 2024 to $141.44 billion by 2034, fueled by investments in AI-driven risk assessment and automation. AI is transforming underwriting, claims processing, and fraud detection, enhancing productivity and potentially reducing operational costs by 40% by 2030. Consumers increasingly demand personalized insurance services, with 80% preferring tailored offerings. However, challenges such as data privacy and regulatory compliance persist. Insurers adopting AI can better customize services, making it essential to stay updated on trends to meet evolving consumer needs.

UK FinTech Tide Secures £100M Investment from Fasanara to Enhance SME Lending Solutions

Tide, a UK-based financial platform, is transforming cash flow management for SMEs globally by securing a £100 million securitisation debt facility from Fasanara Capital. This partnership will allow Tide to distribute over £300 million in working capital loans, addressing the need for flexible funding among SMEs. Founded in 2015, Tide supports around 650,000 SMEs in the UK, offering services like business accounts and access to credit. The company is also expanding internationally, having launched in India and planning to enter Germany in 2024. Tide’s CEO emphasized the importance of flexible financing for SMEs to avoid cash flow issues.

Paynet and Salt Edge Join Forces to Boost Open Banking Compliance in Moldova

Paynet, a prominent FinTech in Moldova, has partnered with Salt Edge, a leader in open banking services, to enhance compliance with the Payment Services Directive 2 (PSD2) regulations. This collaboration aims to streamline Paynet’s adherence to these regulations while innovating payment services. Paynet offers solutions like Paynet Wallet and Mastercard, while Salt Edge provides tools for regulatory compliance, including customer consent management. This partnership will reduce costs, improve customer experiences, and ensure a secure financial environment. Both companies are committed to setting new standards in Moldova’s financial sector, anticipating future market demands.

Unlocking the Future: How the EU’s Omnibus Package Will Transform ESG Reporting

The European Commission’s Omnibus Simplification Package, introduced in February 2025, aims to streamline sustainability reporting across the EU, reducing bureaucratic challenges to enhance competitiveness. It includes two main proposals: a ‘stop-the-clock’ delay on ESG reporting requirements and a shift from mandatory to voluntary reporting for many companies. While this may encourage ESG reporting among SMEs, concerns arise about potential confusion, diminished data quality, and challenges for investors. Companies are advised to use this transition to strengthen their sustainability frameworks, conduct assessments, and maintain transparency, as future regulatory developments may continue to influence reporting practices.