Similar Posts

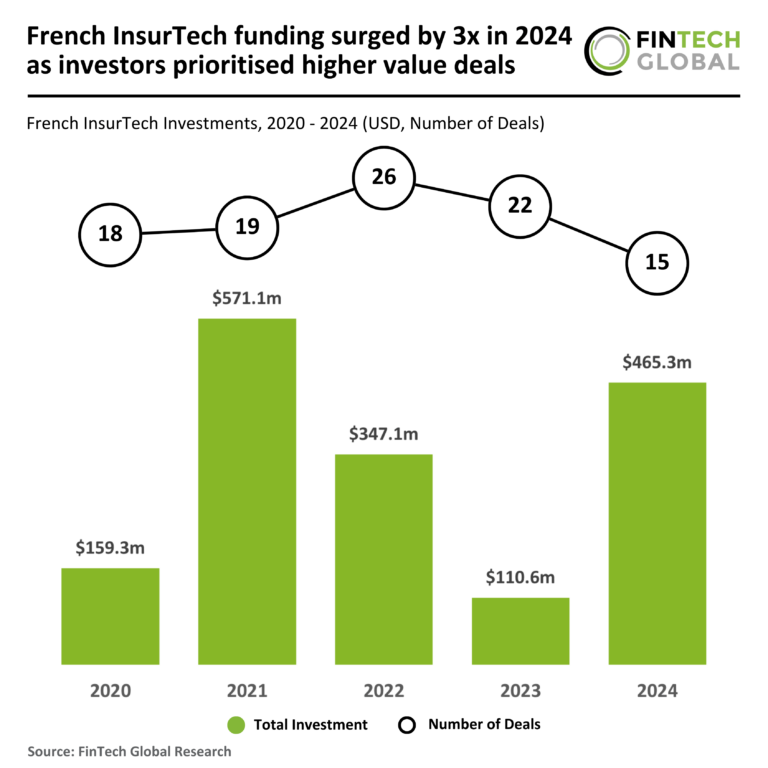

French InsurTech Funding Soars 300% in 2024: Investors Focus on High-Value Opportunities

In 2024, the French InsurTech sector is witnessing a remarkable transformation, with funding skyrocketing to $465 million, a tripling from $111 million in 2023. Although the number of deals has decreased by 32% to 15, the average deal size has surged to $31 million, indicating a strategic shift towards larger investments in established firms. This trend reflects growing investor confidence, particularly in companies like Alan, which raised $193 million in its Series F funding round, the largest for the sector this year. Alan aims to enhance healthcare through automated claims and various digital health services, poised for significant growth.

Axyon AI and ALLINDEX Team Up to Transform Predictive Investment Research with Cutting-Edge AI Solutions

Axyon AI has partnered with ALLINDEX to enhance thematic investment strategies by combining Axyon AI’s predictive capabilities with ALLINDEX’s innovative research tools. This collaboration will empower investors to customize and optimize their portfolios with greater efficiency. Axyon AI offers advanced predictive analytics and recently expanded its products with AI-Powered Factors and AI-Compass for market insights. Meanwhile, ALLINDEX specializes in AI-driven thematic indices and research through its platform, Findall. Together, they aim to create tailored investment strategies, integrating advanced research and signal generation, redefining investment management in the AI era. Company leaders expressed enthusiasm about the partnership’s potential.

Urgent NTR EOL Countdown: Essential Guide to Migrating Call Recordings for Firms

Financial institutions relying on Nice Trading Recording (NTR) systems face significant challenges due to its impending end-of-life in September. This retirement poses risks of data loss and compliance violations, as outdated technology lacks vendor support and increases security vulnerabilities. Companies must prepare for potential regulatory fines, loss of historical recordings, and operational disruptions if they fail to transition. Wordwatch, a RegTech firm, offers a migration solution that preserves original media quality and ensures compliance-ready storage with enhanced security measures. Financial firms must act swiftly to protect operations, maintain compliance, and safeguard data integrity before the NTR shutdown.

ExtractAlpha Enhances ESG Solutions with Strategic Acquisition of ESG Analytics

ExtractAlpha has acquired ESG Analytics to enhance its ESG analytics capabilities, providing clients with advanced insights for responsible investing. ESG Analytics is known for its innovative methodologies that deliver real-time, actionable insights into environmental, social, and governance metrics, essential for managing ESG risks and identifying sustainable investment opportunities. This acquisition will strengthen ExtractAlpha’s data-driven solutions, with Qayyum “Q” Rajan appointed as the Head of ExtractAlpha Labs to develop innovative tools for investors. CEO Vinesh Jha emphasized the importance of this move for delivering cutting-edge ESG insights, underscoring ExtractAlpha’s commitment to innovation in sustainable investing.

G+D Unveils Convego SecureCode: Revolutionizing Dynamic Card Security to Combat CNP Fraud

Giesecke+Devrient (G+D) has launched Convego SecureCode, a new payment card aimed at combating card-not-present (CNP) fraud, which constitutes about 70% of credit card fraud. With global fraud losses expected to reach nearly $50 billion by 2030, this product is timely for banks and financial institutions. Key features include a dynamic verification code that changes with each transaction, an integrated e-ink screen for displaying the code, and a battery-free design that simplifies operations. Mikko Kähkönen from G+D emphasizes that this innovation enhances security while maintaining user convenience, providing a future-ready solution for digital payments.

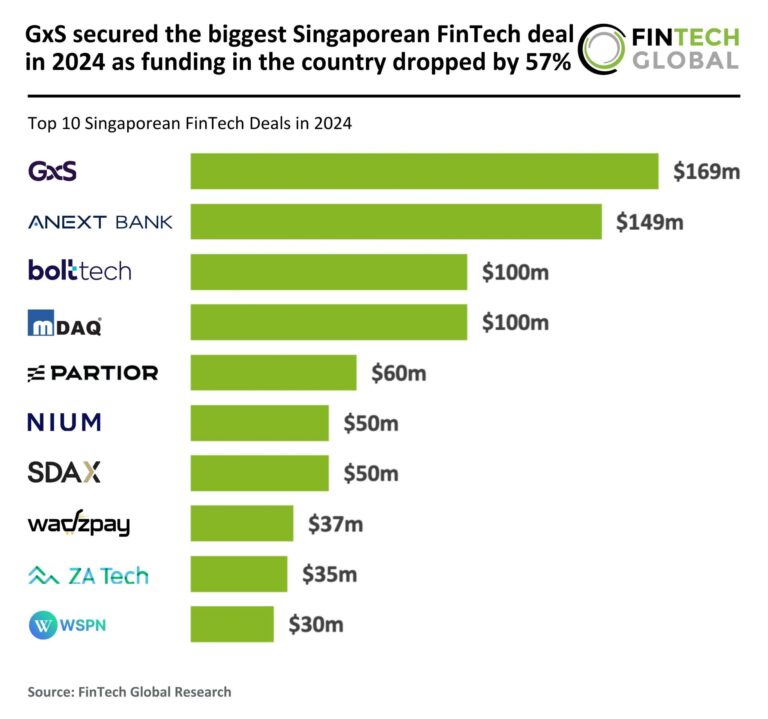

GxS Clinches Major Singapore FinTech Deal in 2024 Amidst 57% Drop in National Funding

In 2024, Singapore’s FinTech sector faced a significant downturn, experiencing a 57% drop in funding, with total investments falling to $1.7 billion from $4 billion in 2023. Deal activity also decreased sharply, with 116 deals recorded, down from 221. This shift reflects a cautious investment climate driven by economic uncertainties and regulatory challenges. Investors are now prioritizing sustainable growth over aggressive expansion. Despite the overall decline, GXS Bank secured the largest deal of the year at $169.1 million, aimed at enhancing its FlexiLoan product for underserved customers. Stakeholders must adapt strategies to navigate this evolving landscape.