Similar Posts

Feedzai Acquires DemystData: Revolutionizing AI-Driven Fraud Prevention and Data Orchestration

Feedzai, a leader in AI-driven fraud prevention, has acquired DemystData to enhance data access for financial institutions through its RiskOps platform. This acquisition integrates DemystData’s Zonic platform, streamlining processes such as Know Your Customer (KYC), Anti-Money Laundering (AML), and fraud detection. The collaboration aims to improve real-time financial crime detection, reduce consumer friction, and provide contextual intelligence across various data points. By merging their capabilities, Feedzai will create a unified platform that accelerates onboarding, minimizes false positives, and empowers non-technical teams to manage data workflows independently, ultimately enhancing operational efficiency and compliance.

NSAVE Secures $18M to Provide Secure Offshore Accounts for High-Inflation Economies

In response to economic instability, nsave has launched a new investment platform offering secure offshore accounts to help individuals in high-inflation economies safeguard and grow their wealth. The company recently raised $18 million in a Series A funding round, led by TQ Ventures and supported by prominent investors like Sequoia Capital and Y Combinator. nsave provides access to diverse investment options, including US equities and ETFs, through partnerships with regulated financial institutions in the UK and Switzerland. CEO Amer Baroudi emphasizes the mission to support financial inclusion and empower users to enhance their financial assets.

Visa Unveils Apple Pay in Egypt: Revolutionizing Digital Payments for a Cashless Future

Visa has partnered with Apple to launch Apple Pay for Visa cardholders in Egypt, responding to the growing demand for secure and contactless payment solutions. This collaboration emphasizes the shift towards a digital-first lifestyle in the country. Apple Pay allows users to make secure payments using their iPhone or Apple Watch by holding the device near payment terminals, with transactions protected by Face ID, Touch ID, or a passcode. Accepted at various locations, including grocery stores and restaurants, Apple Pay simplifies transactions while enabling Visa cardholders to retain their rewards. Visa’s Country Manager, Malak El Baba, highlighted this launch as a significant milestone in payment innovation.

Moderne Secures $30M Series B Funding to Supercharge AI-Driven Code Transformation

Moderne, a leader in automated code refactoring, has secured $30 million in Series B funding, led by Acrew Capital with participation from Morgan Stanley, Amex Ventures, and TIAA Ventures. Based in Miami, Moderne specializes in helping enterprises modernize large codebases, addressing technical debt and enhancing software security. Its platform, built on OpenRewrite technology, features the Lossless Semantic Tree data model and integrates with popular developer tools like AWS and GitHub Copilot. With a 250% increase in its customer base, including Fortune 500 firms, Moderne is poised to further improve its services and streamline processes in various industries.

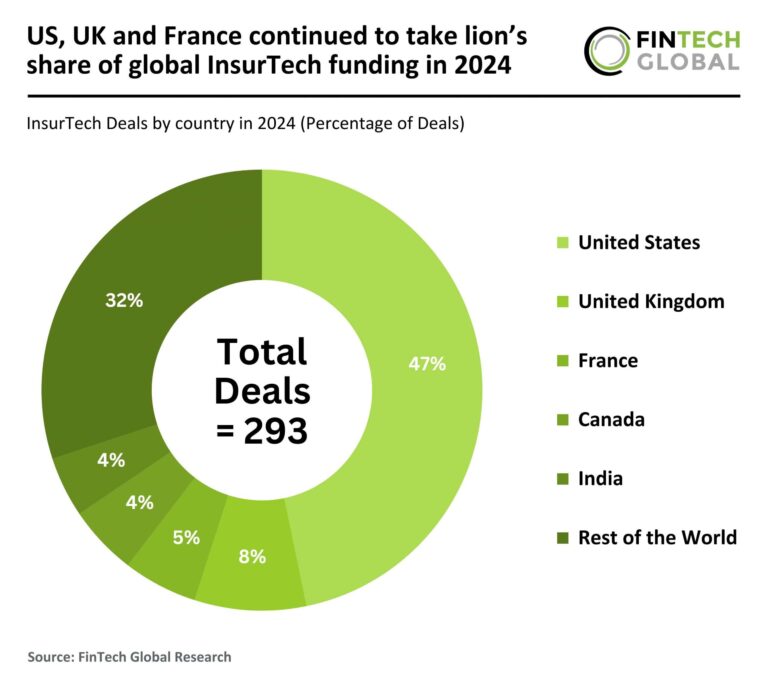

US, UK, and France Dominate Global InsurTech Funding Landscape in 2024

In 2024, the global InsurTech market faced a significant downturn, with total funding dropping to $5 billion, a 35% decrease from 2023 and a 64% decline since 2020. The number of deals also fell sharply to 293, down 47% from the previous year. Contributing factors include macroeconomic uncertainties, regulatory changes, and investor caution. Despite the downturn, the US, UK, and France led funding, accounting for 60% of deals. Notably, Akur8 secured a $120 million Series C round, focusing on insurance pricing innovation. Investors remain selective, prioritizing mature opportunities in this evolving landscape.

LGT Partners with NatureAlpha: A Strategic Alliance to Combat Biodiversity Risks in Finance

Sustainable finance is gaining traction as companies like LGT and NatureAlpha team up to combat biodiversity loss. This collaboration focuses on integrating NatureAlpha’s advanced data analysis into LGT’s investment strategies, enabling investors to assess environmental impacts, minimize biodiversity risks, and make sustainable decisions. LGT’s Sustainability Strategy 2030 aims for impactful investments that prioritize ecological considerations. The partnership aligns with global initiatives like the Taskforce on Nature Related Financial Disclosures, highlighting the importance of data in investment decisions. LGT’s commitment is further emphasized by its participation in the Finance for Biodiversity Pledge, showcasing leadership in nature-positive finance.