Similar Posts

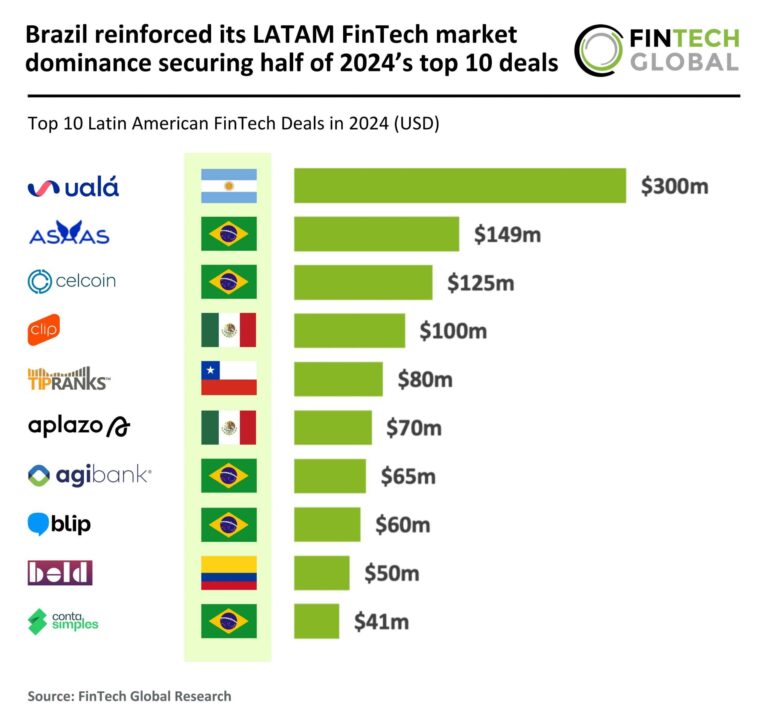

Brazil Solidifies LATAM FinTech Leadership with 50% of 2024’s Top 10 Investment Deals

In 2024, LATAM FinTech funding declined to $2.4 billion across 140 deals, a 13% drop from 2023 and a 56% decrease in transactions since last year. However, average deal sizes increased to $16.9 million, indicating a trend toward larger funding rounds for established players. Brazil remains dominant, securing five of the top ten deals, while Mexico saw a reduction in activity. Notably, Argentine neobank Ualá raised $300 million in a Series E round, supported by major investors like Allianz X and Goldman Sachs, to enhance its financial services and expand across Argentina, Mexico, and Colombia.

Master Tax Reporting: Ensure Accuracy with Real-Time and Bulk TIN Validation Solutions

The IRS has expanded regulations to include digital assets, designating platforms, payment processors, and wallet providers as brokers, which imposes traditional reporting obligations. To aid compliance, companies are encouraged to utilize the IRS TIN matching program for verifying Taxpayer Identification Numbers (TINs), crucial for avoiding penalties under Sections 3406 and 6721. Best practices include collecting TINs at account opening, real-time matching, and bulk matching to ensure accuracy before reporting deadlines. Although Notice 2024-56 offers some relief, it doesn’t cover all obligations, highlighting the need for diligent TIN management. Businesses are urged to stay informed and proactive in compliance efforts.

Vouchsafe Secures £1M Pre-Seed Funding to Combat ID Poverty: A Game-Changer in Identity Verification

Vouchsafe, a UK-based identity verification platform, has raised £1 million in a pre-seed funding round to tackle global ID poverty and enhance financial inclusion. The oversubscribed round was led by Bethnal Green Ventures and included investors like Biometric Ventures and angel investor Andrew Chevis. Vouchsafe addresses the needs of approximately one billion people without official ID, including 11 million in the UK, by providing accessible verification solutions. Their innovative technology accepts diverse evidence and integrates advanced background checks. Collaborating with financial institutions and the Scottish Government, Vouchsafe aims to unlock banking access for millions while aligning with UN Sustainable Development Goal 16.9.

Bourn Secures £1.5M Seed Funding to Transform Cash Flow Management for SMEs

Bourn, a UK FinTech startup focused on SME finance, has secured £1.5 million in seed funding to develop its AI-driven Flexible Trade Account (FTA). The funding round, led by Haatch, included investors like Love Ventures and Portfolio Ventures. Founded by industry veterans Roger Vincent, Nick Tracey, and Paul Gambrell, Bourn aims to address cash flow challenges faced by SMEs. Their FTA offers an alternative to traditional overdrafts, utilizing AI risk assessment and Open Banking technology. The funds will be used for product development and market expansion. New board member Leda Glyptis emphasizes Bourn’s commitment to enhancing financial accessibility for businesses.

EU Delays Sustainability Reporting Rules to Alleviate Business Burden: What It Means for Companies

The European Union (EU) has approved a proposal to postpone key sustainability reporting requirements, aimed at easing regulatory burdens on companies. This decision introduces a “Stop-the-clock” mechanism, extending deadlines for the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD) by two years for large companies and one year for the largest firms. Polish Minister Adam Szłapka emphasized simplification as a priority of the Polish presidency. This measure is part of the broader “Omnibus I” legislative package to streamline sustainability regulations, with a vote scheduled for April 1.

Eric de Tessières Appointed Chief Sustainability Officer at Edmond de Rothschild: A New Era in Sustainable Finance

Edmond de Rothschild has appointed Eric de Tessières as Group Chief Sustainability Officer, effective April 7, 2023, to enhance its sustainability initiatives in asset management and private banking. With nearly 20 years of experience in sustainable investment, including roles at BNP Paribas and Ernst & Young, de Tessières brings valuable expertise. Currently, half of the firm’s assets comply with SFDR’s Article 8 or 9 regulations, reflecting its commitment to sustainable finance. He will work with specialists in Paris and Geneva to navigate regulatory challenges, reinforcing the firm’s leadership in sustainability under the guidance of Deputy CEO Cynthia Tobiano.