Similar Posts

CloudSEK Secures $19M Funding Boost to Expand Global AI Cyber Threat Intelligence Operations

CloudSEK, a cybersecurity firm specializing in AI-driven threat prediction, has raised $19 million in Series A2 and B1 funding to enhance its cyber intelligence solutions. Investors included MassMutual Ventures, Inflexor Ventures, and others, with previous backers reaffirming their support. Founded in 2015 by Rahul Sasi, CloudSEK focuses on identifying potential cyber threats through early indicators like leaked credentials. The funding will accelerate product development and support global expansion, particularly in the US. Serving over 250 clients across various sectors, the company boasts a 4.8-star rating on Gartner Peer Insights, reflecting its effectiveness in proactive cybersecurity.

Orca Security Strengthens CNAPP Leadership: Opus Acquisition and AI-Driven Remediation Revolutionize Cloud Security

Orca Security, a leader in agentless cloud security, has acquired Opus, a startup focused on AI-powered automation, enhancing its cloud-native application protection platform (CNAPP) capabilities. This acquisition aims to advance Orca’s offerings from threat detection to AI-driven remediation, significantly reducing manual efforts for security teams. Orca’s CEO, Gil Geron, highlighted the importance of this move in transitioning to intelligent, automated cloud security solutions. Opus, co-founded by former Siemplify team members, provides advanced technology to address security challenges effectively. Together, they set a new standard for cloud security, aiming for a safer digital landscape for organizations globally.

Visa Direct Leverages Banking Circle API for Seamless Global Payment Solutions

Banking Circle S.A. has partnered with Visa to enhance cross-border payment efficiency through Visa Direct, a global digital payments platform. This collaboration allows Visa Direct to utilize Banking Circle’s extensive local clearing rails via a streamlined single API, facilitating seamless transactions across different cards, currencies, and markets. Banking Circle CEO Laust Bertelsen highlighted the partnership as a significant milestone in improving transaction speed and reducing costs. Visa Direct’s global head, Sandeep Gupta, expressed excitement about leveraging Banking Circle’s technology to enhance customer services. The partnership underscores Banking Circle’s commitment to innovative solutions for international businesses.

Exploring the Innovation Impact of Regulatory Sandboxes: Unlocking Opportunities for Growth

Regulatory sandboxes are gaining recognition as crucial tools for innovation in the financial sector, allowing businesses to test new products and services while ensuring compliance with regulations. These environments encourage collaboration between financial institutions and RegTech providers, streamline data management, and optimize anti-money laundering (AML) systems. With the success of sandboxes in places like Singapore and the UAE, their adoption is expected to broaden, enhancing compliance with international standards. Key benefits include accelerated AI and machine learning adoption, strengthened collaboration between regulators and firms, and increased investment opportunities, making sandboxes essential for evolving financial compliance and innovation.

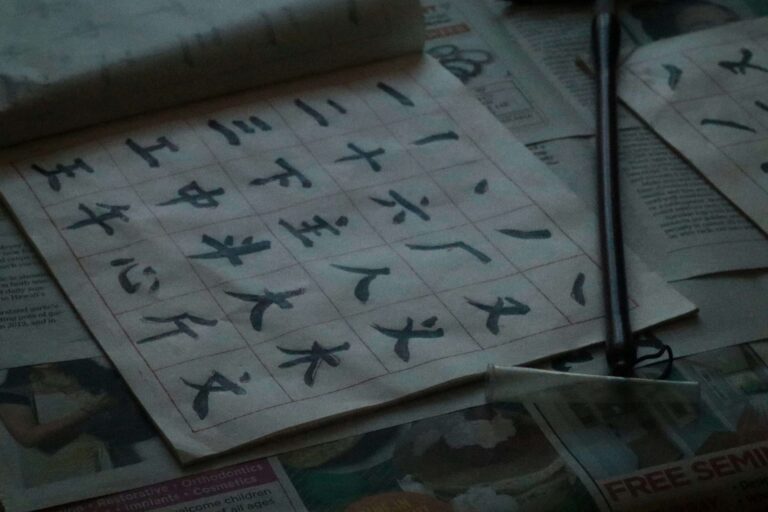

Mastering Name Screening: Tackling Challenges in Chinese and Non-Latin Scripts

Accurate name matching is vital for regulatory compliance in KYC and AML processes, yet it faces challenges due to language and script variations. IMTF has partnered with Babel Street to improve name matching precision and reduce compliance risks. Their guide highlights the complexities of screening names, especially in non-Latin scripts like Chinese, where transliteration can lead to ambiguity. Traditional methods often produce false positives and negatives, increasing operational costs and regulatory exposure. Babel Street’s innovative two-pass hybrid approach, integrated into IMTF’s Siron One, utilizes AI-driven techniques to enhance accuracy, supporting 24 scripts and streamlining compliance efforts.

Net-Zero Banking Alliance Adapts to Empower Banks in Meeting Growing Climate Reporting Requirements

The Net-Zero Banking Alliance (NZBA) has renewed its mandate to enhance support for member banks in aligning with the Paris Agreement’s climate goals. Following a year-long review, the NZBA aims to focus on real economy decarbonization and strengthen banking climate strategies. Chair Shargiil Bashir highlighted the urgency of emissions reduction, emphasizing the alliance’s role in facilitating client collaboration and green investments. The updated strategy allows for diverse net-zero pathways while ensuring accountability to stakeholders. The NZBA is committed to guiding banks through evolving regulations and fostering knowledge exchange to effectively implement their climate strategies.