Similar Posts

Ki Insurance and QBE Join Forces to Enhance Digital Solutions for Brokers

Ki Insurance has partnered with QBE Insurance to enhance broker insurance solutions through a digital platform that simplifies access to follow-form insurance capacity. This collaboration allows brokers to efficiently access coverage from multiple providers, expediting the binding process and improving market efficiency. Starting in February, brokers will benefit from QBE’s capacity across eleven business classes, including Cyber and D&O. Mark Allan, Ki’s CEO, and Jason Harris, QBE’s CEO, emphasized the partnership’s potential to advance digital trading in the insurance sector, providing faster, high-quality coverage options for brokers and insureds.

EU Commission’s ESG Reform Plan Under Legal Fire: Concerns Over Due Diligence Reductions

The European Ombudsman has launched a formal investigation into the European Commission’s Omnibus proposals, which may alter sustainability reporting and due diligence requirements for EU businesses. This follows a complaint from a coalition of NGOs, including ClientEarth and Friends of the Earth Europe, alleging procedural violations like bypassing public consultations and failing to conduct necessary impact assessments. The Omnibus I package, introduced in February 2025, aims to streamline regulations affecting major frameworks such as the Corporate Sustainability Reporting Directive. Concerns include potential exemptions for many firms, raising significant implications for environmental and human rights standards within the EU.

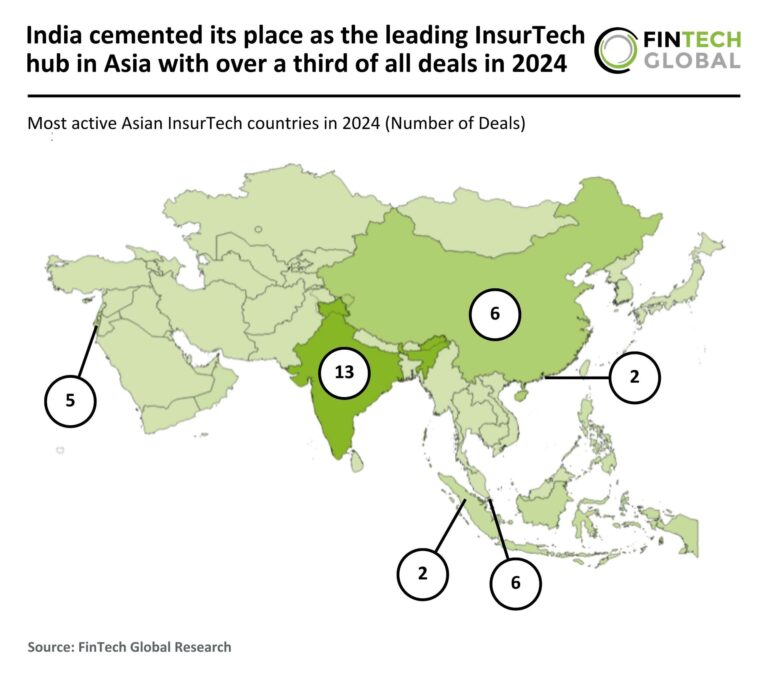

India Emerges as Asia’s Top InsurTech Hub, Capturing Over 33% of All Deals in 2024

In 2024, the Asian InsurTech market faced a significant downturn, with deal activity dropping 64% year-over-year and funding plummeting 71% to $369 million from $1.3 billion in 2023. This decline is attributed to investor caution, regulatory challenges, and changing funding priorities. Despite the overall contraction, India emerged as the leading InsurTech hub, securing 13 deals (35% market share), followed by China and Singapore with six deals each. Notably, Indian startup Zopper raised $25 million in a Series D funding round, aimed at enhancing its digital infrastructure and product offerings, highlighting ongoing innovation in the sector.

AscentAI: Transforming Regulatory Compliance Through Innovative Technology

Chicago’s Ascent Technologies has rebranded as AscentAI, launching a new Regulatory Lifecycle Management (RLM) Platform designed for financial institutions. This AI-driven platform aims to enhance compliance processes, reduce costs, and improve risk management. Key components include AscentHorizon, which tracks global regulations, and AscentFocus, which evaluates regulatory obligations. CEO Christopher Junker noted the overwhelming information challenges faced by compliance organizations, while VP Ellen Krueger highlighted the platform’s ability to streamline change management. AscentAI aims to provide actionable insights and automate compliance tasks, reflecting a commitment to innovation in the legal and risk management sectors.

Persona Achieves $2 Billion Valuation with $200 Million Funding Boost in Identity Verification Sector

Persona, a San Francisco-based identity verification platform, has raised $200 million in Series D funding, boosting its valuation to $2 billion. The round was co-led by Founders Fund and Ribbit Capital, with participation from notable investors like BOND and Index Ventures. Persona’s platform serves various industries, including FinTech and retail, and operates in over 200 countries and 20 languages. Amid rising concerns about synthetic fraud and AI-generated deepfakes, CEO Rick Song highlighted the urgency of addressing the identity authenticity crisis, emphasizing that understanding identity is crucial in an AI-driven world. The new funding will help enhance their verification systems.

ArmourZero Secures Gobi Partners Investment to Streamline Cybersecurity Solutions for Businesses

Gobi Partners, a leading Asian venture capital firm, has invested in ArmourZero, a cloud-based cybersecurity company specializing in AI-driven Application Security and Security-as-a-Service (SECaaS). The investment, part of the Gobi Dana Impak Ventures fund supported by Khazanah Nasional Berhad, will help ArmourZero expand its offerings in Southeast Asia. Founded in 2022, ArmourZero provides an integrated cybersecurity platform with key products like ShieldOne and ScoutTwo, targeting small to medium-sized enterprises (SMEs) facing significant cyber threats. CEO Tho Kit Hoong aims to simplify cybersecurity for all businesses, while Gobi Partners recognizes the importance of supporting SMEs in digital protection.