Similar Posts

FinTech Surge: Over $1 Billion Raised in 16 Major Deals This Week!

The FinTech sector attracted over $1 billion in investments this week, with 16 transactions totaling $1.13 billion despite a slow deal flow. Notable deals included UK-based Abound securing £250 million ($324 million) from Deutsche Bank, Mercury Financial raising $300 million to reach a $3.5 billion valuation, and Island obtaining $250 million in Series E funding, boosting its valuation to nearly $5 billion. Additionally, MoonPay received a $200 million credit line, and Aura raised $140 million to enhance its AI-driven safety solutions. The U.S. dominated the investment landscape, accounting for 11 of the deals, with CyberTech leading sector activity.

How Arbonics is Revolutionizing Carbon Credits to Eliminate 1 Gigaton of CO2 from Our Atmosphere

Arbonics, founded in 2022 by Kristjan Lepik and Lisett Luik, is an ESG FinTech company addressing deforestation’s impact on climate change by helping landowners generate income through carbon credits. Operating in Estonia, Finland, Lithuania, and Latvia, Arbonics aims to remove one gigatonne of CO2 by verifying nature-based carbon removal credits under Verra. Their approach allows landowners to start earning from afforestation in five years, compared to traditional timber sales that take up to 70 years. Utilizing advanced data models, Arbonics emphasizes collaboration with experts to promote sustainable forestry, ultimately benefiting the environment and local economies.

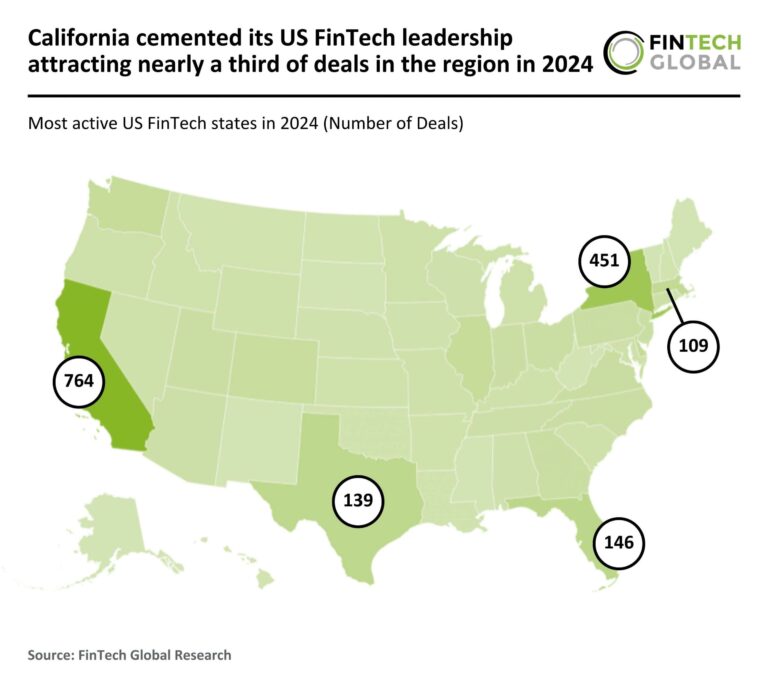

California Dominates US FinTech Landscape: Capturing Nearly One-Third of 2024 Deals

In 2024, California maintained its position as the leading US FinTech hub, accounting for 31% of deals with 764 transactions, despite a 59% decline from 2023. Overall, US FinTech funding plummeted to $18.4 billion, a 47% decrease, with deal volume dropping to 1,506, a 63% reduction. Economic uncertainty and rising interest rates contributed to this downturn. New York followed California with 451 deals (18% share), while Florida surpassed Texas with 146 deals (6% share). Notably, Cyera raised $300 million in a Series C funding round, highlighting the importance of advanced data security solutions.

NCR Atleos Elevates NatWest Group’s ATM Upgrade: A New Era in Banking Technology

NatWest Group is transforming its self-service banking network through a partnership with NCR Atleos, aiming to enhance the customer experience for over 19 million users of its brands, including NatWest Bank and Royal Bank of Scotland. The upgrade involves replacing over 5,500 ATMs and multi-function devices with advanced technology, featuring a 19-inch touchscreen for improved interaction and operational efficiency. This initiative reflects NatWest’s commitment to innovation and community support, as highlighted by Richard Talbot and Diego Navarrete. The upgrade is essential for maintaining NatWest’s competitive edge in the evolving banking landscape.

LSEG Expands APAC Footprint: Hiroki Tomiyasu Appointed as New Head of Post-Trade Operations

LSEG has appointed Hiroki Tomiyasu as the new Head of Post Trade for Japan and Head of Post Trade Solutions for the Asia-Pacific region, effective February 17, 2023. This strategic move aims to enhance LSEG’s operations in the rapidly evolving markets of Japan and APAC. Reporting to Rohit Verma and Andrew Williams, Tomiyasu brings extensive experience from his previous role as Managing Director at Morgan Stanley MUFG Securities and significant positions at the Development Bank of Japan. His advanced degrees in finance and management position him to drive innovation and growth in LSEG’s Post Trade services, underscoring the company’s commitment to the region.

RIIG-HOOTL Secures UAE Funding to Scale AI-Powered Cybersecurity and Health Tech Insurance Solutions

RIIG – HOOTL, a cybersecurity and AI-driven health tech company, has secured significant funding from UAE investors, prompting a rebranding to HOOTL, which stands for “Humans Out of the Loop.” This funding will accelerate product development, establish a UAE office, and strengthen partnerships with local entities. HOOTL aims to enhance insurance processes through advanced AI systems, aligning with the UAE’s digital transformation goals. CEO Denver Riggleman expressed gratitude for the support, highlighting the innovative nature of their solutions in insurance verification and claims adjudication. Engagements with UAE leaders have reinforced HOOTL’s commitment to the region’s healthcare modernization efforts.