Similar Posts

Crux Secures $50M to Revolutionize Clean Energy Capital Markets with Innovative FinTech Solutions

Crux, a capital markets technology firm focused on clean energy financing, has raised $50 million in a Series B funding round led by Lowercarbon Capital, with participation from new investors like Liberty Mutual Strategic Ventures and MassMutual Ventures. Existing investors, including Andreessen Horowitz, also contributed. Founded in 2023, Crux’s platform facilitates financing for clean energy projects, offering features such as tax credit transfers and debt marketplaces. The funding will help Crux scale its software, expand its team, and explore growth opportunities. CEO Alfred Johnson expressed excitement about collaborating with new investors to enhance the platform and drive investments in energy infrastructure.

Allianz Partners UK Expands Roadside Assistance Collaboration with Volvo Car UK for Enhanced Driver Support

Allianz Partners UK has been reaffirmed as the exclusive roadside assistance provider for Volvo Car UK for the next three years, enhancing customer support for both new and used vehicles. This partnership, ongoing since 2010, adapts to market changes, including the rise of electric vehicles (EVs), and integrates Volvo’s diagnostic tools. Key features include the Service Activated Roadside Assistance program, which offers an extra year of support when servicing at authorized retailers, and flexible mobility options. Allianz aims to innovate and improve customer service, reflecting a commitment to sustainability and advanced assistance solutions in collaboration with Volvo.

India Initiates Climate Taxonomy Consultation to Combat Greenwashing and Promote Sustainable Practices

India’s Ministry of Finance has unveiled a draft framework for its Climate Finance Taxonomy, aimed at boosting sustainable investment and combating climate change. To achieve its net-zero emissions target by 2070 and reduce emissions intensity by 45% by 2030, India requires approximately $2.5 trillion. The taxonomy will promote climate-friendly technologies, ensure access to affordable energy, and prevent greenwashing. It aligns with global standards and categorizes activities as either climate-supportive or transition-supportive. The framework will focus on critical sectors like iron, steel, cement, power, and agriculture. A public consultation for stakeholder feedback is open until June 25, 2025.

Google Cloud Boosts Market Presence with $32 Billion Wiz Acquisition

Google has finalized its $32 billion acquisition of Wiz, enhancing its capabilities in cloud computing and cybersecurity. This all-cash deal will integrate Wiz into Google Cloud, focusing on improving cloud security and multicloud support. Wiz, known for its user-friendly security platform, helps mitigate cybersecurity risks for various clients, including startups and government organizations. The partnership aims to redefine security management, automate processes, reduce costs, and bolster defenses against evolving threats, particularly from AI. Wiz’s products will remain available across major platforms like AWS and Azure, further promoting multicloud security solutions within Google Cloud’s offerings.

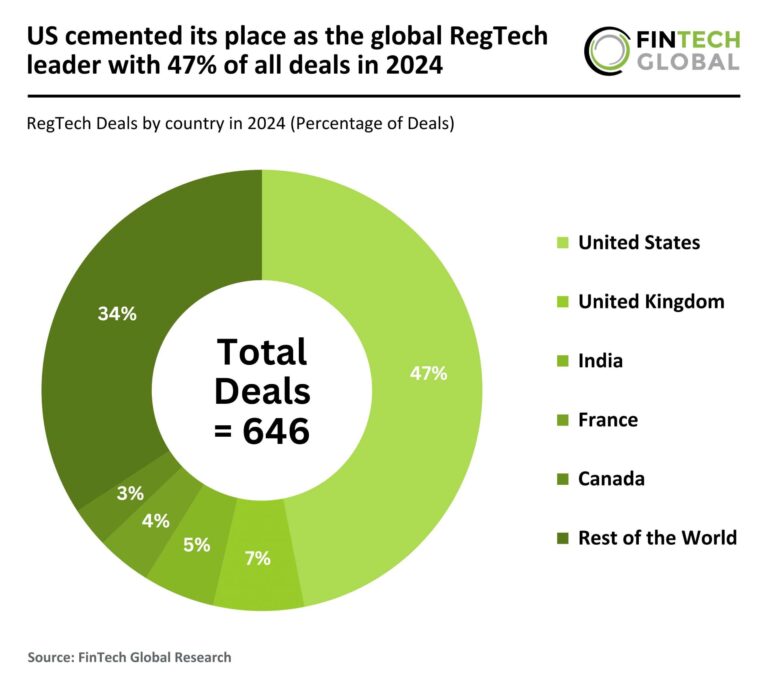

US Dominates Global RegTech Market in 2024 with 47% of All Investment Deals

In 2024, the global RegTech industry experienced a 43% decline in deal activity, with total funding dropping to $6.53 billion, a 36% decrease from 2023. The U.S. led the market, securing 303 deals but down from 572 the previous year. The UK and India also saw declines, while India emerged as a noteworthy player with 34 deals. Notably, Vanta secured the largest RegTech deal of the year, raising $150 million to enhance its AI-driven compliance platform, boosting its valuation to $2.45 billion. Despite the downturn, regulatory technology remains crucial for compliance solutions.

Worth Secures $25M in TTV Capital-Led Funding to Accelerate Onboarding Automation

Worth, a prominent FinTech company focused on onboarding and underwriting automation, has raised $25 million in funding led by TTV Capital. The round included investments from Silicon Valley Bank and other notable backers. Worth’s AI-driven platform streamlines onboarding, enhances underwriting efficiency, and utilizes a proprietary database of over 242 million small businesses. With this funding, Worth plans to accelerate expansion, improve AI technology, and scale services for larger clients. Co-founders Sal Rehmetullah and Suneera Madhani emphasized the need for innovative solutions in the financial sector, positioning Worth as a key player in the growing demand for automation in financial services.