Similar Posts

Flourish Ventures Fuels MEA’s MoneyHash with $5.2M Pre-A Investment to Accelerate Growth

MoneyHash, a prominent payment orchestration platform in the Middle East and Africa, has raised $5.2 million in a pre-A funding round to enhance its technology and expand its market presence. The round was led by Flourish Ventures, with participation from Vision Ventures, Arab Bank Venture Capital, and Emurgo Kepple Ventures, among others. This funding will be used for technological advancements and regional expansion, addressing challenges in emerging markets. CEO Nader Abdelrazik emphasized the platform’s role in converting payment inefficiencies into strategic advantages for merchants. MoneyHash has now raised a total of $7.5 million in two funding rounds.

MoneyGram Teams Up with Plaid to Revolutionize Cross-Border Payments with Innovative Pay-by-Bank Solution

MoneyGram has partnered with Plaid to enhance its MoneyGram Online (MGO) platform by integrating Plaid’s bank verification technology. This collaboration aims to streamline funding for domestic and international payments, starting in the U.S. and expanding globally. The integration promises improved consumer satisfaction, reduced fraud, and faster transactions. Customers can link their bank accounts easily, benefiting from instant verification and proactive fraud detection. The partnership addresses the high demand for linked financial services, as over 75% of U.S. consumers find it essential. MoneyGram’s CEO emphasizes this step as crucial for delivering secure, efficient cross-border payments.

AI Revolution: Transforming UK Financial Advice to Seize a £50bn Market Opportunity

The UK’s financial advice sector is poised for change, driven by a study from AI fintech firm Aveni and YouGov, revealing a potential £50 billion market for advisers who adopt AI. The research shows a generational trust gap, with only 24% of 35-44-year-olds consulting advisers compared to 49% of those over 55. Younger respondents are more open to AI-driven financial advice, with 83% of 25-34-year-olds willing to use it for lower costs. Experts emphasize the need for advisers to integrate AI to improve accessibility and affordability, especially as £7 trillion in generational wealth is set to transfer in the coming decade.

Fundraise Up Secures $70 Million to Propel Global Expansion of Nonprofit Fundraising Solutions

Fundraise Up, a leading nonprofit fundraising platform, has secured $70 million in minority growth investment led by Summit Partners, with support from Telescope Partners. Founded in 2017, the company uses AI to streamline online fundraising for nonprofits. Its platform features a transaction-based pricing model and serves clients like UNICEF USA and The Salvation Army UK. The new funding will help expand product offerings, accelerate global reach, and enhance AI technology to improve donor engagement. CEO Peter Byrnes emphasizes the need for nonprofits to access advanced technology, positioning Fundraise Up to significantly impact the sector’s fundraising efforts.

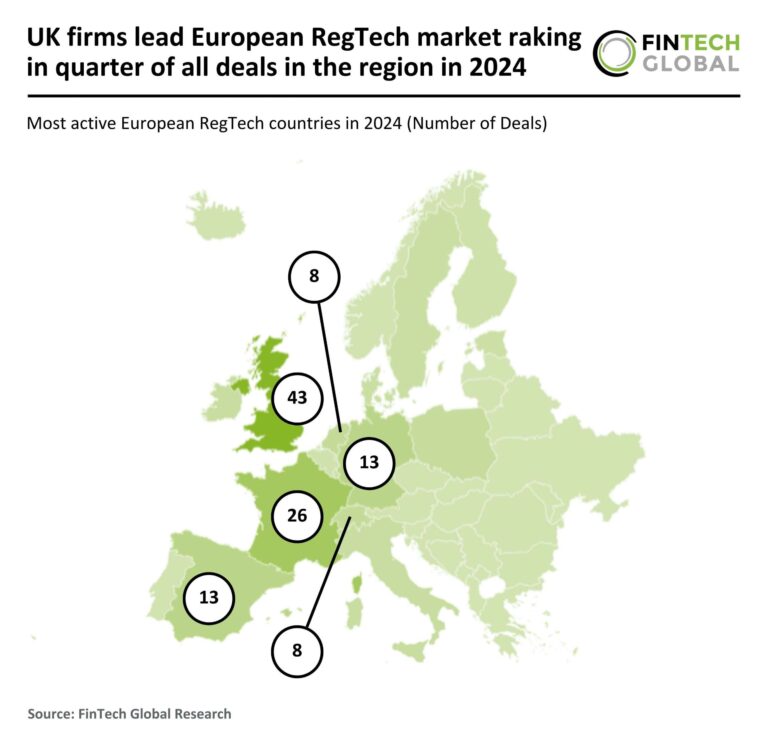

UK Firms Dominate European RegTech Market, Capturing 25% of 2024 Regional Deals

In 2024, the European RegTech market faced a significant decline, with total funding dropping 53% to $724 million and completed deals falling by 50% to 111. This downturn reflects investor caution amid market uncertainty. The UK remained the leader, accounting for 26% of deals, despite a 54% decrease to 43 deals. France and Germany also saw declines, while Spain emerged as a new player. Notably, London-based Napier AI secured $56.9 million in funding, one of the largest deals of the year, highlighting innovation as a potential driver for future recovery in the sector.

Safetrust Secures Strategic Investment from dormakaba: A Major Step for Secure Identity Solutions

Safetrust, a leader in secure identity solutions, has received a strategic investment from dormakaba, a global access solutions provider. This partnership aims to enhance Safetrust’s market presence and advance its post-quantum-ready security technology. While specific investment details remain undisclosed, the collaboration will improve Safetrust’s innovative technologies that leverage neuroscience and data analytics for enhanced security intelligence. Safetrust’s offerings include cloud-connected sensors and solutions for physical access and digital identity verification. Both CEOs expressed enthusiasm for the partnership, highlighting its potential to address security challenges in a digital landscape.