Similar Posts

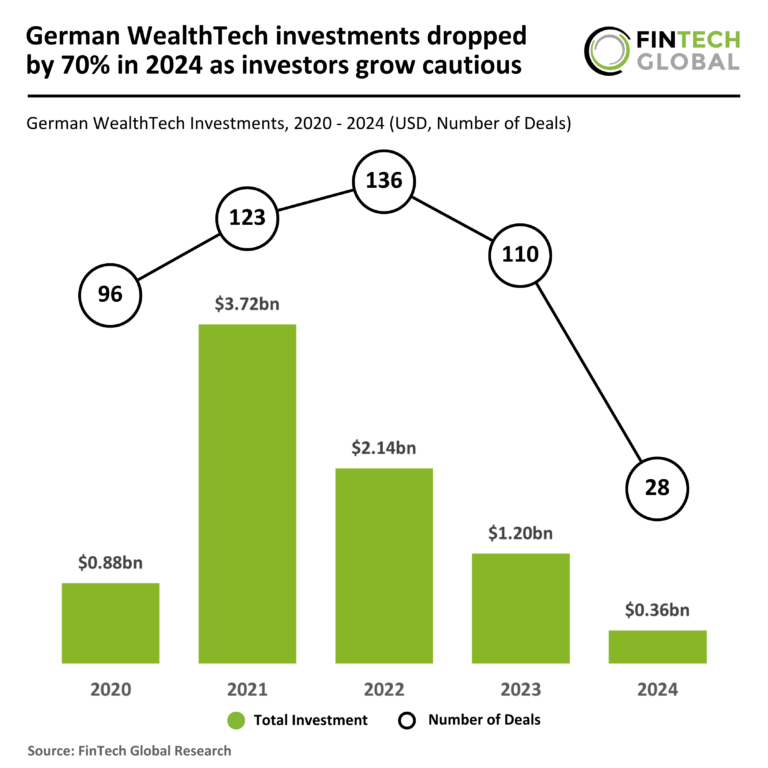

German WealthTech Investments Plummet 70% in 2024 as Investor Caution Surges

In 2024, Germany’s WealthTech sector experienced a significant downturn, with investment activity falling 70% year-on-year. Funding dropped from $1.204 billion in 2023 to $362 million, with only 28 deals recorded, an 82% decrease. The average deal value also declined to $12.9 million. Investors are now more cautious, focusing on established companies with proven business models. Amidst this backdrop, QPLIX secured a notable $26.5 million funding round from Partech to enhance its wealth management software, supporting its expansion into international markets such as France and the UK. The sector must adapt to attract future investments.

MENA InsureLab Partners with TIC to Propel InsurTech Innovation Forward

MENA InsureLab, an InsurTech accelerator, has secured strategic investment from TIC Technology Innovation Capital, a prominent US venture capital firm, as part of TIC’s $100 million fund aimed at supporting early-stage tech companies. MENA InsureLab focuses on digital transformation in insurance by connecting traditional firms with innovative startups. The investment includes not only financial backing but also software development services for equity, enhancing startup growth. With this funding, MENA InsureLab plans to expand operations, improve funding opportunities, implement mentorship programs, and facilitate market access in the MENA region, fostering collaboration and innovation in the InsurTech sector.

Seeds Secures $10M Series A Funding to Revolutionize Personalized Investment with WealthTech Innovation

Seeds, a US-based WealthTech company, has raised $10 million in a Series A funding round led by Portage, alongside existing investors Social Leverage and Blank Ventures, totaling over $15 million since its 2020 inception. The funding will enhance Seeds’ platform for registered investment advisors (RIAs) by aligning portfolios with clients’ values, streamlining processes, and improving client experiences. Plans include product innovation, team expansion, and marketing efforts. CEO Zach Conway emphasized the partnership with Portage aims to revolutionize wealth management technology, fostering stronger client-advisor relationships and moving beyond outdated systems.

AssuredPartners Partners with Carrum Health to Enhance Access to Specialty Care Services

AssuredPartners has partnered with Carrum Health to improve specialty care access for self-insured clients across the U.S. This collaboration focuses on connecting employers and employees to a network of top-tier specialty care providers, offering benefits such as high-quality surgery, cancer care, and substance use treatment, often with minimal out-of-pocket expenses. The partnership aims to significantly reduce healthcare costs, potentially saving employers up to 45% on surgeries and up to 30% on cancer care. With dedicated care coordinators and streamlined processes, the alliance enhances patient outcomes while alleviating administrative burdens.

Unlocking Global Payments: RedCompass Labs Unveils Game-Changing AI Tool for Modernisation

RedCompass Labs, a London-based consultancy, has launched AnalystAccelerator v2.5, an AI solution designed for the payments sector. This tool aims to enhance the payments modernization process for banks globally, addressing the need for accurate, domain-specific AI amid the adoption of new standards like ISO 20022 and FedNow. AnalystAccelerator v2.5 improves efficiency by accelerating analysis by 45% and reducing project costs by 25%. It is model-agnostic, continuously updated, and minimizes resource usage. The company has begun a proof of concept with a major North American bank and is in talks with other global institutions to implement the solution.