Similar Posts

Discover La Banque Postale’s Innovative Sustainable Savings Product: Empowering Your Future with ESG Principles

La Banque Postale, a prominent French bank focused on sustainable finance, has launched a new savings offer based on Environmental, Social, and Governance (ESG) criteria. This initiative responds to customer demand for investments aligned with sustainability. The offer includes life insurance, securities accounts, and share savings plans, categorized into three tiers: Level 1 excludes harmful companies, Level 2 focuses on firms with strong ESG practices, and Level 3 prioritizes impact-driven solutions. Executives Stéphane Dedeyan and Sarah Bouquerel highlighted the bank’s commitment to facilitating responsible investments that support ecological and social transitions while ensuring financial performance.

Unlocking Success: How Wealth Advisors Can Leverage Personalized Data and Client-Centric Tools to Stay Relevant

In the evolving wealth management landscape, advisors must adapt to industry changes and anticipate client needs. A recent LSEG report emphasizes a client-centric approach, highlighting that 68% of clients value a comprehensive view of their assets. Advisors need to leverage data-driven insights and technology to deliver timely, personalized advice. The Advisor Dashboard by LSEG aids this by providing essential data and insights to enhance client interactions. With 61% of wealth managers prioritizing personalized analytics, firms must utilize cost-effective technology solutions to improve productivity and foster long-term, value-driven client relationships in a competitive environment.

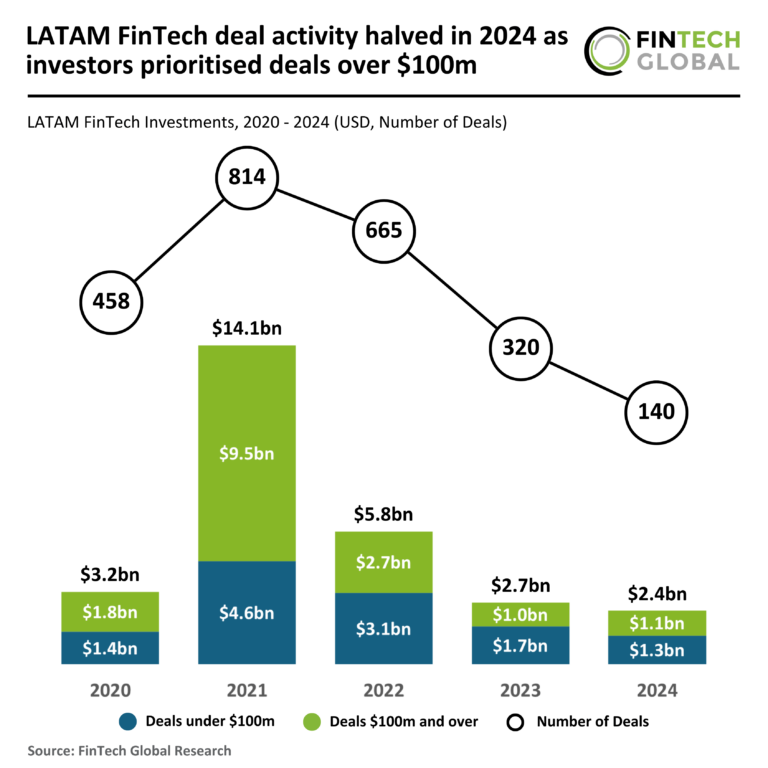

LATAM FinTech Investment Plummets in 2024: Why Investors Focused on $100M+ Deals

In 2024, the Latin American FinTech sector has seen a significant decline in deal activity, with total funding dropping to $2.4 billion across 140 deals, a 13% decrease from 2023. This downturn reflects a 56% drop in deal volume compared to the previous year. However, investments in larger rounds over $100 million have increased by 5%, indicating a trend toward fewer but larger transactions. A highlight is Ualá’s $300 million Series E funding round, aimed at expanding its services in Argentina, Mexico, and Colombia. Ualá plans to enhance its offerings with AI-driven tools, targeting over eight million users.

2024 WealthTech Trends: A Year of Innovation and Growth in Financial Technology

As 2025 begins, the WealthTech sector reflects on 2024’s performance during a recent expert discussion. Key insights include the rise of digital wealth management platforms, the closure of unsustainable business models, and the diversification of fee structures. Experts emphasized the importance of integrating technology stacks for success and highlighted the role of advanced analytics and AI in personalizing services. The rise of generative AI is also shaping new strategies in the sector. Industry leaders, including Fredrik Davéus and Tamara Kostova, stress the need for companies to stay informed about these evolving trends to remain competitive.

Unlocking Compliance Success: How Real-Time Data Revolutionizes Business Strategies

As financial crime risks increase amid complex regulations, businesses must prioritize early detection to protect their future. Traditional compliance methods, like annual audits, are no longer sufficient; continuous monitoring is essential, particularly in the financial sector, where failing to identify risks can lead to severe consequences. Comprehensive coverage is critical, as missing key developments can be costly. Access to global data streams enables timely compliance insights, while adverse media screening is often overlooked, posing reputational risks. Machine learning enhances real-time anomaly detection, but human oversight remains vital. Ultimately, compliance requires a collective responsibility within organizations to safeguard data integrity.

FCA Cranks Up Pressure on Misleading Financial Promotions: What You Need to Know

The Financial Conduct Authority (FCA) has intensified its oversight of financial promotions in the UK, withdrawing or amending nearly 20,000 advertisements in 2024 alone, with 9,197 related to claims management companies (CMCs). This surge addresses concerns over misleading promotions, especially in sectors like cryptoassets and debt solutions. The FCA is also proactively collaborating with social media platforms to curb illegal promotions and has interviewed 20 individuals for related violations. New regulations like the Section 21 Gateway require firms to seek FCA approval for promotions, reinforcing consumer protection and transparency in the financial landscape. Consumers are urged to report suspicious activities.