Similar Posts

Qevlar AI Raises $14M to Revolutionize Cyber Operations with Cutting-Edge Autonomous Technology

Qevlar AI, a leader in cybersecurity, has secured a $14 million investment to enhance its Security Operations Centers (SOCs). Led by EQT Ventures and Forgepoint Capital, the funding will automate routine tasks, improving efficiency and reducing the analyst burden amidst rising cyber threats. Qevlar AI’s autonomous technology aims to revolutionize threat detection and response, enabling quicker response times and less workload for analysts. CEO Ahmed Achchak emphasized the need for innovation in cybersecurity operations, stating their agents can conduct investigations in seconds rather than hours. This investment reflects strong confidence in Qevlar AI’s potential to reshape the cybersecurity landscape.

ClearVector Secures $13M to Tackle AI-Driven Threats with Identity-Focused Security Solutions

ClearVector, a cybersecurity innovator, has raised $13 million in Series A funding to boost its identity-driven threat detection capabilities. Led by Scale Venture Partners and supported by Okta Ventures, Inner Loop Capital, and Menlo Ventures, this investment will enhance ClearVector’s platform, which focuses on real-time monitoring of identity behaviors to identify threats. Key features include a unified security view through a commercial graph and monitoring of cloud services and CI/CD pipelines. As cyber threats grow more sophisticated, ClearVector’s approach is vital for organizations seeking to improve their security posture and protect sensitive data in cloud environments.

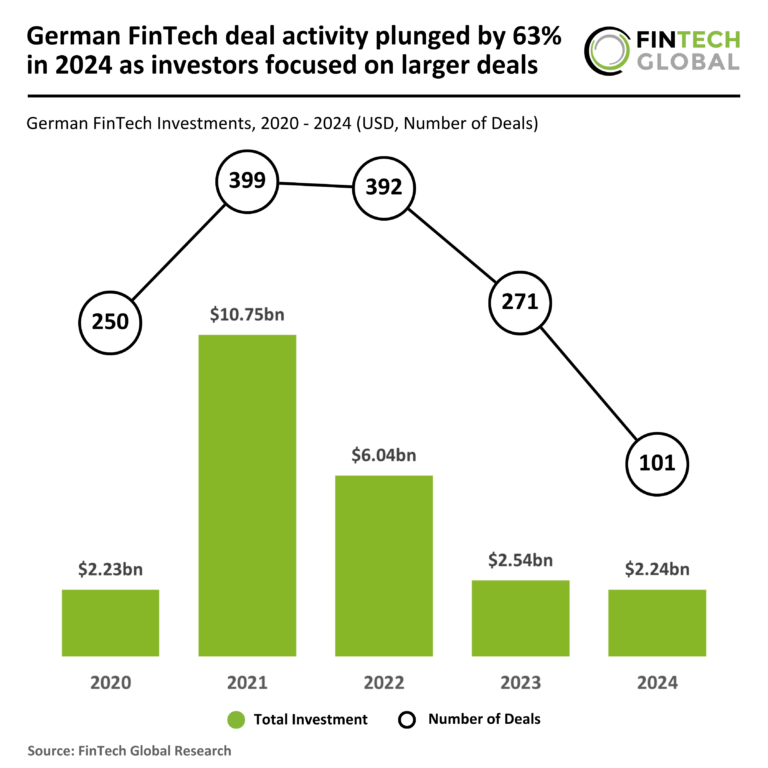

2024 Sees 63% Drop in German FinTech Deal Activity as Investors Shift Focus to Bigger Opportunities

In 2024, German FinTech investments experienced a 63% decline in deal activity, with only 101 deals recorded compared to 271 in 2023, marking the lowest level in five years. Total funding decreased slightly to $2.2 billion from $2.5 billion, reflecting a more selective investment approach amid economic uncertainties. However, the average deal value surged to $22.1 million, more than doubling from $9.4 million in 2023, indicating a shift towards investing in established firms. Notably, osapiens secured a $120 million Series B funding round, the largest FinTech deal in Germany this year, emphasizing the focus on quality investments.

UK’s Bold Overhaul of Payment Systems Oversight: A Game-Changer for Economic Reform

The UK government is considering abolishing the Payment Systems Regulator (PSR) to streamline regulatory oversight and boost economic performance. This decision, influenced by Prime Minister Sir Keir Starmer and Chancellor Rachel Reeves, aims to reduce red tape and enhance growth. Established in 2015, the PSR oversees payment systems but has faced criticism over fraud reimbursement practices. The government is also contemplating merging the PSR with the Financial Conduct Authority (FCA) as part of a broader regulatory review. Recent leadership changes and consultations with industry leaders underscore the commitment to improving the UK’s competitive edge and regulatory framework.

Crowded Lands Secures $7.5M Investment to Empower Nonprofits During Funding Challenges

Crowded, a Miami-based platform, has raised $7.5 million in a Series A funding round, bringing its total funding to $13.5 million. The round was led by Flashpoint, with participation from Florida Opportunity Fund, Wilson’s Bird Capital, and existing investors. Crowded specializes in AI-powered financial management solutions for nonprofits, offering features like multi-chapter banking, payment processing, and expense management. CEO Daniel Grunstein highlighted the need for better financial management in the sector, especially amid recent scrutiny. The new funding will enhance Crowded’s capabilities, especially in compliance and taxation tools, helping nonprofits focus on their core missions.

Weavr Launches Innovative Embedded Payment Solution in Partnership with Paperchase

Weavr, a UK provider of embedded finance solutions, has partnered with Paperchase, a leader in financial management for hospitality, to launch the Embedded Payment Run (EPR) solution. This innovation aims to streamline Accounts Payable (AP) processes, particularly in fast-paced sectors, by facilitating near-instant transactions and minimizing errors through an integrated system. Research shows strong demand for integrated workflows, with 94% of AP professionals wanting payment processing within existing platforms. Leaders from both companies highlight the partnership’s potential to cut costs and improve efficiency while opening new revenue streams. The EPR solution is poised to revolutionize financial operations across industries.