Similar Posts

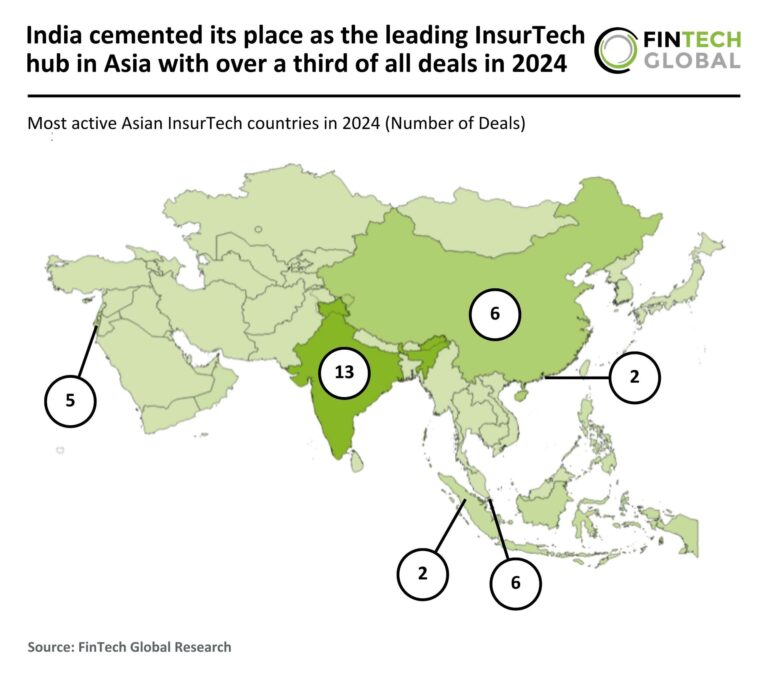

India Emerges as Asia’s Top InsurTech Hub, Capturing Over 33% of All Deals in 2024

In 2024, the Asian InsurTech market faced a significant downturn, with deal activity dropping 64% year-over-year and funding plummeting 71% to $369 million from $1.3 billion in 2023. This decline is attributed to investor caution, regulatory challenges, and changing funding priorities. Despite the overall contraction, India emerged as the leading InsurTech hub, securing 13 deals (35% market share), followed by China and Singapore with six deals each. Notably, Indian startup Zopper raised $25 million in a Series D funding round, aimed at enhancing its digital infrastructure and product offerings, highlighting ongoing innovation in the sector.

Mastercard’s $300M Investment in Corpay: Revolutionizing Cross-Border Payment Solutions

Mastercard has expanded its partnership with Corpay, enhancing its offerings in corporate cross-border payment solutions. Key developments include streamlined access for banking partners to a broader range of payment options, supported by a $300 million equity investment in Corpay, valuing it at $10.7 billion. Corpay will exclusively manage currency risk and large-value cross-border payments for Mastercard’s partners, while continuing to provide virtual card programs. Additionally, Mastercard Move will be extended to small and medium-sized enterprises in new markets. Both companies express optimism about the partnership’s potential to improve financial services for institutions and clients.

UK FinTech Capital on Tap Secures £650M to Boost £1.2B Master Trust Facility Expansion

Capital on Tap, a UK FinTech specializing in business credit cards for small enterprises, has raised £650 million, boosting its Master Trust facility to £1.2 billion. This funding, supported by partnerships with major financial institutions like SMBC Group, Société Générale, and HSBC, aims to enhance funding flexibility and support growth. The company focuses on providing flexible credit lines and financing solutions to small businesses in the UK and US, offering benefits such as cashback and travel rewards. CEO Damian Brychcy emphasized the funding’s importance in empowering small business owners to thrive in a competitive landscape.

TradeBridge Secures £70M Credit Line from Castlelake to Boost UK SMEs and eCommerce Growth

TradeBridge, a FinTech lender focusing on embedded finance for small and medium-sized enterprises (SMEs), has secured a £70 million financing facility led by Castlelake, furthering its commitment to SME growth. This follows a £100 million facility granted earlier in 2023. The funding will enhance TradeBridge’s ability to support B2B and B2C eCommerce, especially benefiting UK Amazon sellers through a new partnership. TradeBridge has disbursed over £5 billion in capital across various sectors globally. Castlelake, a significant player in private credit, has a history of supporting SMEs, reinforcing TradeBridge’s role in providing essential financing solutions.

Unlocking Green Funding: New SME Finance Standard Enhances Access to Sustainable Capital

The Platform on Sustainable Finance, an advisory group for the European Commission, has released a report advocating for a voluntary “SME sustainable finance standard” to enhance access to sustainable finance for small and medium-sized enterprises (SMEs). SMEs are crucial to the EU economy, contributing over 50% of GDP and over 63% of enterprise CO2 emissions. The new standard aims to simplify reporting and classification processes for banks and financial institutions, enabling SMEs to effectively showcase their sustainability efforts. This initiative addresses existing gaps in the EU taxonomy, empowering SMEs to access green finance and support the transition to a sustainable economy.

New York Regulator Imposes $40 Million Fine on Block for Anti-Money Laundering Violations

Block, the company behind Cash App, has been fined $40 million by the New York State Department of Financial Services (DFS) for serious failures in anti-money laundering (AML) and virtual currency compliance. An investigation revealed deficiencies in customer due diligence, risk controls, and delays in reviewing suspicious transactions, particularly during its rapid growth from 2019 to 2020. DFS Superintendent Adrienne Harris stated that these issues created vulnerabilities for money laundering. As part of the settlement, Block must pay the fine and engage an independent monitor to ensure compliance with regulatory standards moving forward.