Similar Posts

Klarna and OnePay Join Forces to Revolutionize Walmart Installment Loans in the U.S.

Klarna has partnered with OnePay, a consumer finance app, to offer exclusive installment loans for Walmart purchases in the U.S. This collaboration aims to enhance the shopping experience by providing flexible payment options both in-store and online. The integration of OnePay’s services into Walmart’s checkout is expected later this year, allowing customers to finance various products, including electronics. Klarna’s CEO, Sebastian Siemiatkowski, called the partnership a game changer, while OnePay’s CEO, Omer Ismail, stressed the importance of accessible credit options. Approved customers can choose repayment plans between 3 to 36 months, improving their purchasing flexibility.

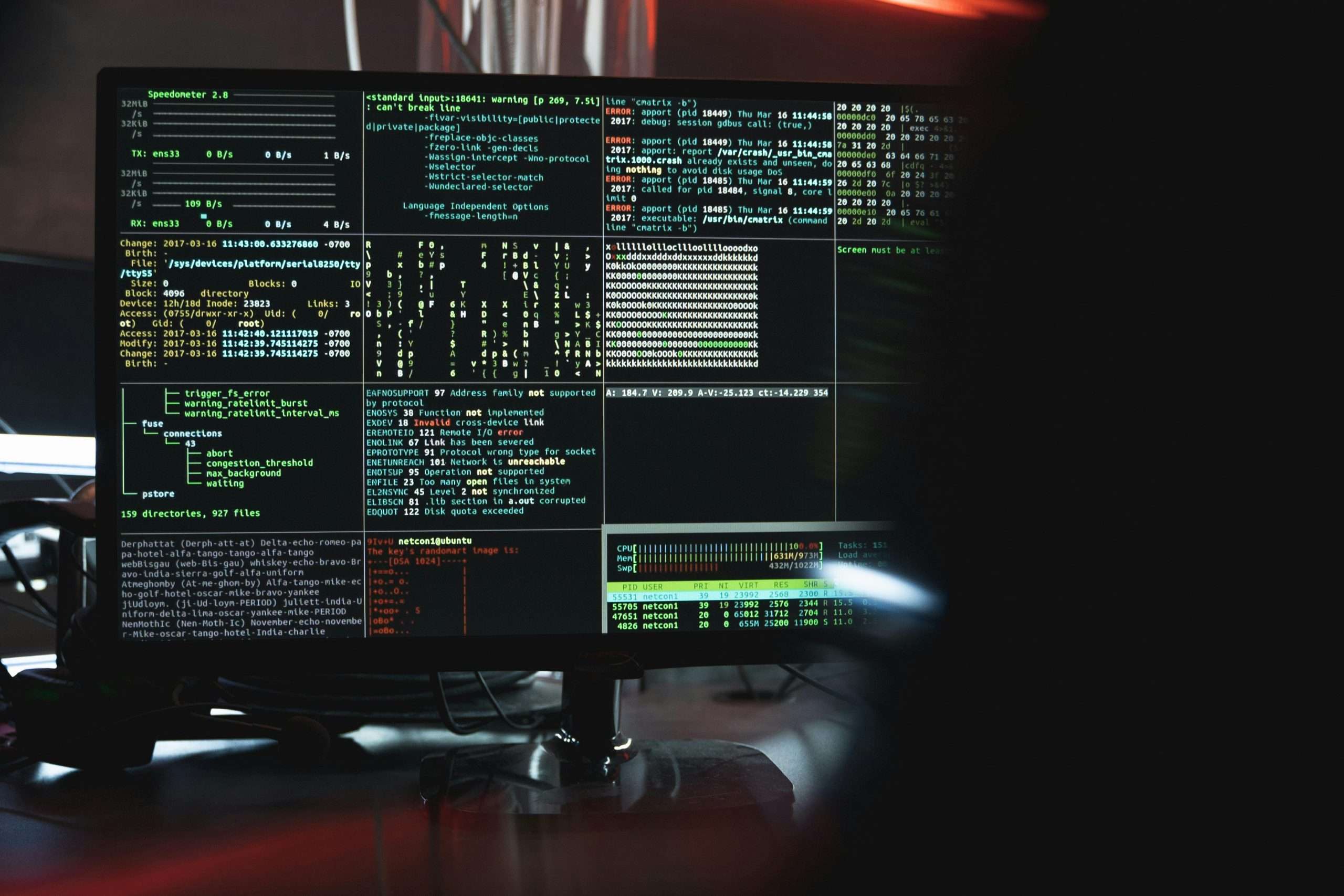

Qevlar AI Raises $14M to Revolutionize Cyber Operations with Cutting-Edge Autonomous Technology

Qevlar AI, a leader in cybersecurity, has secured a $14 million investment to enhance its Security Operations Centers (SOCs). Led by EQT Ventures and Forgepoint Capital, the funding will automate routine tasks, improving efficiency and reducing the analyst burden amidst rising cyber threats. Qevlar AI’s autonomous technology aims to revolutionize threat detection and response, enabling quicker response times and less workload for analysts. CEO Ahmed Achchak emphasized the need for innovation in cybersecurity operations, stating their agents can conduct investigations in seconds rather than hours. This investment reflects strong confidence in Qevlar AI’s potential to reshape the cybersecurity landscape.

Centiglobe and Mastercard Join Forces to Revolutionize Cross-Border Payments

Centiglobe has partnered with Mastercard Move to enhance its blockchain-based payment platform, improving access to international payment services for its members, which include regulated banks and payment service providers. This integration allows near real-time transactions through a single connection, simplifying cross-border payment processes. Key benefits include enhanced accessibility to various payment services, a fixed cost structure based on transaction volume, and effective liquidity management. Mastercard Move supports over 180 countries and 150 currencies, connecting with over 95% of the global banked population. This collaboration aims to redefine the payment landscape and drive efficiency in international transactions.

FMSB Unveils New Guidelines to Simplify Client Onboarding and Enhance Efficiency

The Financial Markets Standards Board (FMSB) is dedicated to improving fairness and efficiency in wholesale financial markets by promoting transparency and high standards. Recently, the FMSB released client onboarding guidelines to simplify documentation processes for financial institutions (FIs) and ensure compliance with regulatory standards. Key recommendations focus on identity, business, and structure verification, as well as mapping documents to data points. Enhanced due diligence communication templates are provided for high-risk cases. By adhering to these guidelines, FIs can improve onboarding processes, maintain data integrity, and uphold accountability in financial practices, according to Moody’s Marisol Lopez Mellado.