Similar Posts

Blockchain Advocates Take Legal Action Against IRS Over Controversial DeFi Regulations

The recent lawsuit filed by the Blockchain Association, DeFi Education Fund, and the Texas Blockchain Council in a US District Court in Texas has stirred significant interest in the ongoing debate surrounding cryptocurrency regulations. The primary focus of this legal action is the new IRS rules set to take effect in 2027, which the plaintiffs…

Kraken and Mastercard Partner to Launch Innovative Crypto Debit Cards

Kraken has partnered with Mastercard to launch physical and digital debit cards, enabling users to spend cryptocurrencies and stablecoins at millions of Mastercard-accepting locations worldwide. Co-CEO David Ripley highlighted the partnership’s aim to simplify real-world transactions for crypto holders. Benefits include seamless transactions, diverse payment options, and global reach. Mastercard’s EVP Scott Abrahams emphasized their shared goal of enhancing the digital asset ecosystem. This collaboration builds on Kraken’s recent launch of Kraken Pay, facilitating instant payments in over 300 cryptocurrencies. Overall, this partnership marks a significant step towards mainstream cryptocurrency adoption and a more integrated financial experience.

Ziglu Unveils Game-Changing Crypto on Card Feature: Your Gateway to Effortless Digital Currency Transactions!

Ziglu has launched a transformative feature allowing users to prioritize and spend their cryptocurrencies easily. Users can select which digital assets to use, and Ziglu automatically converts them to GBP at the time of purchase. This update includes prioritized spending accounts and fallback options for insufficient funds. Ziglu also integrates with Apple Pay and Google Pay, ensuring transparent rates and no hidden fees. CEO Mark Hipperson highlighted the importance of this launch for real-life cryptocurrency use. Additionally, Ziglu recently raised £5 million and plans to launch its own stablecoin in Q2 next year, enhancing its offerings.

Stripe Soars to $91.5 Billion Valuation: How AI Investments Are Driving Growth

Stripe and its investors are set to repurchase shares to improve liquidity for current and former employees, signaling a valuation rebound close to its 2021 peak, following a March 2023 funding round that valued the company at $50 billion. In its annual letter, Stripe reported a 38% year-on-year increase in total payment volume, reaching $1.4 trillion in 2024. Cofounders Patrick and John Collison attributed this growth to investments in AI, increased adoption, and support for emerging businesses. They also emphasized the rising significance of stablecoins in the economy, noting their potential to enhance financial systems and promote growth.

How Neobanks Are Revolutionizing Finance: Bridging Gaps with Blockchain Technology

Traditional finance faces criticism for inefficiencies and exclusionary practices, leaving 1.4 billion people unbanked. Outdated models hinder access for those lacking documentation or credit histories, imposing high fees and delays on transactions. Neobanks, utilizing blockchain technology, present a solution by offering faster, cost-effective services and decentralized models that enhance financial inclusion. They provide non-custodial accounts allowing full ownership of assets and improve data security through decentralized management. Moreover, stablecoins address volatility concerns, making blockchain-powered neobanks a promising alternative to traditional finance. This shift towards decentralization aims to create a more inclusive financial system for all.

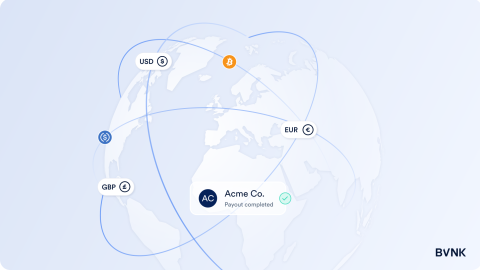

BVNK Unveils Innovative Embedded Wallet for Seamless Fiat and Stablecoin Transactions

A new embedded wallet revolutionizes digital finance by integrating fiat, crypto, and stablecoin payments, offering businesses enhanced payment options. Key features include multi-currency support (e.g., Swift, ACH, Bitcoin, Ethereum), API integration for seamless embedding into various platforms, and storage flexibility for stablecoins and fiat. The wallet also includes auto-conversion capabilities, allowing businesses to convert stablecoins to fiat easily. Simon Griffin, BVNK’s Chief Product Officer, emphasizes that stablecoins are transforming global transactions by enabling continuous payments, though challenges remain in currency conversion. This innovative wallet is essential for companies aiming to adapt to the evolving financial landscape.