Similar Posts

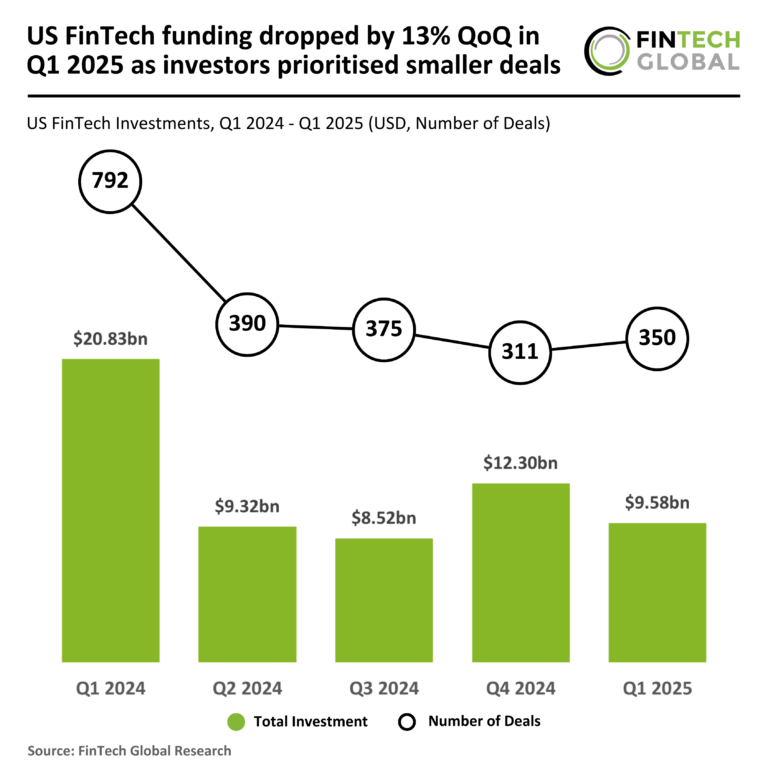

US FinTech Funding Falls 13% QoQ in Q1 2025: Investors Shift Focus to Smaller Deals

In Q1 2025, the US FinTech sector experienced a notable decline in investment activity, with a 13% drop quarter-over-quarter. Total deals fell 56% to 350, while funding decreased 54% to $9.6 billion compared to Q1 2024. Although deals increased modestly from Q4 2024, total funding dropped 22%. The average deal value also declined to $27.3 million, indicating a preference for lower-risk investments. Noteworthy transactions included Rokt’s $335 million share offering, boosting its valuation to $3.5 billion, and a planned $300 million merger with mParticle, reflecting a strategic shift in the market amid cautious investor sentiment.

SaaScada and ARIE Finance Join Forces to Revolutionize Cross-Border Payments

SaaScada has partnered with ARIE Finance to enhance international payments for mid-sized B2B businesses, particularly in Africa. This collaboration aims to streamline cross-border transactions, with ARIE Finance becoming a pioneer in acquiring a Payment Service Provider license in Mauritius. SaaScada’s cloud-native banking solutions will enable fast, secure transactions and personalized services. ARIE Finance plans to improve onboarding by customizing the process for clients, ensuring quick account setups while maintaining fraud prevention. Both companies aim to revolutionize the financial landscape by leveraging real-time data and fostering growth for underserved businesses in emerging markets.

Town Secures $18M to Transform Tax Support for Small Businesses: A Game-Changer Initiative

Town has secured $18 million in seed funding to enhance its AI-powered tax automation services for small businesses. The funding round, led by First Round Capital and supported by various investors and angel backers, aims to provide dedicated tax support to entrepreneurs facing challenges in the tax system. Town’s platform combines human expertise with AI to simplify compliance, offering features like personalized advisor support, streamlined data collection, and a flat-fee pricing model. Since its recent launch, Town has already assisted hundreds of businesses in preparing for FY 2024 taxes and has formed strategic partnerships to expand its services.

ClimeFi Launches Innovative Analyst Ratings to Transform CDR Market Decision-Making

ClimeFi has launched an innovative Analyst Rating system, advancing the Carbon Dioxide Removal (CDR) market, as reported by Clean Technica. This evaluation tool offers comprehensive insights into CDR projects, factoring in regulatory changes, scalability, and financial health, unlike traditional carbon credit ratings. ClimeFi emphasizes ongoing performance monitoring with quarterly updates and real-time data integration, enhancing transparency and standardization in the CDR market. Their detailed Rating Methodology is publicly available to build trust among stakeholders. By focusing on advanced assessments, ClimeFi aims to lead in the CDR sector, helping stakeholders make informed decisions in this evolving landscape.

Hong Kong and Abu Dhabi Join Forces to Enhance Investment Manager Regulatory Oversight

The Securities and Futures Commission (SFC) of Hong Kong and the Financial Services Regulatory Authority (FSRA) of Abu Dhabi have signed a Memorandum of Understanding (MoU) to enhance regulatory collaboration in cross-border investment management. This agreement establishes a framework for consultation, cooperation, and information exchange, focusing on collective investment scheme managers. The MoU was signed at the IOSCO annual meeting in Doha and aims to improve fund management, advisory services, and transparency. Both authorities expect it to foster market connectivity, facilitate cross-border opportunities, and strengthen investor protection, thereby reinforcing the integrity of their financial markets.