Similar Posts

Unlocking Insurance Innovation: Data-Driven Monetization Strategies for Success

The insurance industry is increasingly adopting data monetisation to enhance efficiency, improve risk assessments, and reduce costs. By leveraging data as a strategic asset, insurers can implement monetisation strategies such as refining underwriting models and selling anonymised analytics. Traditional methods have evolved, with advanced analytics now enabling accurate risk assessments and real-time pricing. Insurers are also commercialising data through services like predictive analytics. However, ethical data use and privacy compliance are crucial. Future trends include AI-driven assessments and blockchain for security, with solutions like dacadoo helping insurers optimise data while maintaining strong privacy standards.

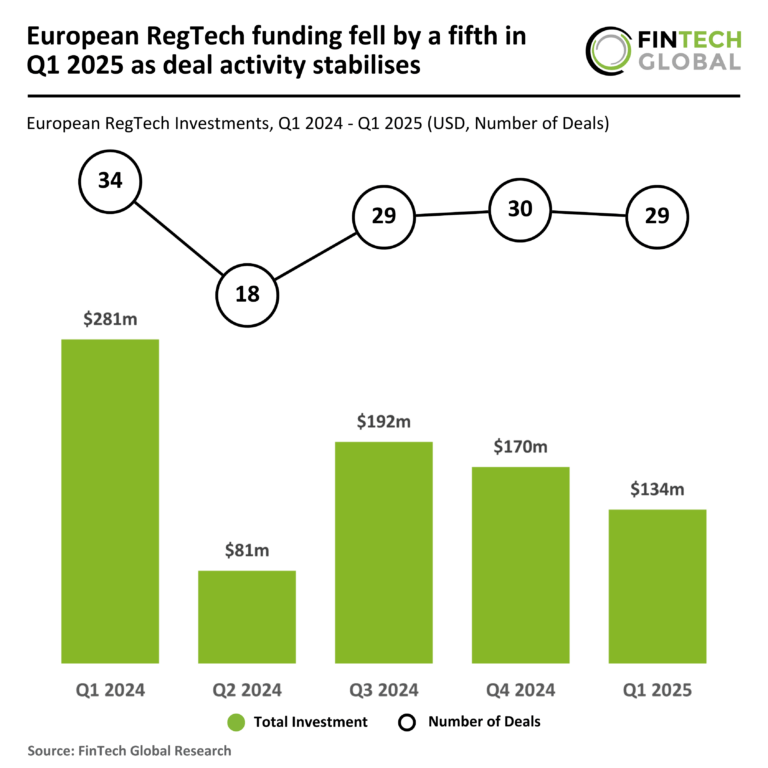

Q1 2025 Sees European RegTech Funding Dip 20% Amidst Stabilizing Deal Activity

In Q1 2025, the European RegTech sector experienced a significant decline in investment, with funding dropping 20% quarter-over-quarter to $134 million, reflecting a broader cautious investment climate. Only 29 deals were completed, a 15% decrease from the previous year, with average deal sizes falling to $4.6 million. Notably, ThreatMark secured $23 million in funding, making it one of the largest deals this quarter, driven by investors like Octopus Ventures. The company focuses on fraud prevention, crucial given the $486 billion in global fraud losses in 2023. The evolving landscape requires stakeholders to adapt to these changes.

Encova Insurance Welcomes New CIO to Drive Digital Transformation Initiatives

Encova Insurance has appointed Ramu Lingala as the new Executive Vice President and Chief Information Officer, succeeding Tony Laska, who will retire in 2025. Lingala will oversee the technology teams, ensuring optimal system performance, and will align IT initiatives with the company’s strategic objectives. President and CEO TJ Obrokta Jr. praised Laska for his significant contributions to the organization and expressed excitement about Lingala’s leadership, highlighting the potential for advancements in technology under his guidance. This leadership transition marks a key moment for Encova as they aim to enhance their service delivery and strengthen their position in the industry.

Payabl. and Sift Team Up to Revolutionize AI-Driven Fraud Prevention for European Merchants

Payabl., a prominent European FinTech, has partnered with Sift, an AI-driven fraud prevention leader, to enhance real-time fraud protection for merchants amid rising payment fraud in the European Economic Area (EEA). Fraud losses in the EEA reached €4.3 billion in 2022, with an additional €2 billion lost in early 2023. The collaboration integrates Sift’s technology into payabl.’s platform, offering automated fraud checks, reduced false positives, and improved approval rates. It also helps merchants qualify for Transaction Risk Analysis exemptions under European regulations. This partnership aims to protect merchants while facilitating secure, flexible transactions across borders.

Multiply Mortgage Raises $23.5M to Revolutionize Employee Mortgage Benefits

Multiply Mortgage is transforming homeownership by integrating mortgage benefits into employment packages. Recently, the company secured $23.5 million in Series A funding, led by Kleiner Perkins, bringing total funding to $27 million. Founded in 2022, Multiply Mortgage offers an AI-driven mortgage origination platform with expert advisors, ensuring competitive rates and personalized service. The new funding will support an initiative providing lower-rate mortgages as an employee benefit, enhancing financial wellness and making homeownership more accessible. This innovative approach aims to attract and retain talent while alleviating burdens on employers, marking a significant advancement in employee benefits.

Metro Bank Partners with Ask Silver to Launch Innovative AI Scam Detection Tool

Metro Bank has partnered with AI scam detection firm Ask Silver, becoming the UK’s first bank to implement advanced technology to combat financial fraud. This collaboration has led to the launch of the Metro Bank Scam Checker, which enables customers to verify the authenticity of communications such as emails and websites. Users can send photos or screenshots via WhatsApp, and Ask Silver’s AI will analyze them for legitimacy within minutes. The service offers instant verification, educational resources on scam tactics, real-time fraud alerts, and automatic reporting to authorities. Metro Bank emphasizes customer security and aims to enhance trust through innovative solutions.