Similar Posts

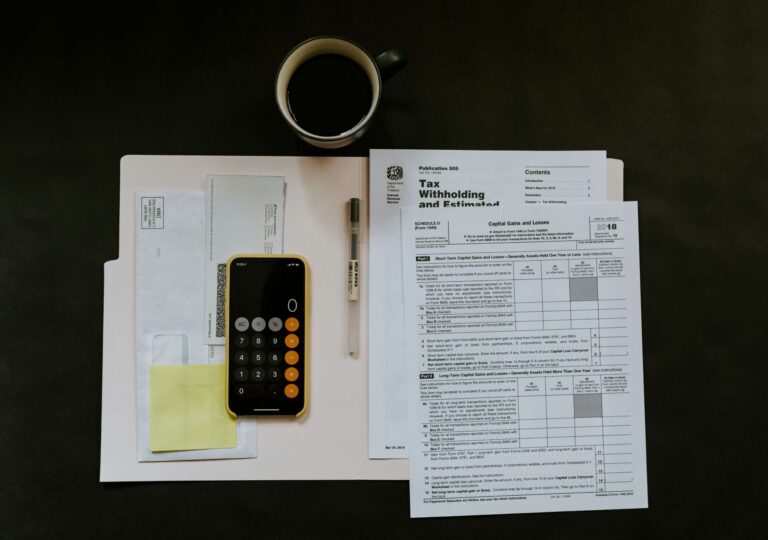

Master Tax Reporting: Ensure Accuracy with Real-Time and Bulk TIN Validation Solutions

The IRS has expanded regulations to include digital assets, designating platforms, payment processors, and wallet providers as brokers, which imposes traditional reporting obligations. To aid compliance, companies are encouraged to utilize the IRS TIN matching program for verifying Taxpayer Identification Numbers (TINs), crucial for avoiding penalties under Sections 3406 and 6721. Best practices include collecting TINs at account opening, real-time matching, and bulk matching to ensure accuracy before reporting deadlines. Although Notice 2024-56 offers some relief, it doesn’t cover all obligations, highlighting the need for diligent TIN management. Businesses are urged to stay informed and proactive in compliance efforts.

Revolutionizing Investments: SDI AOP Launches Innovative Tool for Measuring Sustainability Outcomes

The Sustainable Development Investments Asset Owner Platform (SDI AOP) has launched SDI Outcomes, a tool aimed at improving sustainability data in the investment sector. Founded by major pension asset managers in 2020, SDI AOP seeks to enhance transparency in sustainable investing. SDI Outcomes provides a comprehensive dataset at company and geographic levels, focusing on sustainability impacts, particularly in renewable energy and healthcare. It tracks metrics like avoided carbon emissions and individuals served. The tool addresses greenwashing concerns by offering consistent data, allowing investors to make informed decisions aligned with Sustainable Development Goals (SDGs).

Red Flag Alert Secures £4M Series A+ Funding to Strengthen Market Position and Drive Growth

Red Flag Alert, a Manchester-based business intelligence platform, has secured a £4 million Series A+ investment from Foresight Group and Ric Traynor, following a previous £3.5 million investment. The funding will support strategic expansion across five industries: Financial Services, Accounting, Legal, Construction/Manufacturing, and Business Utilities. The company has experienced significant growth, with its Annual Recurring Revenue (ARR) rising from £1.8 million to £5.2 million, aiming for £10 million within two years. CEO Richard West highlighted increased inquiries from enterprise clients, while Vincent Kilcoyne has been appointed Chief Product Officer to drive product development.

VanishID Secures $10M to Launch Digital CEO Protection with Innovative Agentic AI Cybersecurity Solutions

VanishID, formerly Picnic Corporation, has rebranded to enhance its position in cybersecurity, launching a $10 million funding round led by Dell Technologies Capital and notable investors. The firm introduced its innovative CEO Protection service, which protects executives and their families by removing personally identifiable information (PII) from the internet. This service includes impersonation protection and a Red Team Assessment. With rising security concerns—93% of C-Suite executives have their home addresses online—VanishID aims to provide scalable, automated solutions. CEO Matt Polak is committed to expanding their AI-driven capabilities to safeguard organizations and executives against digital threats.

CFOs Go Green: Investing in Sustainability for Future Profit Growth

The Kearney report, “Staying the Course: Chief Financial Officers and the Green Transition,” reveals a significant shift in CFOs’ investment strategies towards sustainability. Surveying 500 CFOs from the UK, US, UAE, and India, it found that 69% expect higher returns from sustainable initiatives, with 92% planning to boost sustainability investments in 2024. While 61% still view sustainability through a cost lens, 65% recognize the costs of inaction related to climate risks. CFOs are increasingly incorporating sustainability into employee retirement funds and broader investment strategies, highlighting their crucial role in corporate ESG efforts amid rising regulatory demands.

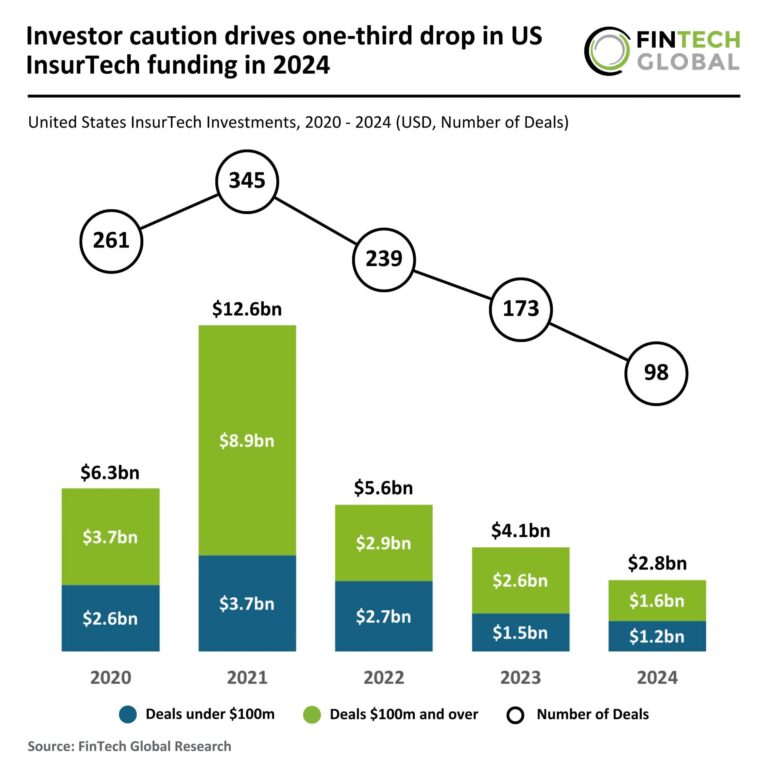

US InsurTech Funding Plummets 33% in 2024 Amid Investor Caution

In 2024, the US InsurTech sector experienced a significant decline in funding, dropping to $2.8 billion across 98 deals, a 33% decrease from 2023 and 56% from 2020. Deal activity also fell sharply, with a 43% reduction in transactions compared to the previous year. Investor caution is evident, particularly in large deals over $100 million, which decreased by 38%. Despite this, the average deal value rose to $28.1 million. Notably, Cowbell, a cyber insurance provider, secured a $60 million Series C round to enhance its AI-driven technology and expand internationally, positioning itself as a key player in the market.