Similar Posts

Klearly Secures €6M Seed Funding to Revolutionize In-Person Payment Solutions

Klearly, a company focused on enhancing in-person payment solutions, has raised €6 million in a seed funding round led by Global PayTech Ventures, with participation from Antler Elevate and notable angel investors. The funds will aid in expanding their innovative payment technology for small and medium-sized businesses (SMBs) across Europe. Klearly aims to replace outdated payment systems with data-driven solutions compatible with devices like smartphones and modern terminals. Their flagship product, Tap to Pay, allows secure transactions on everyday devices. With over 4,000 merchants onboarded and a projected 500% increase in payment volume for 2024, Klearly is poised for significant growth.

Highnote and Splitit Join Forces to Revolutionize Seamless Installment Payments in Digital Wallets

Highnote has partnered with Splitit to enhance online shopping by integrating Splitit’s installment payment solutions with digital wallets. This collaboration allows consumers to use existing credit cards without needing additional credit checks, streamlining the payment process. Key benefits include real-time payments through Highnote’s tokenized virtual card technology and easy access to installment options within digital wallets. Splitit’s CEO Nandan Sheth highlighted the partnership’s goal to provide a seamless pay-over-time experience, while Highnote’s CEO John MacIlwaine emphasized the development of modern payment solutions to improve consumer experiences. Together, they aim to transform the landscape of online payments.

Mastering AML Compliance: The Ultimate 2026 Guide for Registered Investment Advisors (RIAs)

The Financial Crimes Enforcement Network (FinCEN) has introduced a significant final rule requiring registered investment advisers (RIAs) and exempt reporting advisers (ERAs), now termed “Covered IAs,” to implement robust anti-money laundering (AML) and countering the financing of terrorism (CFT) frameworks in line with the Bank Secrecy Act (BSA). This regulation impacts around 15,000 SEC-registered RIAs and 5,800 ERAs, aiming to mitigate illicit financial activities. Covered IAs must establish AML/CFT programs, conduct customer due diligence, report suspicious transactions, and maintain records. The Securities and Exchange Commission (SEC) will oversee compliance, with full adherence required by January 1, 2026.

EcoVadis Launches Innovative Carbon Data Network for Enhanced Scope 3 Emission Tracking

EcoVadis has launched its Carbon Data Network, a groundbreaking platform aimed at improving how businesses collect and share carbon data from suppliers, crucial for meeting net-zero goals. This network streamlines the collection of greenhouse gas emissions data, particularly for challenging Scope 3 indirect emissions. Supported by the Carbon Action Manager, it includes a database from over 150,000 organizations and tools for enhanced carbon management. Collaborating with partners like Sweep and Normative, EcoVadis emphasizes the importance of reliable data in achieving sustainability targets. This initiative empowers businesses to make informed decisions and accelerates their decarbonization efforts.

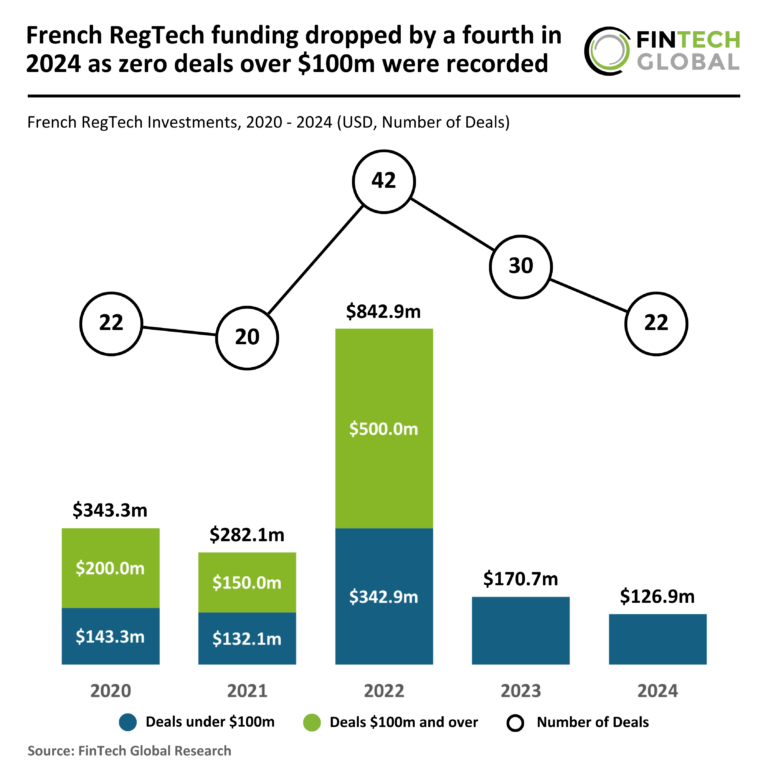

2024 Sees 25% Decline in French RegTech Funding: No Deals Exceeding $100M

In 2024, French RegTech investments have faced a significant downturn, with total funding dropping to $127 million, a 26% decline from 2023 and 63% from 2020. While deal volume remained stable at 22, the average deal size slightly increased to $5.8 million, yet still far below the $15.6 million average seen in 2020. Investors are focusing on lower-risk, smaller deals amid economic uncertainties. A notable exception is Dotfile, an AI-driven compliance automation firm, which raised $6.7 million to enhance its compliance platform and expand internationally, positioning itself as a leader in the RegTech market.

authID Partners with TechDemocracy for Seamless and Secure Access Solutions

authID has partnered with TechDemocracy to enhance passwordless authentication in enterprises through advanced biometric solutions. This collaboration will certify 25 professionals to implement authID’s tools, including Proof and PrivacyKey™, which feature one-in-a-billion false match rates and ensure data privacy by not storing biometric data. The partnership aims to provide secure, frictionless access for enterprises and includes the development of QuickStart accelerators for smoother integration. Both companies will promote knowledge on biometric authentication through white papers, webinars, and workshops, with TechDemocracy’s leadership expressing excitement about expanding their security offerings.