Similar Posts

Jscrambler Secures $5.2M Funding to Enhance Client-Side Security Innovations

Jscrambler, a leader in client-side protection, has secured a $5.2 million investment from Iberis Capital, reflecting strong investor confidence in its security solutions amid rising cyber threats. The funds will enhance Jscrambler’s application security capabilities, focusing on real-time monitoring of JavaScript and protection against digital skimming, while aiding companies in achieving PCI DSS v4 compliance before the March 31, 2025 deadline. Despite the urgency highlighted in a recent report, only 36% of businesses have adopted necessary protections. Jscrambler aims to meet the growing demand for robust digital security, supported by its experienced leadership and previous funding rounds.

Visa and Extend Revolutionize B2B Payments with Strategic New Referral Agreement

Extend, a leading platform for virtual cards and spend management, has partnered with Visa to enhance B2B payment solutions for middle-market businesses. This collaboration aims to empower these companies by providing advanced virtual card technology, improving financial transaction control, and automating processes like vendor payments and expense reconciliation. As global virtual card spending is projected to surge to nearly $14 trillion by 2028, this partnership will allow Visa’s issuing banks to offer Extend’s capabilities to their clients. Extend CEO Andrew Jamison highlighted the importance of this relationship in delivering effective payment solutions without disrupting existing banking preferences.

Telr and Bank AlJazira Join Forces to Revolutionize Digital Payments in Saudi Arabia

Telr has partnered with Bank AlJazira to support Saudi Arabia’s Vision 2030 initiative, promoting a cashless economy. This collaboration aims to enhance transaction efficiency by offering merchants and customers faster payments, advanced fraud protection, and a seamless checkout experience. Key features include payment links, recurring payments, e-invoicing, and Buy Now, Pay Later options. Founded in 2014, Telr specializes in secure payment solutions across the Middle East, while Bank AlJazira provides a range of banking services in Saudi Arabia. This partnership is expected to boost e-commerce growth and customer trust in digital transactions, transforming the payment landscape in the Kingdom.

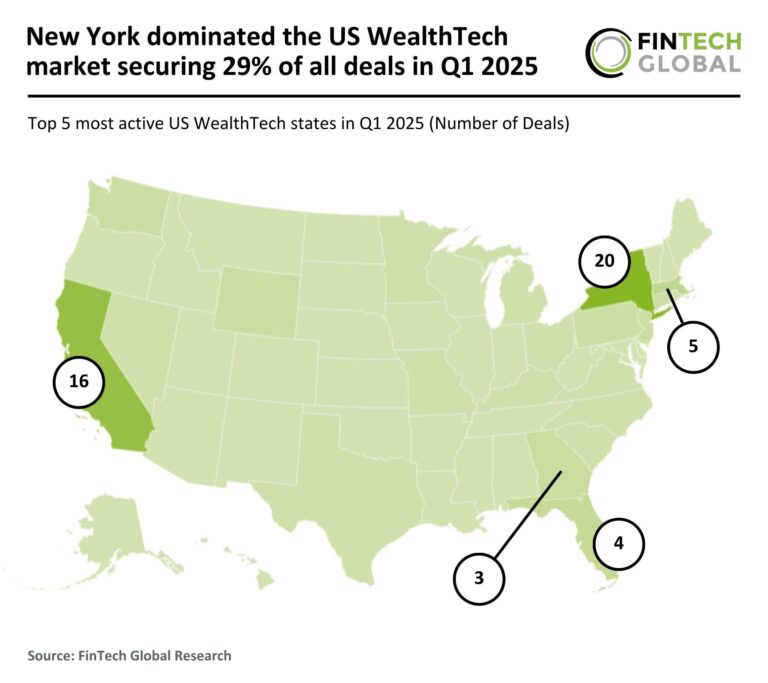

New York Leads US WealthTech Sector with 29% of Q1 2025 Deal Flow

In Q1 2025, the US WealthTech sector experienced a significant investment downturn, with deal activity falling by 71% to 68 deals and funding plummeting 76% to $1 billion compared to the previous year. New York led with 29% of deals, followed by California at 24%. Taktile, a key player in WealthTech, raised $54 million in Series B funding, bringing its total to $79 million. The platform assists financial institutions in AI-driven risk decisioning, achieving 3.5x growth in annual recurring revenue in 2024. This reflects a cautious investor sentiment amidst a broader FinTech slowdown.

MuchBetter Unveils Prepaid Corporate Mastercard: Revolutionizing Business Expense Management

MuchBetter has launched the MuchBetter Prepaid Corporate Mastercard, aimed at improving corporate expense management for scaleups, FinTechs, and global enterprises. This initiative enhances their B2B services and marks a shift towards comprehensive financial solutions. Key features include instant virtual cards, customizable controls, real-time tracking via a mobile app, and seamless integration with accounting systems. The card integrates with MuchBetter Business’s Accounts banking platform, offering multi-currency accounts with lower fees. A partnership with Living Sky, a white-label platform, will leverage the Corporate Card for premium banking services. MuchBetter aims to provide a consumer-grade experience in business banking.

Revolutionizing Open Banking Compliance in Australia: Ozone API and ProductCloud Join Forces

Ozone API, a UK FinTech leader in open banking technology, has partnered with Australia’s ProductCloud to enhance financial product information management and simplify compliance with Australia’s Consumer Data Right (CDR) regulations. This collaboration comes amidst recent CDR updates aimed at improving data-sharing capabilities and reducing compliance complexities for financial institutions. Ozone API’s platform will enable banks to deliver compliant APIs efficiently, while ProductCloud ensures adherence to CDR and regulatory standards. Both companies’ leaders express excitement about combining their expertise to provide a swift and cost-effective solution for open banking compliance, allowing organizations to focus on their core operations.