Similar Posts

Intuit Expands Financial Solutions with Acquisition of Deserve’s Innovative Mobile-First Credit Card Platform

Intuit has acquired Deserve, a mobile-first technology platform, to enhance its financial service offerings and strengthen its competitive position in the fintech industry. The acquisition, finalized on April 18, has led to the integration of Deserve’s Palo Alto employees into Intuit’s Mountain View team, while operations in Pune, India, will continue as is. Deserve, founded in 2013, specializes in cloud-native credit card solutions for various financial entities. Intuit’s Senior VP of Fintech, James Barrese, and Deserve’s CEO, Kalpesh Kapadia, expressed excitement about the merger, emphasizing its potential to revolutionize money management and enhance customer experiences.

Ekuinas Boosts Malaysia’s Cybersecurity Resilience with Strategic Investment in Bluesify

Ekuiti Nasional Berhad (Ekuinas) has invested in Bluesify Solutions, a leading Malaysian Managed Security Service Provider, to bolster the country’s cybersecurity amid increasing digital threats. Founded in 2012, Bluesify offers a range of services, including 24/7 managed cyber detection and response, threat intelligence, and incident response for various sectors like finance, energy, and healthcare. Ekuinas CEO highlighted the urgent need for this investment to strengthen Malaysia’s cybersecurity landscape and expand Bluesify’s capabilities. The company aims to grow regionally, capitalizing on the Southeast Asian cybersecurity market, expected to reach US$7.1 billion by 2029, while delivering advanced AI-driven solutions.

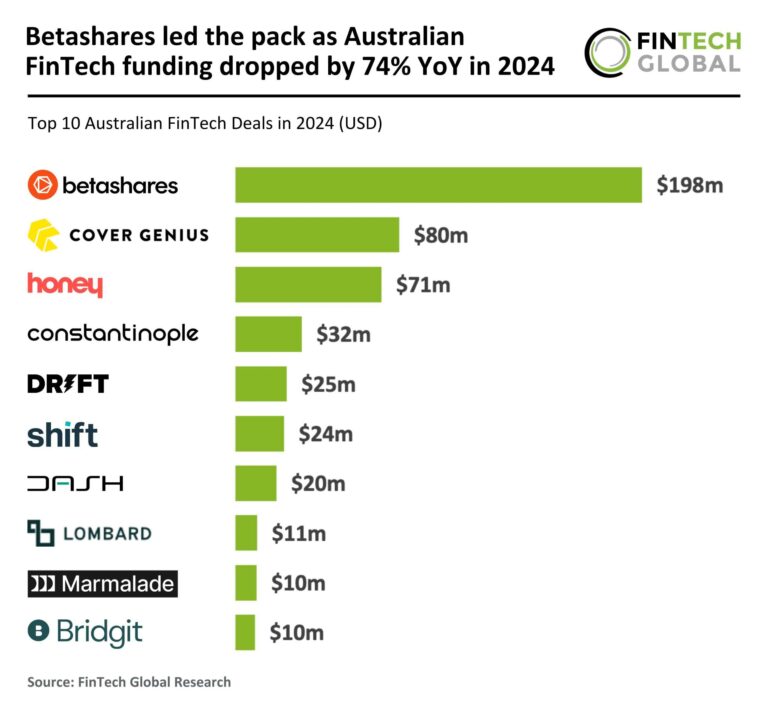

Betashares Tops Australian FinTech Scene Despite 74% Year-Over-Year Funding Decline in 2024

In 2024, the Australian FinTech landscape experienced a significant investment decline, with funding plummeting 74% to $891 million from $3.5 billion in 2023. Deal activity also fell sharply, with only 57 deals recorded, a 66% drop from the previous year. Investors are becoming more selective, focusing on sustainable growth, as reflected in the decreased average deal size of $15.6 million. Notably, Betashares secured the largest deal of the year with a $198 million investment from Temasek. As the market adjusts, FinTech firms must prioritize transparency and cost-effectiveness to attract investment and create long-term value.

Temenos Launches Cutting-Edge Innovation Hub in Central Florida: A New Era for Financial Technology

Temenos, a Swiss banking technology firm, has launched a new Innovation Hub in Central Florida to better support US clients and advance banking solutions, particularly through GenAI integration. The hub aims to recruit around 200 technology and product developers, focusing on R&D for the US market. It will serve as a collaborative space for financial institutions to access emerging technologies and work with Temenos experts. CEO Jean-Pierre Brulard highlighted this investment as part of their commitment to the US market. Collaborating with the Orlando Economic Partnership, Temenos seeks to strengthen local ties and tap into the region’s growing tech talent.

Alinea Invest Secures $10.4 Million to Fuel Gen Z’s Investing Revolution

Alinea Invest, a New York-based fintech startup founded in 2021, has raised $10.4 million in Series A funding to enhance its investing app for Gen Z users. The platform has rapidly grown to over one million users, with 92% being women and 70% from Gen Z. Alinea has achieved a six-fold revenue increase, reaching a run rate of $6 million. The new funding will support the launch of AI Allie, a personal finance coach that helps users make informed investment decisions. The round was led by Play Ventures and aims to empower younger investors, addressing a significant generational wealth transfer.

Affiniti Secures $17M Series A Funding to Enhance Fintech Solutions for Small Businesses

Affiniti, a New York-based fintech startup, has raised $17 million in a Series A funding round led by Signal Fire, following a $11 million seed round just six months prior. The funding attracted notable investors, including Contrarian Thinking Capital and Yahya Mokhtarzada. Affiniti specializes in expense management software for small businesses, offering features like customizable cashback credit cards and QuickBooks integration. Co-founders Aaron Bai and Sahil Phadnis, both UC Berkeley students, aim to enhance their services with new capital and tap into a growing market, having already served 1,800 customers and processing $20 million monthly in transactions.