Similar Posts

Turbine Secures $121M Investment to Revolutionize Liquidity for Private Equity Investors

Turbine Finance has secured $13 million in Series A funding, co-led by Alpha Edison and TTV Capital, bringing its total funding to $121.75 million, including a $100 million warehouse facility with Silicon Valley Bank. As a liquidity platform that utilizes data science, Turbine aims to unlock capital in the $13 trillion private equity market, offering venture investors essential credit facilities. The new funds will help the company deploy its warehouse line and expand its data science team, enhancing insights for seasoned fund managers. CEO Mike Hurst highlighted the importance of liquidity in boosting investments in high-performance funds.

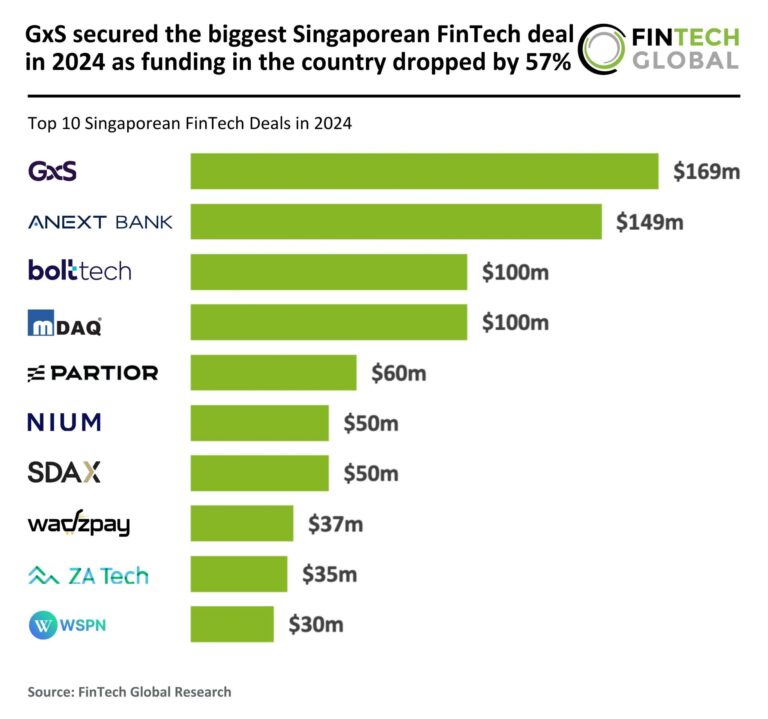

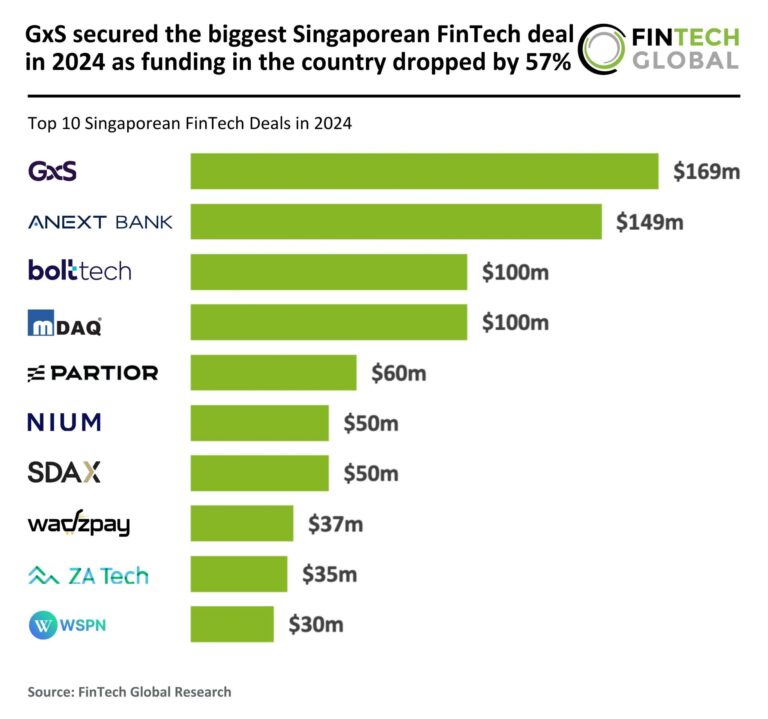

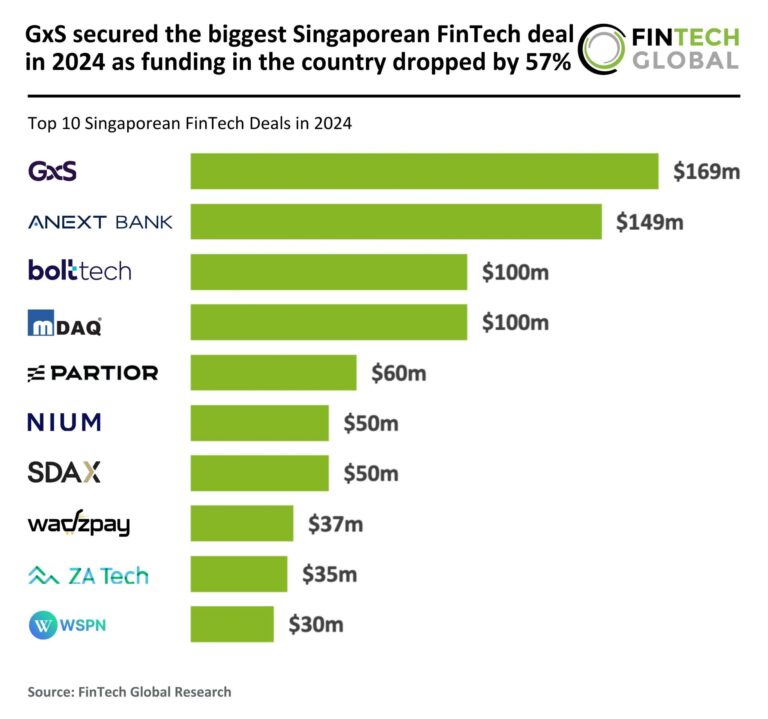

GxS Clinches Major Singapore FinTech Deal in 2024 Amidst 57% Drop in National Funding

In 2024, Singapore’s FinTech sector faced a significant downturn, experiencing a 57% drop in funding, with total investments falling to $1.7 billion from $4 billion in 2023. Deal activity also decreased sharply, with 116 deals recorded, down from 221. This shift reflects a cautious investment climate driven by economic uncertainties and regulatory challenges. Investors are now prioritizing sustainable growth over aggressive expansion. Despite the overall decline, GXS Bank secured the largest deal of the year at $169.1 million, aimed at enhancing its FlexiLoan product for underserved customers. Stakeholders must adapt strategies to navigate this evolving landscape.

Unlocking Regulatory Compliance in FinTech: How AI is Transforming the Industry

The financial sector is undergoing a significant transformation due to artificial intelligence (AI), particularly in regulatory compliance. The EU AI Act aims to enhance security, protect rights, and establish accountability, impacting banks and service providers globally. RegTech solutions leveraging AI improve efficiency by enabling real-time monitoring of regulatory changes, thus reducing non-compliance risks. Technologies like Machine Learning, Natural Language Processing, and Generative AI enhance compliance practices by automating data interpretation and summarization. However, human oversight remains essential for tailoring compliance strategies. Embracing AI helps streamline processes and ensures timely updates, benefiting organizations navigating the evolving regulatory landscape.

DryRun Security Secures $8.7M Funding to Revolutionize Application Security with User-Friendly Code Policies

DryRun Security, an AI-driven enterprise focused on enhancing application security, has raised $8.7 million in seed funding led by LiveOak Ventures and Work-Bench. The company introduces a unique Contextual Security Analysis (CSA) that provides near real-time security assessments for modern applications, benefiting DevOps practices by reducing developer friction and promoting collaboration between security and development teams. With the new funding, DryRun plans to expand its engineering team, improve Go-To-Market strategies, and develop Natural Language Code Policies (NLCP) for easier security policy management. This innovative approach aims to integrate security seamlessly into developers’ workflows, identifying risks early in the software lifecycle.

TransFICC Secures $25M to Revolutionize Fixed Income Market Connectivity

TransFICC, a leader in low-latency connectivity for Fixed Income and Derivatives markets, has secured a $25 million Series B investment, boosting its total funding to $50 million. Led by Citadel Securities, the round included contributions from BlackFin Tech and other investors like Citi and HSBC. The funds will enhance TransFICC’s product offerings and market presence, including the launch of TransACT, an Automated Customer Trading platform now expanding to Government Bonds and IRS. The company is also advancing its technological infrastructure across North America, Europe, and Asia to improve latency and support for clients in electronic trading.

Turbine Secures $121M Investment to Revolutionize Liquidity for Private Equity Investors

Turbine Finance has secured $13 million in Series A funding, co-led by Alpha Edison and TTV Capital, bringing its total funding to $121.75 million, including a $100 million warehouse facility with Silicon Valley Bank. As a liquidity platform that utilizes data science, Turbine aims to unlock capital in the $13 trillion private equity market, offering venture investors essential credit facilities. The new funds will help the company deploy its warehouse line and expand its data science team, enhancing insights for seasoned fund managers. CEO Mike Hurst highlighted the importance of liquidity in boosting investments in high-performance funds.

GxS Clinches Major Singapore FinTech Deal in 2024 Amidst 57% Drop in National Funding

In 2024, Singapore’s FinTech sector faced a significant downturn, experiencing a 57% drop in funding, with total investments falling to $1.7 billion from $4 billion in 2023. Deal activity also decreased sharply, with 116 deals recorded, down from 221. This shift reflects a cautious investment climate driven by economic uncertainties and regulatory challenges. Investors are now prioritizing sustainable growth over aggressive expansion. Despite the overall decline, GXS Bank secured the largest deal of the year at $169.1 million, aimed at enhancing its FlexiLoan product for underserved customers. Stakeholders must adapt strategies to navigate this evolving landscape.

Unlocking Regulatory Compliance in FinTech: How AI is Transforming the Industry

The financial sector is undergoing a significant transformation due to artificial intelligence (AI), particularly in regulatory compliance. The EU AI Act aims to enhance security, protect rights, and establish accountability, impacting banks and service providers globally. RegTech solutions leveraging AI improve efficiency by enabling real-time monitoring of regulatory changes, thus reducing non-compliance risks. Technologies like Machine Learning, Natural Language Processing, and Generative AI enhance compliance practices by automating data interpretation and summarization. However, human oversight remains essential for tailoring compliance strategies. Embracing AI helps streamline processes and ensures timely updates, benefiting organizations navigating the evolving regulatory landscape.

DryRun Security Secures $8.7M Funding to Revolutionize Application Security with User-Friendly Code Policies

DryRun Security, an AI-driven enterprise focused on enhancing application security, has raised $8.7 million in seed funding led by LiveOak Ventures and Work-Bench. The company introduces a unique Contextual Security Analysis (CSA) that provides near real-time security assessments for modern applications, benefiting DevOps practices by reducing developer friction and promoting collaboration between security and development teams. With the new funding, DryRun plans to expand its engineering team, improve Go-To-Market strategies, and develop Natural Language Code Policies (NLCP) for easier security policy management. This innovative approach aims to integrate security seamlessly into developers’ workflows, identifying risks early in the software lifecycle.

TransFICC Secures $25M to Revolutionize Fixed Income Market Connectivity

TransFICC, a leader in low-latency connectivity for Fixed Income and Derivatives markets, has secured a $25 million Series B investment, boosting its total funding to $50 million. Led by Citadel Securities, the round included contributions from BlackFin Tech and other investors like Citi and HSBC. The funds will enhance TransFICC’s product offerings and market presence, including the launch of TransACT, an Automated Customer Trading platform now expanding to Government Bonds and IRS. The company is also advancing its technological infrastructure across North America, Europe, and Asia to improve latency and support for clients in electronic trading.

Turbine Secures $121M Investment to Revolutionize Liquidity for Private Equity Investors

Turbine Finance has secured $13 million in Series A funding, co-led by Alpha Edison and TTV Capital, bringing its total funding to $121.75 million, including a $100 million warehouse facility with Silicon Valley Bank. As a liquidity platform that utilizes data science, Turbine aims to unlock capital in the $13 trillion private equity market, offering venture investors essential credit facilities. The new funds will help the company deploy its warehouse line and expand its data science team, enhancing insights for seasoned fund managers. CEO Mike Hurst highlighted the importance of liquidity in boosting investments in high-performance funds.

GxS Clinches Major Singapore FinTech Deal in 2024 Amidst 57% Drop in National Funding

In 2024, Singapore’s FinTech sector faced a significant downturn, experiencing a 57% drop in funding, with total investments falling to $1.7 billion from $4 billion in 2023. Deal activity also decreased sharply, with 116 deals recorded, down from 221. This shift reflects a cautious investment climate driven by economic uncertainties and regulatory challenges. Investors are now prioritizing sustainable growth over aggressive expansion. Despite the overall decline, GXS Bank secured the largest deal of the year at $169.1 million, aimed at enhancing its FlexiLoan product for underserved customers. Stakeholders must adapt strategies to navigate this evolving landscape.