Similar Posts

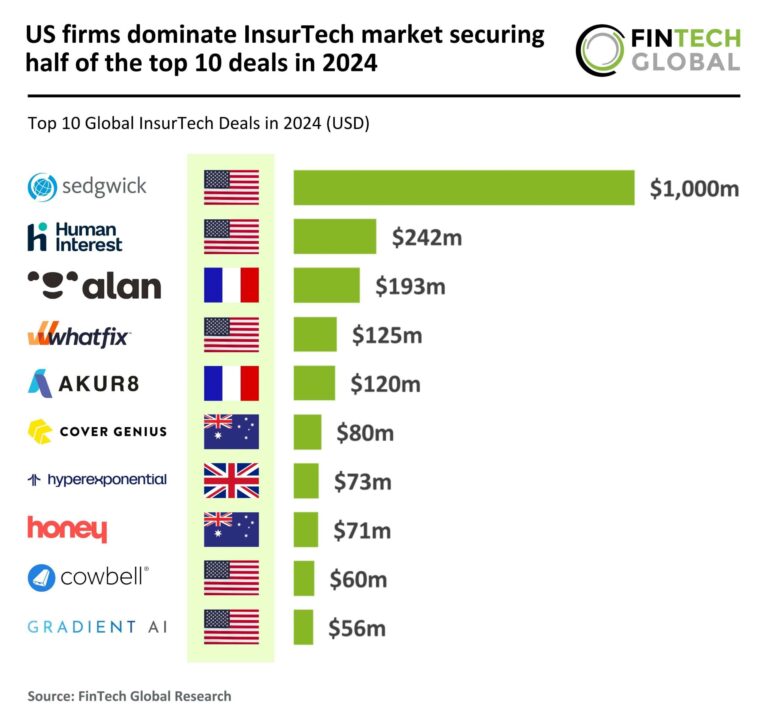

US InsurTech Powerhouses Lead the Market: Securing 50% of Top 10 Deals in 2024

In 2024, the InsurTech market faced a significant funding decline, with global investments dropping 35% year-over-year to $5 billion, and deal count plummeting to 206 from 609 in 2020. U.S. firms led the sector with five of the top ten funding deals, while Australia and France secured two each. The UK saw a decrease, and emerging markets like Singapore and India were absent from the top rankings. Notably, French InsurTech Alan raised $193 million in Series F funding, expanding its health insurance offerings and enhancing its position in the market, particularly through partnerships with Belfius Bank.

Hitachi Payment Services Partners with Spydra to Revolutionize CBDC and Web 3.0 Payment Solutions

Hitachi Payment Services has announced a minority investment in Spydra Technologies to enhance its payment infrastructure with blockchain solutions, improving transaction efficiency, security, and fraud prevention. This collaboration, part of the Hitachi Payments Accelerator (HPX) Program, aims to revolutionize payment capabilities, including cross-border transactions and real-time settlements. Spydra Technologies specializes in scalable blockchain solutions, focusing on real-world asset tokenization and customizable financial products. Industry leaders see this partnership as a significant step towards advancing digital payment innovation and fostering financial inclusion. The HPX Program supports various FinTech innovations, from embedded finance to AI and Web 3.0 technologies.

Macquarie Exits Net-Zero Banking Alliance: A Strategic Shift Towards Sustainable Finance

Macquarie Group’s recent withdrawal from the Net-Zero Banking Alliance (NZBA) marks a significant shift in its climate strategy, despite its ongoing commitment to achieving net-zero emissions by 2050. The exit, which affects key sectors such as oil, gas, and coal, comes amid increasing political scrutiny, particularly in the U.S., where ESG alliances face criticism. Macquarie remains involved in the Glasgow Financial Alliance for Net Zero, indicating a strategic realignment rather than a retreat from climate goals. This move reflects broader trends in the financial sector, as institutions adapt to regulatory demands and client needs.

Navigating Cybersecurity: The Impact of Africa’s Digital Transformation on Emerging Threats

The cybersecurity landscape in Africa is undergoing significant change, as highlighted by KnowBe4 AFRICA’s annual survey revealing that 58% of participants are “very concerned” about cybercrime, nearly double from two years ago. This anxiety is largely driven by fears of online fraud and financial losses, with South Africa alone losing $3 billion to digital crime last year. The survey, conducted across seven African nations, noted increased mobile banking use and a rise in complacency regarding personal data security. Experts stress the importance of cybersecurity education and robust practices to combat the evolving threats posed by digital financial services and AI-driven cybercrime.

Kai-Christian Nerger Takes Charge of JP Morgan’s Green Banking Strategy in Europe

JP Morgan has appointed Kai-Christian Nerger as the new head of green economy banking for Europe, emphasizing its commitment to green finance amid global climate challenges. In this role, Nerger will assist European clients in transitioning to renewable energy and sustainable technologies, reflecting the bank’s efforts to enhance its green finance initiatives. With over a decade of experience at JP Morgan, Nerger has a strong background in the energy sector and client engagement. Despite earlier withdrawals from climate alliances, the bank has pledged $1 trillion for climate-related financing, reaffirming its dedication to supporting global energy transitions and sustainable investments.

Standard Chartered and Engie Launch Innovative Carbon Market Platform to Drive Sustainability

Standard Chartered has collaborated with Engie Group to launch Qatalyst, a due diligence platform tailored for carbon finance markets. Developed by SC Ventures, Qatalyst aims to streamline the identification and oversight of carbon abatement projects, promoting sustainable investment practices. Key features include an enterprise-grade solution for project assessment, advanced technology for data-driven decisions, improved investment workflow, and AI-enabled verification of project credibility. Emphasizing ethical practices, Qatalyst involves indigenous communities in project consent processes. Leaders Poyan Rajamand and Harald Eltvedt highlight the platform’s commitment to transparency and sound investments in carbon credit projects.