Similar Posts

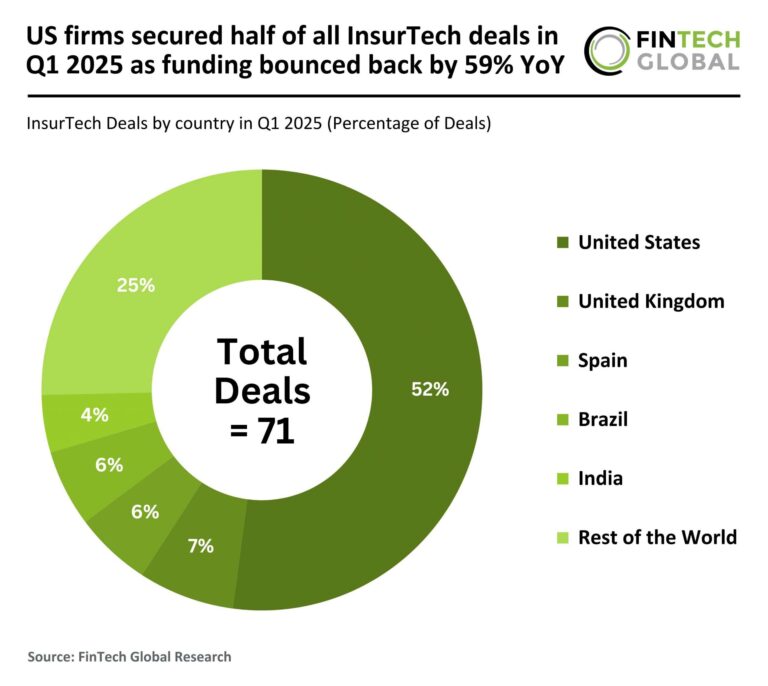

US Firms Dominate InsurTech Landscape: 50% of Q1 2025 Deals as Funding Surges 59% Year-Over-Year!

In Q1 2025, global InsurTech funding surged by 59% year-over-year, reaching $1.1 billion, despite a 22% drop in deal volume to 71 transactions. This shift indicates investors are now favoring fewer, high-value opportunities, signaling renewed confidence in the sector. The US dominated the market, accounting for 52% of deals, while the UK, Spain, and Brazil followed. Notably, High Definition Vehicle Insurance (HDVI) secured $40 million in funding to enhance its telematics-based offerings, achieving a 107% annual growth rate since its 2021 launch and maintaining a low loss ratio, positioning itself to innovate commercial auto insurance.

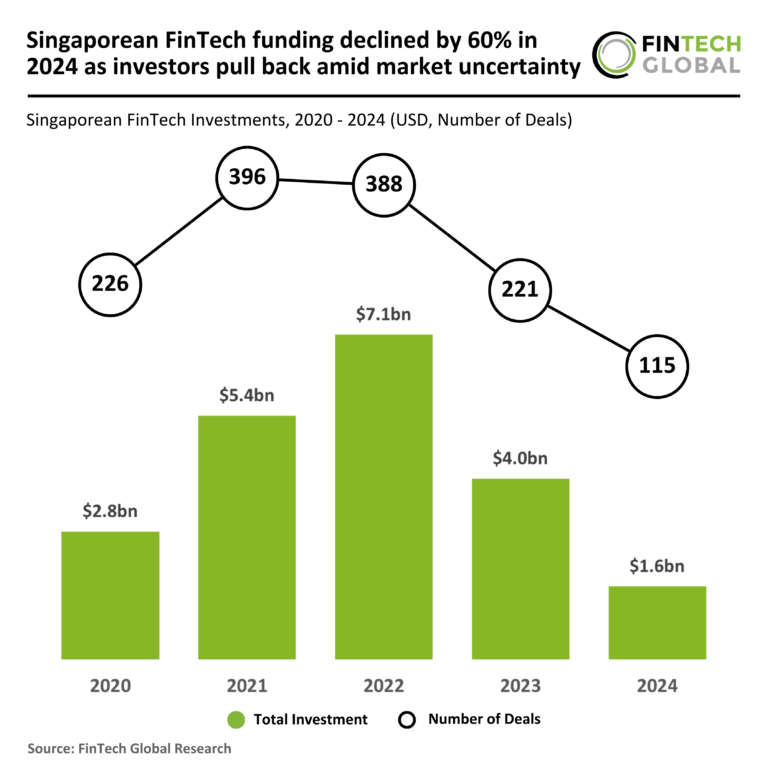

Singaporean FinTech Funding Plummets 60% in 2024: Investors Retreat Amid Market Uncertainty

In 2024, Singapore’s FinTech sector experienced a dramatic 60% drop in investment, totaling around $1.6 billion, with only 115 deals made—down 48% from 2023. This downturn reflects growing economic uncertainties leading to cautious investor sentiment. Despite the overall decline, the average deal value increased to $14 million, highlighting a shift towards larger investments. Notably, SDAX, a digital assets exchange, secured the largest FinTech deal with $50 million in Series B2 funding, positioning itself for growth through client acquisition and new business lines. The funding decline underscores significant challenges in the industry as companies adapt to a changing landscape.

Blackwall Raises €45M in Series B Funding to Boost Cybersecurity for SMBs

Blackwall has secured €45 million in Series B funding, primarily to expand operations and workforce, with a focus on the U.S. and Asia-Pacific markets. Led by Dawn Capital, the investment will allow Blackwall to double its staff, accelerate international growth, and enhance global partnerships. The company aims to protect web ecosystems from malicious automated threats, crucial for the 43% of cyberattacks targeting small and medium-sized businesses (SMBs). Blackwall’s flagship product, GateKeeper, offers advanced bot detection and significantly boosts security and performance for hosting providers. The funding supports Blackwall’s mission to innovate and safeguard SMBs against rising digital threats.

Neva Sgr Fuels Phosphorus Cybersecurity’s Growth with Major New Funding Round

Phosphorus Cybersecurity, focused on cybersecurity and device management for the extended Internet of Things (xIoT), has received significant investment from Neva Sgr, the venture capital arm of Italy’s Intesa Sanpaolo Group, through the Neva II Fund. While the investment amount remains undisclosed, it aims to automate security tasks like password updates and firmware patches, enhancing protection against cyberattacks. The funding will also support Phosphorus’s expansion into Italy, leveraging Intesa Sanpaolo’s network. CEO Chris Rouland highlighted the company’s innovative technology, which currently secures interactions with over 1 million device models, driving international growth.