Similar Posts

Pixee Secures $15M in Funding to Revolutionize Application Security with AI-Powered Code Remediation

Pixee, a U.S.-based application security firm, has secured $15 million in seed funding to enhance its AI-driven code remediation platform aimed at automating security processes for developers. Co-led by Decibel and Wing VC, with support from TEDCO and strategic angels including early GitHub engineer Zach Holman, the funding will accelerate product development and expand Pixee’s market efforts. The platform automates application security, improving developer efficiency with reported gains of 91% in remediation time reclaimed and 74% in triage time. CEO Surag Patel emphasized empowering security teams to enhance productivity and expedite secure code delivery.

Pineapple Financial Secures $1.5M in Public Offering: A Major Boost for Canadian Mortgage Tech Innovation

Pineapple Financial, a Canadian mortgage technology and brokerage firm, has announced a public offering valued at $1.5 million, featuring 10 million units priced at $0.15 each. Each unit comprises one common share and a warrant for an additional share. This initiative aims to enhance the company’s operational capabilities and market reach. D. Boral Capital is the exclusive placement agent, with legal support from Sichenzia Ross Ference Carmel LLP and Lucosky Brookman LLP. Known for its innovative technology solutions, Pineapple Financial offers tools like marketing automation and analytics to improve the mortgage process and client engagement.

Mastercard Launches TRACE in the Philippines: Revolutionizing Real-Time Payments to Combat Money Laundering

Mastercard has launched its AI-driven financial crime detection solution, TRACE, in the Philippines, enhancing the security of real-time payment (RTP) networks. In collaboration with BancNet, TRACE becomes the second implementation globally, following the UK. As demand for RTP transactions grows, the system combats money laundering and fraud by analyzing transactions across the payments network. TRACE provides real-time alerts to banks and integrates with 36 domestic banks, aligning with the Philippines’ new Anti-Financial Account Scamming Act. This initiative reflects Mastercard’s commitment to safeguarding digital payments and combating evolving financial crime tactics in the Asia Pacific region.

Novata Launches Cutting-Edge ESG Due Diligence Platform for Private Market Investors

Novata has launched a new ESG Due Diligence solution aimed at improving sustainability assessments in private market investments. This innovative platform addresses inefficiencies in traditional diligence workflows by centralizing the collection, management, and reporting of sustainability data. Key features include secure data access, real-time benchmarking, and collaborative workflows that connect pre-investment assessments with ongoing portfolio monitoring. By simplifying the ESG diligence process, Novata enables investors to identify risks and opportunities efficiently, ultimately aligning sustainability with financial outcomes. The solution is designed to enhance ESG practices, contributing to more sustainable investment strategies.

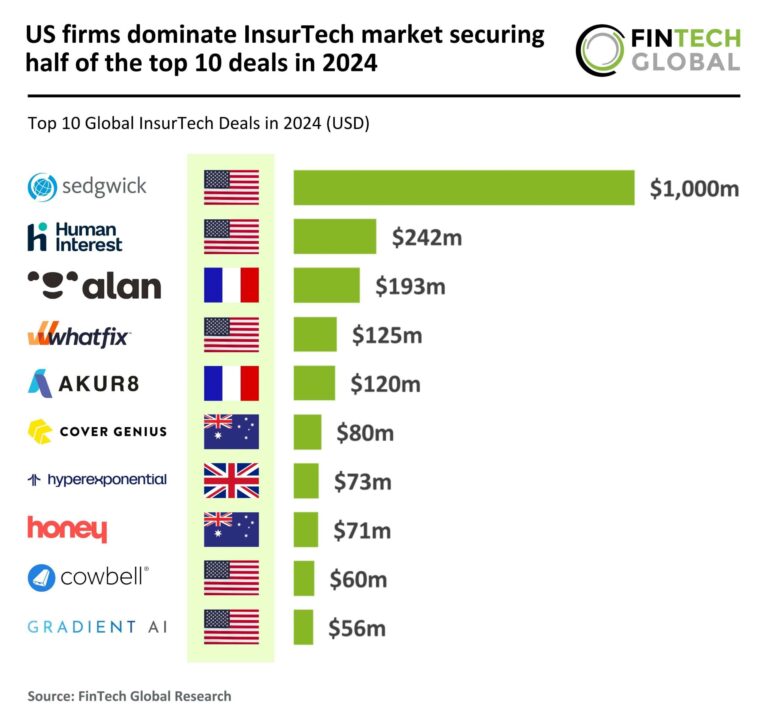

US InsurTech Powerhouses Lead the Market: Securing 50% of Top 10 Deals in 2024

In 2024, the InsurTech market faced a significant funding decline, with global investments dropping 35% year-over-year to $5 billion, and deal count plummeting to 206 from 609 in 2020. U.S. firms led the sector with five of the top ten funding deals, while Australia and France secured two each. The UK saw a decrease, and emerging markets like Singapore and India were absent from the top rankings. Notably, French InsurTech Alan raised $193 million in Series F funding, expanding its health insurance offerings and enhancing its position in the market, particularly through partnerships with Belfius Bank.

Dodo Payments Raises $1.1M Pre-Seed Funding to Revolutionize Global Transaction Simplicity

Dodo Payments, an innovative cross-border payment platform targeting emerging markets, has raised $1.1 million in pre-seed funding to enhance its global payment infrastructure. The funding round was led by Antler, 9Unicorns, and Venture Catalysts, with support from notable angel investors. Dodo Payments aims to simplify global transactions by offering various payment methods and effective compliance and fraud protection. With the new funds, the company plans to accelerate product development, expand into over 30 new markets, and enhance security measures, with a goal of supporting 100 currencies and 300 local payment methods by 2025. Currently, it has onboarded over 1,000 merchants.