Similar Posts

Valarian Secures $20M Seed Funding to Revolutionize Cybersecurity Solutions

Valarian, a cybersecurity firm specializing in enforced isolation and secure infrastructure through its ACRA platform, has emerged from stealth mode with $20 million in seed funding, including a recent $7 million investment co-led by Scout Ventures and Artis Ventures. Founded by military and finance professionals, Valarian aims to enhance technology for high-trust environments. The newly launched Valarian Defence targets governments in high-risk scenarios, offering government-grade infrastructure. With plans to expand partnerships and innovate deployment models, the leadership team, including CEO Max Buchan and COO Josh McLaughlin, emphasizes the importance of ACRA in addressing modern cybersecurity challenges.

Etops Expands Digital Financial Planning Solutions with Strategic Acquisition of Finanzportal24

Etops, a leading WealthTech provider in Europe, has acquired Finanzportal24, a prominent German software company specializing in financial planning tools. This strategic acquisition aims to bolster Etops’ presence in the digital wealth advisory sector, enhancing services for independent financial advisors and institutions. Established in 2002, Finanzportal24 serves over 4,500 users with its advanced solutions and will maintain operational independence post-acquisition. The move aligns with Etops’ goal to enhance its integrated offerings and drive digital transformation in financial advisory. Leadership from both companies expressed optimism about the partnership’s potential to expand capabilities and market reach in the WealthTech landscape.

Demystifying KYC and AML: Key Differences and Their Importance in Financial Security

In finance, Know Your Customer (KYC) and Anti-Money Laundering (AML) are critical for businesses in regulated sectors, each serving distinct roles. KYC focuses on verifying customer identities through personal information and document validation, while AML encompasses broader regulations to prevent money laundering and terrorism financing, involving customer screening and transaction monitoring. KYC aids in mitigating risks like identity theft, whereas AML integrates Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) for high-risk profiles. With increasing regulatory scrutiny, technology enhances these processes, offering automation and streamlined compliance solutions. Understanding both concepts is essential for maintaining compliance and operational efficiency.

Riverse Secures €5M Funding to Accelerate Engineered Climate Solutions through Innovative Carbon Credit Platform

Riverse, a carbon crediting platform focused on engineered climate solutions, has raised €5 million in a successful seed funding round to enhance its operations in the voluntary carbon market. Co-led by Alven and Racine², the oversubscribed round signifies strong investor interest in sustainability. Founded in 2021, Riverse offers a carbon crediting standard and supports various carbon avoidance and removal projects, utilizing transparent verification processes with auditable industrial data. Endorsed by the International Carbon Reduction and Offset Alliance, Riverse has validated over 60 projects and issued 250,000+ carbon credits. The funding will aid in expanding its offerings and operations.

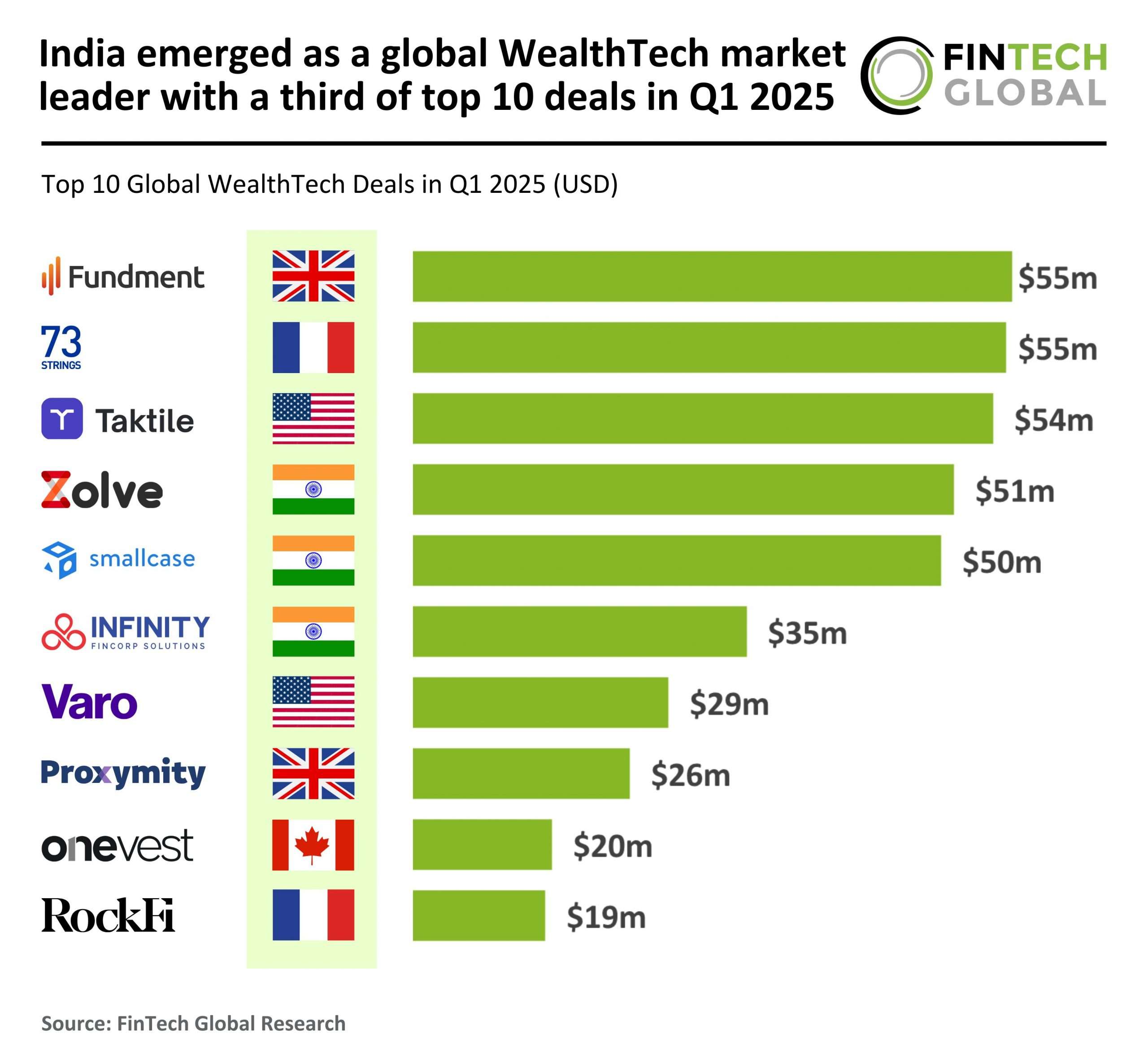

UK WealthTech Fundment Secures £45M in Series C Funding: A Major Boost for Financial Innovation

Fundment, a technology platform for financial advisers, has raised £45 million in a Series C funding round led by Highland Europe, with support from ETFS Capital. Founded in 2018 by Ola Abdul, the platform addresses technological challenges faced by advisers, offering comprehensive integration of essential services and client portals. The funding will enhance product development, expand the team, and prepare for future growth. Fundment’s tools aim to help advisers navigate complex regulatory environments and meet client demands efficiently. Abdul expressed excitement about the investment, emphasizing the platform’s commitment to supporting financial advice firms.

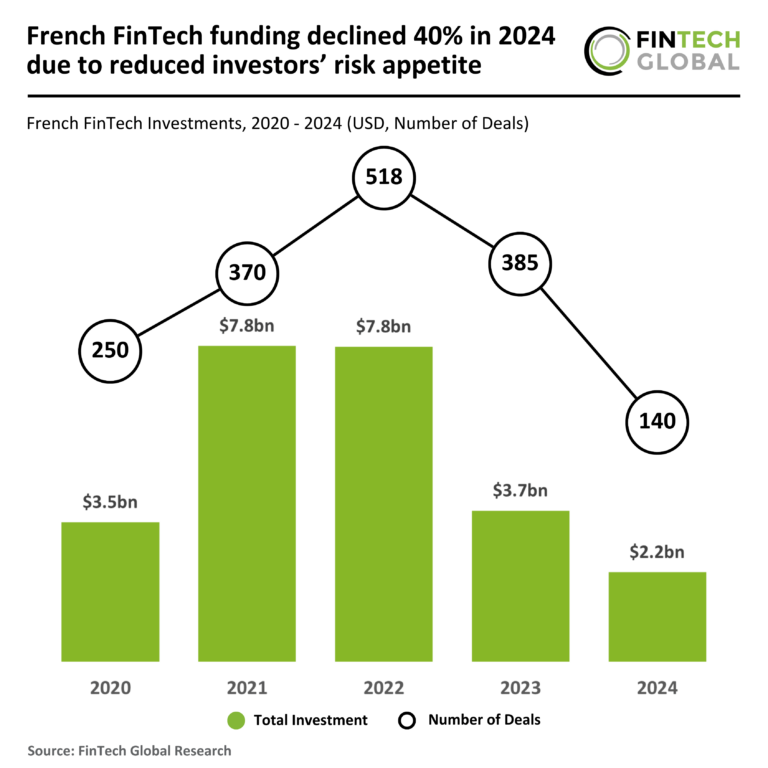

French FinTech Funding Plummets 40% in 2024 Amidst Diminished Investor Risk Appetite

In 2024, the French FinTech sector experienced a significant decline, with funding dropping 40% year-over-year to $2.2 billion and a 64% decrease in deal activity, totaling only 140 deals— the lowest in five years. This downturn reflects investor caution due to macroeconomic challenges and regulatory shifts, emphasizing profitability over growth. Despite fewer deals, the average deal value rose by 67% to $15.8 million, indicating a focus on high-value opportunities. Notably, ChapsVision secured $90 million in funding to expand into European and North American markets, enhancing its AI capabilities through the acquisition of Sinequa.