Similar Posts

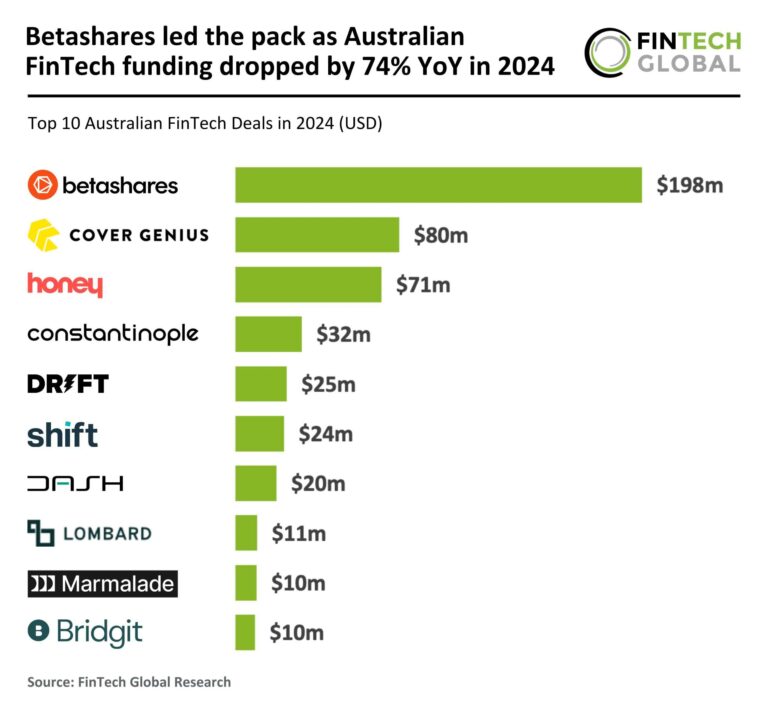

Betashares Tops Australian FinTech Scene Despite 74% Year-Over-Year Funding Decline in 2024

In 2024, the Australian FinTech landscape experienced a significant investment decline, with funding plummeting 74% to $891 million from $3.5 billion in 2023. Deal activity also fell sharply, with only 57 deals recorded, a 66% drop from the previous year. Investors are becoming more selective, focusing on sustainable growth, as reflected in the decreased average deal size of $15.6 million. Notably, Betashares secured the largest deal of the year with a $198 million investment from Temasek. As the market adjusts, FinTech firms must prioritize transparency and cost-effectiveness to attract investment and create long-term value.

U.S. Federal Reserve Exits Global Climate Finance Coalition: What It Means for Future Investments

The U.S. Federal Reserve’s recent decision to withdraw from the Network of Central Banks and Supervisors for Greening the Financial System (NGFS) signals a shift in climate finance discussions, coinciding with Donald Trump’s presidential inauguration and growing Republican skepticism about climate initiatives. Established in 2017, the NGFS aims to enhance the financial sector’s response to climate challenges, including supporting the Paris Agreement and assessing environmental risks. The Fed, which joined in 2020, conducted climate scenario analysis but withdrew due to concerns over NGFS’s expanding scope beyond its original goals. The NGFS acknowledged the withdrawal and remains focused on environmental resilience.

Worldpay Expands into Colombia: Unlocking E-Commerce Growth and Global Payment Solutions

Worldpay, a global payments technology provider, is expanding its operations into Colombia, introducing domestic acquiring capabilities to enhance the country’s growing e-commerce sector. This move is part of Worldpay’s strategy to strengthen its presence in Latin America, building on existing operations in Argentina, Brazil, and Mexico. Key features of the expansion include advanced payment processing solutions, multi-layered fraud protection, enhanced security measures, and a dedicated local team to assist merchants. With its extensive global network, Worldpay aims to empower Colombian businesses to thrive in the digital landscape and facilitate smoother international transactions.

SavvyMoney Expands Digital Lending Landscape with CreditSnap Acquisition for Enhanced Onboarding Solutions

SavvyMoney has acquired CreditSnap to enhance its digital lending solutions, aiming to provide a seamless financial experience for banks and credit unions. The acquisition combines SavvyMoney’s personalized credit insights with CreditSnap’s modular technology, enabling efficient loan origination through integration with over 73 systems. This partnership is expected to reduce loan application processing time from 12 minutes to just 2, increase loan volumes by 20-40%, and achieve high deposit funding rates of 78%. Both companies share a vision of improving financial access through user-friendly technology, positioning themselves to meet modern customer expectations effectively.