Similar Posts

Revolutionizing FinTech: How Compliance-First AI Drives Innovative AML Solutions

As artificial intelligence (AI) transforms the financial sector, a compliance-first approach has become crucial for institutions navigating regulatory complexities. This strategy seeks to enhance operational efficiency while ensuring transparency and adherence to regulations. Financial organizations face pressure to adopt AI tools for managing transaction volumes but must avoid non-transparent systems that could lead to compliance issues. Oversight is essential to prevent increased false positives and undetected illicit activities. Effective strategies include user-friendly, explainable, and customizable AI solutions. Companies like Napier AI exemplify successful compliance-first implementations, aligning with evolving regulatory requirements as scrutiny intensifies in 2024.

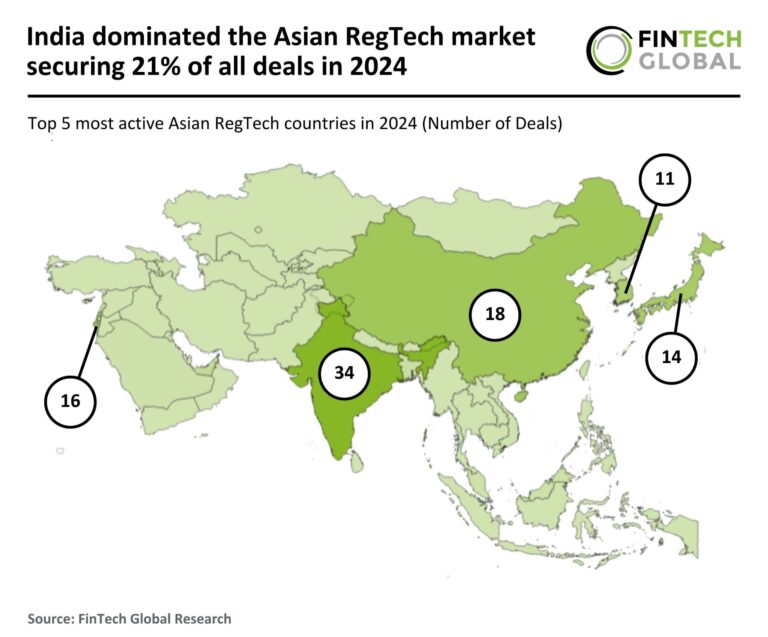

India Leads the Charge: Capturing 21% of Asia’s RegTech Market Deals in 2024

In 2024, the Asian RegTech market has faced significant challenges, with a 35% decline in deal activity and a 57% drop in total investments, falling to around $560 million from $1.3 billion in 2023. The number of deals decreased to 113, influenced by economic uncertainties and investor caution. India emerged as a leader, capturing 30% of deals with 34 transactions, while China saw its deal count fall to 18. Notably, Hyderabad-based startup Equal secured $10 million in Series A funding, aiming to expand its operations and product offerings, highlighting potential for recovery despite the overall downturn.

Crux Secures $50M to Revolutionize Clean Energy Capital Markets with Innovative FinTech Solutions

Crux, a capital markets technology firm focused on clean energy financing, has raised $50 million in a Series B funding round led by Lowercarbon Capital, with participation from new investors like Liberty Mutual Strategic Ventures and MassMutual Ventures. Existing investors, including Andreessen Horowitz, also contributed. Founded in 2023, Crux’s platform facilitates financing for clean energy projects, offering features such as tax credit transfers and debt marketplaces. The funding will help Crux scale its software, expand its team, and explore growth opportunities. CEO Alfred Johnson expressed excitement about collaborating with new investors to enhance the platform and drive investments in energy infrastructure.

Revolutionizing Wealth Management: The Transformative Impact of AI on Financial Services

Artificial intelligence (AI) is significantly transforming the FinTech sector, particularly in wealth management. In a discussion with Dion Kraanen, managing director at Brightstone, the importance of integrating AI into business strategies was emphasized for achieving success. Key elements include adopting a long-term vision, maintaining agility and innovation, and ensuring compliance with regulatory standards. Kraanen noted that with technology’s advancement, AI has become essential in finance, urging firms to adapt and innovate continuously. As AI evolves, its integration will be crucial for competitiveness in the FinTech industry, aligning business strategies with regulatory frameworks and client needs.

J.P. Morgan Payments Partners with Primer to Enhance Merchant Payment Solutions

Primer has announced its integration with J.P. Morgan Payments, joining the J.P. Morgan Payments Partner Network to enhance global payment solutions for merchants. This partnership allows businesses to access a wider range of payment options, improve authorization rates, and streamline operations through a single platform. GetYourGuide, a travel booking platform, is the first client to benefit from this integration. The collaboration aims to optimize payment processes and support localized payment methods, ultimately enhancing customer experience and growth opportunities for merchants. Primer’s CEO emphasized the importance of this integration in building a seamless payments ecosystem.