Similar Posts

Thomson Reuters Boosts Tax Software Solutions with $600 Million Acquisition of SafeSend

Thomson Reuters has acquired SafeSend for $600 million, enhancing its tax and accounting services. Founded in 2008, SafeSend offers cloud-based software that automates tax return preparation processes, widely adopted by accounting firms, including 70% of the top 500 in the U.S. The acquisition aims to streamline workflows and improve client interactions for tax professionals. Elizabeth Beastrom, President of Tax, Audit, and Accounting at Thomson Reuters, highlighted the commitment to addressing tax preparation challenges. SafeSend is projected to generate $60 million in revenue by 2025, with an anticipated annual growth rate exceeding 25%, reflecting rising demand for efficient tax solutions.

Transforming European Banking: The Impact of SEPA and Faster Payments on the Future of Finance

The Single Euro Payments Area (SEPA) is revolutionizing bank transfers in the Eurozone, covering 38 countries and simplifying cashless transactions to enhance economic integration. A Moody’s report highlights SEPA’s role in boosting trade through standardized processes. The advent of faster payments allows near-instant transfers, offering benefits like enhanced speed, lower fees, and reduced errors compared to traditional systems like CHAPS. By January 2025, EU payment service providers must process instant payments 24/7. Future regulations will include payee verification and fee standardization. AI and machine learning will be crucial for compliance as financial leaders adapt to these changes for improved operational efficiency.

SavvyMoney Expands Digital Lending Landscape with CreditSnap Acquisition for Enhanced Onboarding Solutions

SavvyMoney has acquired CreditSnap to enhance its digital lending solutions, aiming to provide a seamless financial experience for banks and credit unions. The acquisition combines SavvyMoney’s personalized credit insights with CreditSnap’s modular technology, enabling efficient loan origination through integration with over 73 systems. This partnership is expected to reduce loan application processing time from 12 minutes to just 2, increase loan volumes by 20-40%, and achieve high deposit funding rates of 78%. Both companies share a vision of improving financial access through user-friendly technology, positioning themselves to meet modern customer expectations effectively.

Unveiling the Hidden Carbon Costs: The Untold Impact of ESG Reporting

Sustainability reporting is essential for organizations to track carbon emissions, yet the digital infrastructure supporting these reports, such as cloud storage and ESG software, significantly contributes to electricity consumption, often sourced from fossil fuels. Research shows that managing ESG data can escalate Scope 3 emissions. Companies can reduce their digital carbon footprint by consolidating data, streamlining updates, choosing sustainable cloud providers, and minimizing digital communication. Including IT-related emissions in sustainability assessments is crucial, as transitioning to renewable energy-powered cloud services could potentially lower emissions by up to 40%. Optimizing these processes is vital for genuine corporate sustainability commitment.

Betterment Expands Horizons: Acquisition of Ellevest’s Automated Investing Division

Betterment, a leading US digital investment advisor, has acquired the automated investing division of Ellevest, a firm focused on women’s financial needs. This acquisition aims to strengthen Betterment’s position in the digital investing sector. While it excludes Ellevest’s other accounts and employees, it will enhance Betterment’s offerings for its 900,000 customers managing over $55 billion in assets. The transition for Ellevest’s automated investing clients to Betterment is set for April 17, 2025. Ellevest will continue its wealth management services for high-net-worth clients. Betterment’s CEO expressed excitement about the acquisition, emphasizing the improved services for clients.

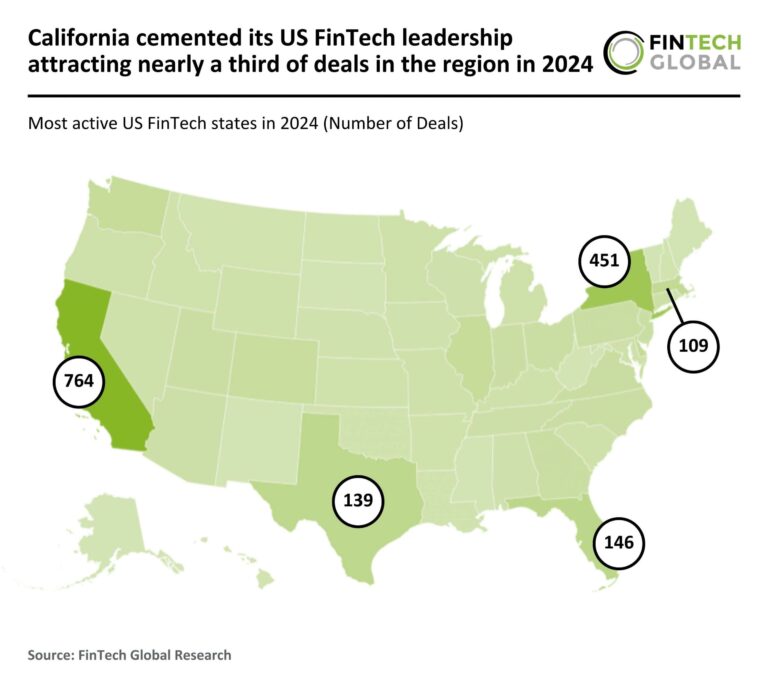

California Dominates US FinTech Landscape: Capturing Nearly One-Third of 2024 Deals

In 2024, California maintained its position as the leading US FinTech hub, accounting for 31% of deals with 764 transactions, despite a 59% decline from 2023. Overall, US FinTech funding plummeted to $18.4 billion, a 47% decrease, with deal volume dropping to 1,506, a 63% reduction. Economic uncertainty and rising interest rates contributed to this downturn. New York followed California with 451 deals (18% share), while Florida surpassed Texas with 146 deals (6% share). Notably, Cyera raised $300 million in a Series C funding round, highlighting the importance of advanced data security solutions.